#59 - The $3.6 Billion Bet: How Polymarket Called the 2024 Election Before Anyone Else

An exploration into blockchain prediction markets as powerful forecasting tools

Stanford Blockchain Review

Volume 6, Article No. 9

📚 Author: Tesvara Jiang - Stanford Blockchain Club

🌟 Technical Prerequisite: Low

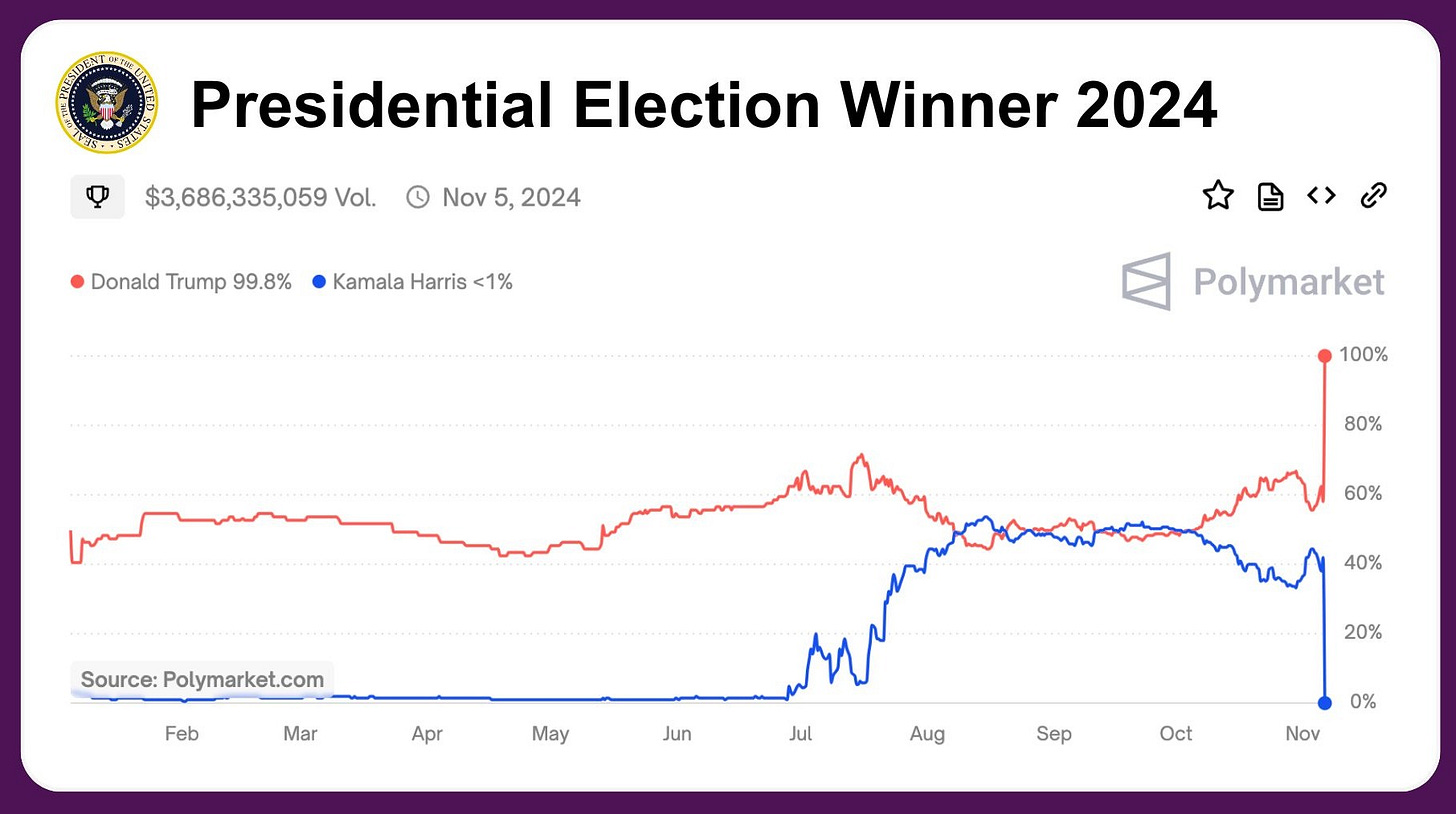

On Election Day 2024, when most were fixated on the New York Times live election board, an undercurrent of digital activity preferred Polymarket—an emerging blockchain-native prediction market that had eclipsed $3.6 billion in bets solely on the election by the end of the night.1 The climax of Polymarket’s fame came at 11:43 p.m. ET, nearly six hours before the Associated Press called the election, when Polymarket’s odds for Trump had already reached 95%.2 You can’t really call this casual gambling for dads anymore. The staggering volume and its appearance on national and international headlines signaled a watershed moment in decentralized finance (DeFi) and crypto.

Yet this excitement is tampered by increasing regulatory scrutiny. The U.S. ban on Polymarket remains firm, and on November 14th, the FBI raided the home of Polymarket’s founder and CEO, Shayne Coplan.3 Against the controversy, urgent questions arise for observers, users, and investors alike: What are blockchain prediction markets? How does it work? Are Polymarket odds a genuine reflection of collective sentiment, or do they echo the biases of a niche demographic? And what is the long-term future of blockchain-native prediction?

Overview on Polymarket and Blockchain

First, let’s open Polymarket and take a look: https://polymarket.com/. A brief tour of the user interface reveals a design reminiscent of Twitter’s minimalist aesthetic. There is a scrollable feed of ongoing markets, each represented by a small profile image and a concise descriptive blurb. Tabbing between categories like “Sports,” “Politics,” or “Crypto” is intuitive, and a simple clickable sidebar displays implied probabilities, alongside “Yes” or “No” buy buttons with their dollar equivalents. Notably, there is no overt mention of crypto on the front page. I would argue that the platform’s clean, approachable look aims to encourage frequent visits to check up on continuous updates to odds and trading volumes. It almost tricks you into checking back every few hours because these numbers update constantly, making the entire experience feel less like a formal betting exchange and more like a casual, interactive social media.

The moment one attempts to place bets, however, Polymarket’s crypto infrastructure reveals itself. Instead of credit cards, users connect an Ethereum-compatible wallet, such as MetaMask. Since U.S. residents are barred from trading due to a 2022 agreement with the Commodity Futures Trading Commission, Americans must use a VPN.4 This necessity surfaces the uncomfortable regulatory gray zone of crypto. While the site’s interface feels welcoming, the underlying technical requirements and legal constraints remain obstacles for many potential users. Despite these hurdles, Polymarket’s unprecedented $3.6 billion in volume—much of it still held on the platform—and command of 84% of all money placed in election-related betting,5 speaks positively on the demand for decentralized prediction markets even under regulatory limitations.

To understand the broader significance of Polymarket, it is helpful to consider the evolution of internet infrastructure. As Chris Dixon’s Read Write Own explains, Web1 offered a read-only online environment, Web2 introduced read-write capabilities through centralized social media platforms, and Web3 envisions a decentralized read-write-own paradigm. In this future, digital content and financial transactions migrate from corporate servers to decentralized networks. Polymarket exemplifies this vision by shifting trust from intermediaries to cryptographic proofs and publicly verifiable smart contracts. If blockchain becomes the default infrastructure of the future internet following this vision, Polymarket’s billions in event-based wagers will be minimal compared to the future valuation of decentralized finance.

One of the clearest use cases for blockchain even early in the days of its existence is actually prediction markets. When blockchain emerged with Bitcoin in 2008, its transformative power lay behind three fundamental components: trust, decentralization, and ownership. Cryptographic verification obviates the need for intermediaries; decentralization distributes authority across a global network, mitigating risks of manipulation; and smart contracts automatically execute predefined rules without human intervention, ensuring that participants' funds are locked and released solely based on verified outcomes. This programmatic enforcement of rules, combined with on-chain asset ownership, grants participants control independent of central gatekeepers. These elements are the foundations of the broader Web3 vision—and just so happens to be exactly what a prediction platform would want to be built on. Polymarket, built upon these principles, offers participants secure deposits, transparent rules, and verifiable evidence of their holdings.

When bettors review an event on Polymarket, the platform first tells you the Rules explaining what exact outcome must occur for you to "win." Upon clicking "confirm," a smart contract is signed on the Polygon blockchain using a modified version of the Conditional Token Framework (CTF). Each purchased share—backed by USDC stablecoins—emerges as a verifiable ERC-1155 token redeemable if the user's prediction proves correct.6 Lastly, Polymarket's oracle system (UMA Optimistic Oracle) settles outcomes efficiently (read more here: 7). Thus, each trade, position, and resolution exists on a transparent, trust-minimized ledger.

Election Key Events

That’s enough about how it works. The Polymarket timeline of events surrounding the 2024 election provides a fascinating case study on prediction markets in action. Throughout the campaign, odds fluctuated as traders responded to news, polls, and even large, idiosyncratic bets from “whale” accounts:

Between August 8 – October 6, 2024:

Polymarket data shows Donald Trump vs Kamala Harris as essentially a coin flip, each candidate sitting within a 2% lead on any given day.

By October 24, 2024:

Trump’s odds climb to a significant lead. Researchers identify four accounts—Fredi9999, Theo4, PrincessCaro, and Michie—as belonging to a single French trader who has placed $28 million in total on Trump. When questioned, the Polymarket team stated that they don’t believe this to be market manipulation but rather a single high-stakes bettor operating on personal conviction.

On October 25, 2024:

The New York Times runs a story about the French trader, driving increased traffic to Polymarket’s election markets (see here: 8)

On October 30, 2024:

Trump’s odds peak at 67% on Polymarket, spurred by growing speculation and broader news coverage.

On November 3, 2024:

News reports poll shows Harris leading in Iowa, causing Trump’s odds to slip to 53%. Regulated betting sites like Kalshi report similar volatility.

On November 4, 2024 (Pre-Election Day):

Trump’s odds stand at 58%, Harris at 42%. Total betting volume hits $3.01 billion on Polymarket.

On November 5, 2024 (Election Day):

Trump’s odds close at 61%, Harris at 39%. Overall volume tops $3.4 billion on Polymarket. Bitcoin also rises by 4%, reflecting a surge in crypto sentiment tied to the election.

On November 6, 2024:

Polymarket settles its election market, and payouts are sent to those who bought Trump. Daily active users remain high as new participants rush in to make post-election bets on cabinet appointments and other upcoming political decisions.

On November 7–10, 2024:

Widespread discussions erupt on social media and mainstream outlets about Polymarket’s accuracy and potential demographic bias. Ongoing debates highlight the possibility of larger players influencing these markets, but also validate the platform’s speed in “calling” election outcomes ahead of most traditional channels.

Throughout December 2024:

Polymarket rolls out markets for Senate races and global sporting events, extending the model of decentralized prediction into a broader range of real-world outcomes. Bitcoin’s price hits new all-time highs (ATHs) every day, sustaining the post-election rally within crypto markets. Bitcoin hits $100K.

Bias Concerns

Critics wonder if Polymarket’s odds genuinely reflect collective sentiment, or if they merely reveal the biases of a niche demographic. Because of the Ethereum wallet plus VPN barrier to entry, the users of Polymarket are restricted to the subset of people who could overcome it, generally younger, crypto-savvy, and politically homogeneous. Initial inefficiencies definitely exist, either due to these demographic concentrations or whale traders, but research on prediction markets by Wolfers and Zitzewitz (2004) on profit-driven arbitrage argues that there only needs to be a handful of knowledgeable traders to correct biases like these. In theory, prediction markets are the best aggregators of diverse information—pulling info from its participants by incentivizing them financially to reveal their true beliefs. This aggregation process should, ideally, generate forecasts that approximate the “true” probabilities of events more accurately than any single expert could.9 Although Polymarket’s early user base is more on the homogeneous side, the financial incentives trump biases and will continue to beat concerns with the growth of crypto. And as the market size of crypto grows (on the optimistic side, having Bitcoin market size overtake gold) and network effects pull more people into the ecosystem, the deeper liquidity will also combat these skews.

Coplan also built Polymarket on the belief that a large enough group of uninformed traders can collectively provide more accurate predictions than any single expert. This builds on prior research about market efficiency—even if individual traders lack complete information, the aggregation of their behaviors will reveal meaningful probabilities.10 The platform's decentralized architecture adds another dimension to this dynamic. While blockchain technology ensures unprecedented transparency in betting patterns and market movements, it also enables holders of typically unavailable information to trade anonymously, leaking inaccessible information into the market without revealing their identity.

Hedging Use Cases and Future Applications

The platform's potential extends far beyond political betting into risk management tools. We can consider how companies might use prediction markets to hedge against geopolitical risks. Here is one example: semiconductor manufacturers and tech companies heavily dependent on Taiwan Semiconductor Manufacturing Company (TSMC) could use prediction markets to hedge against potential disruption risks. If a company expects to lose $50 million in revenue from supply chain disruptions in the event of increased Taiwan-China tensions, they could offset this by taking positions in prediction markets tied to regional stability indicators. This creates a natural hedge—if tensions escalate and disrupt chip supply, the prediction market positions would pay out, helping to offset business losses.

Cross-chain expansion and ongoing smart contract enhancements could further bolster Polymarket's user base and reliability. Integrating other blockchains (e.g., Arbitrum or zkSync) might help bypass Polygon's occasional congestion, while refined contract designs could introduce advanced risk management features like stop-loss orders or partial share selling. These technical improvements, combined with a more welcoming regulatory environment, stand to transform Polymarket from a niche crypto curiosity into a robust financial instrument that everyday investors would consider alongside their stocks, bonds, and ETFs.

Looking ahead, these markets could become integral to how organizations manage complex geopolitical and environmental uncertainties. The combination of transparent blockchain infrastructure, sophisticated market mechanisms, and real-world applications positions platforms like Polymarket to potentially reshape how we collectively predict and prepare for future events. If prediction markets can secure regulatory certainty while maintaining their decentralized benefits, they could evolve into sophisticated tools for both information aggregation and risk management. Success will require balancing technical innovation with regulatory compliance, and demographic diversity with market efficiency. As the Web3 space continues to evolve, prediction markets may serve as an important testing ground for broader applications of blockchain technology in financial markets.

The Harris-Trump election demonstrated Polymarket’s potential to outperform traditional forecasting methods. However, the FBI raid on Coplan's home afterwards pinpointed the gray regulatory environment the platform must navigate. For decentralized prediction markets to fulfill their promise of democratizing information aggregation and risk management, they must first resolve these fundamental tensions between innovation and oversight. Only then can they truly evolve into mainstream financial instruments that reshape how we collectively prepare our financial strategies with future events.

Huge thank you to Kole Lee and Shaun Maguire for thoughts and conversations that inspired me to research Polymarket and write this piece.

Haseeb. (n.d.). The wisdom of the market: Why polymarket outperforms traditional polls in election predictions?. ChainCatcher. https://www.chaincatcher.com/en/article/2150776.

Wisnefski, S. (n.d.). Markets News, November 7, 2024: Stocks extend post-election rally as fed cuts rates; S&P 500, nasdaq close at record highs. Investopedia. https://www.investopedia.com/dow-jones-today-11072024-8741258.

Pargas, S., Atkins, C., & Winter, T. (2024, November 14). FBI raids polymarket CEO Shayne Coplan’s apartment, Seizes Phone: Source. NBCNews.com. https://www.nbcnews.com/tech/tech-news/fbi-raids-polymarket-ceo-shayne-coplans-apartment-seizes-phone-source-rcna180180.

Release number 8478-22. CFTC. (n.d.). https://www.cftc.gov/PressRoom/PressReleases/8478-22.

@shayne_coplan. (2024, May 2). Twitter. https://x.com/shayne_coplan/status/1854229669077307583.

Rock’n’Bock. (2024, November 26). Crypto prediction market development like Polymarket. RSS. https://rocknblock.io/blog/crypto-prediction-market-development-like-polymarket?t.

How are preduction markets resolved? - Polymarket Learn. (n.d.). https://learn.polymarket.com/docs/guides/markets/how-are-markets-resolved/?t.

Sorkin, A. R., Mattu, R., Warner, B., Kessler, S., Merced, M. J. D. L., & Hirsch, L. (2024a, October 24). The French Connection to online bets on trump. The New York Times. https://www.nytimes.com/2024/10/24/business/dealbook/polymarket-trump-trader.html.

Wolfers, Justin, and Eric Zitzewitz. 2004. "Prediction Markets." Journal of Economic Perspectives, 18 (2): 107–126.DOI: 10.1257/0895330041371321.

Chayka, K. (2024a, October 23). The crypto betting platform predicting a Trump win. The New Yorker. https://www.newyorker.com/culture/infinite-scroll/the-crypto-betting-platform-predicting-a-trump-win?t.