#69 - Type III Stablecoins

How Self-Enforcing Mechanisms Can Transform Yield-Bearing Stablecoins

Stanford Blockchain Review

Volume 7, Article No. 9

✍🏻 Author: Benjamin and Jae — Cap Labs

⭐️ Technical Prerequisite: Intermediate

Thanks to Carson, Ekram and Ishaan for their thoughtful feedback on this piece.

With more than $200B in circulating supply, stablecoins have undoubtedly become the most significant sector within crypto today. One could even argue that the stablecoin sector has decoupled itself from the volatile crypto market—stablecoins have proved resiliency despite the crypto market's downturn in 2025, with more TradFi institutions actively integrating DeFi into their solutions.

Specifically, stablecoins have mastered two functions today: settlement for fiat and store of value (SoV). Daily transaction volume for stablecoins is at all-time highs, at $81B, with USDT and USDC capturing more than 95% in both mature economies and emerging markets. They represent not only simple transactions but also financial inclusion and access to a less volatile currency.

However, unlike SoV, yield for stablecoins is in a very different state of adoption. Despite all the innovation in DeFi, yield-bearing stablecoins have remained a niche use case for stablecoins. The total market cap of yield-bearing stablecoins remains at around 10% of USDT and USDC's combined market cap.

Why do such discrepancies exist? More importantly, what can we do to improve where yield-bearing stablecoins are today?

In this piece, we will examine the evolution of yield-bearing stablecoins, the different enforcement rules for yield, and finally, how Cap strives to solve their scalability and safety issues.

Evolution of Yield-Bearing Stablecoins: Endogenous to Exogenous Yield

During the early years, the sources of yield for stablecoins were endogenous; yield stemmed purely from within DeFi platforms. In particular, the yield was generated via liquidity provisioning and platform incentives, meaning the money flow was circular and self-contained. Accordingly, users were jumping from one protocol to another to speculate on the next high APR; thus, yield could only scale as much as the platform.

The most prominent example is crypto-overcollateralized stablecoins or Collateral Debt Positions (CDPs). CDPs are best exemplified by the early days of MakerDAO, where DAI was minted by lending ETH as collateral. CDPs generate yield through interest rates charged to borrowers who use their collateral to mint stablecoins. This interest is then shared with protocol participants, and the mechanism operates entirely within the DeFi ecosystem. Vanilla CDPs could only scale as much as the demand to lever ETH.

Another widely popular model relied on vote-escrow tokens (veTokens), where locking these tokens allowed protocols to direct incentive emissions to certain liquidity pools. These tokens led to what is known as veToken wars, where stablecoin protocols would maximize their ability to control a large percentage of liquidity pools to capture these DEX emissions. These token wars, such as with CRV and BAL, involved yield schemes that relied on external parties purchasing DEX tokens to fuel flywheels.

While both models grew to billions of dollars in TVL, their yields were volatile and speculative. Most importantly, they were limited by the considerably small demand for these platforms, especially compared to the context outside DeFi mechanisms.

Accordingly, founders have made industry-wide efforts to scale stablecoins beyond the ceiling set by endogenous yield models. Acknowledging that most yield for US Dollars can be found outside crypto-specific use cases, strategy-backed synthetic dollars backed by either fiat or other assets have been gaining popularity. From vanilla T-Bill wrappers to experimental hedge fund strategy wrappers, there is now an abundance (as well as fragmentation of liquidity) of stablecoins attempting to address the scalability of yield-bearing stablecoins.

The question then becomes, what lens should we use to analyze these new stablecoins?

Regulating yield-bearing stablecoins

The idea behind yield-bearing stablecoins is simple: a reserve issues new money by lending highly liquid assets to execute an investment strategy.

Beyond the logistical decision of which assets are backing and what lending parameters are used, what fundamentally differentiates a yield-bearing stablecoin is its method for enforcing yield: Who decides who runs what strategies? What recourse do users have in case of bankruptcy?

In other words, the frameworks we use to evaluate enforcement are capital allocation mechanisms and safety guarantees. In DeFi today, there are two prevailing enforcement styles: authoritarian and committee-based. We introduce a third type, self-enforcing yield, that the Cap team is actively pioneering.

The following section is a deep dive into each stablecoin type. Specifically, we will examine the incentives for capital allocation and safety and the corresponding trade-offs.

Type I Stablecoins: Authoritarian

Type I stablecoins are one-sided marketplaces where a single entity utilizes depositor capital to generate yield. They function as hedge funds, where the dApp team handpicks and executes a single (in some cases, few) strategy themselves. As the name suggests, Type 1 stablecoins are centralized, as the team gets the final say over capital allocation and recourse provision. Depending on the team, they can decide to provide safety guarantees, including over-collateralization, decentralization, and transparency, but it is up to the team’s discretion and hence risk is inherently more centralized.

The primary motivations for adopting this model are low development costs for teams and user agency. Low development costs arise from the ease of designing and operating protocols tailored explicitly for a single strategy, such as the basis trade. Additionally, users have the agency to switch between Type I stablecoins to gain exposure to specific strategies.

Examples of Type I stablecoins include Ondo, Ethena, Usual, Agora, Resolv, and other team-run strategy-backed synthetic assets.

Incentive alignment

The decision maker in this model is the dApp team. Naturally, they optimize for higher yield and safety to attract more users. If yield is not competitive or users lose funds, projects quickly become obsolete as more and more projects launch. As such, teams focus on continually growing TVL and maintaining competitive yields.

In theory, it is true that teams should ensure that their strategy has low risk. However, given that most of these stablecoins are incorporated in bankruptcy-remote entities, users have little regulatory or law-enforcement recourse. As such, teams do not have to prioritize optimizing user protections and transparency to the level favored by highly regulated financial institutions.

Trade-offs

The main reason that teams choose Type I stablecoin designs is simplicity. These models have low startup costs because they can focus the engineering effort on implementing a single strategy. This can also reduce the attack surface for potential exploits. Another benefit is user agency. By focusing on one or two strategies, teams return the decision-making power to users - who can move their deposits between applications as market conditions affect yields.

Unfortunately, as mentioned above, Type I stablecoins usually lack recourse. They behave like unsecured loans to application teams. If strategies result in losses, custodians blow up, or teams walk away with user deposits, users have no concrete means to recuperate their funds. Regulations are not present to protect applications if teams decide to hide behind legal structures.

Yet another essential consideration is obsolescence—no strategy can indefinitely generate above-market returns at scale. When a team decides on a particular strategy suitable to the current market condition, they can generate an extraordinary yield of over 30%. Eventually, regardless of the team's competency, market conditions erode the alpha generated by teams, or scale dilutes their yield. This results in teams constantly searching for alternative strategies whenever market conditions change.

Type II Stablecoins: Committee-Based

One obvious solution to the problem of obsolescence is to have multiple strategies that could be run concurrently. Type II stablecoins introduce a governance dimension by establishing committees or decentralized autonomous organizations (DAOs) to delegate user deposits to various yield strategies, including Type I teams but also beyond crypto, including banks and market makers. Rather than internalizing yield generation, these DAOs collectively authorize which external parties can access the pooled capital. Compared to Type I stablecoins, this model shifts the burden of enforcement from a team to a collective.

The primary motivation for adopting this model is scalability. If the current strategy becomes unprofitable or deemed too risky, DAOs can decide to switch to a better strategy. This allows Type II stablecoins to have a stronger robustness guarantee.

Examples of Type II stablecoins include Maple and Sky (formerly MakerDAO).

Incentive alignment

Broadly, three parties can allocate capital: governance token holders, delegates, and committees.

Governance token holders are incentivized to vote to deploy capital to the most performant and scalable third-party strategies. Like Type I stablecoin teams, DAOs want their governance tokens to accrue value. Whereas governance tokens in Type I stablecoins have limited utility and thus function more like equity, Type II governance token holders can exercise more power to have a meaningful impact on the protocol. This leads them to participate in discourse in an open forum that allows DAOs to make more robust, albeit slower, decisions than a single team. Yet, we note that the governance token holders are not necessarily the most knowledgeable in risk management.

Delegates are actors who do not hold governance tokens but are instead allocated voting power by governance token holders. Large token holders like investors and founders typically delegate their voting power to professional delegates, DAO service providers, and university blockchain clubs. Delegates are bound to the best wishes of depositors only by the payments they receive for being delegates, if any. We note that no concrete alignment angles exist between delegates and dApp depositors. Delegates do not have fiduciary duties to depositors, nor do they provide legal warranties to users.

Committees are decision makers within a project assigned to a finite set of decisions. These decisions can include onboarding new collaterals, managing marketing narratives, and other core functionalities of a project. For the purpose of this analysis, we look at committees tasked with allocating user collateral for yield generation. Committees, similarly to delegates, are aligned with depositors by the monetary remuneration they receive from projects. In contrast to delegates, committees tend to have more thorough onboarding requirements. Members of these committees are typically doxxed - this adds an extra layer of protection to the extent that members value their public brands.

Trade-offs

A notable characteristic of Type II stablecoins is scalability via outsourcing. They are a layer on top of professional yield generators, including Type I stablecoins. Because markets always outperform individual teams, Type II stablecoins can harness this market-driven power to achieve yield at scale. The strategies/teams they deploy capital to change as market conditions change, with governing bodies reallocating capital based on performance and safety. In other words, Type II stablecoins have a stronger robustness guarantee than Type I stablecoins.

However, much like Type I stablecoins, recourse is not guaranteed for Type II stablecoins. If third-party teams lose funds, end users cannot recuperate funds. Given the decentralized nature of these organizations, legal recourse is also inviable.

Another important consideration for users is the corruption of groups. As seen throughout the years of DAO experiments, it is relatively straightforward to bribe and corrupt delegates, DAO voters, and committees. Special advisors positions, regular payments, and token allocations are some ways that group decision makers have been successfully corrupted in the past. This directly impacts the safety of Type II stablecoins, as corrupted decision makers can allocate capital to unsafe or malicious actors.

Type III Stablecoins: Self-Enforcing

Type III stablecoins represent a move away from subjective human decision making and towards an autonomously enforced system of common rewards and penalties. In this sense, they resemble more of a protocol than a hedge fund, as seen in other types. Immutable rules set by smart contracts replace the human decision-making process of capital allocation and recourse provision.

The primary motivations for adopting a Type III stablecoin model are safety and latency. Users are protected at the smart contract level, where they can verify the recourse if a strategy fails. Instead of relying on the good faith of dApp teams/committees or obscure legal structures, users can inspect the code to verify the safety guarantees. The latency to switch strategies is significantly reduced in open marketplaces, as they respond rapidly to shifting market dynamics without the delays inherent in governance. This allows Type III stablecoins to fully utilize the power of markets to swiftly identify and deploy multiple concurrent yield strategies.

Today, there are no Type III stablecoins - Cap is the first stablecoin to pioneer this category.

Cap is innovating on the first Type III stablecoin by utilizing the power of lending markets and shared security models (SSMs) to provide efficient capital allocation and credible financial guarantees. The protocol regulates the ability of third-party operators to generate yield by issuing smart contract-level rules of engagement. We recommend interested readers read the introduction article for an overview of the mechanics.

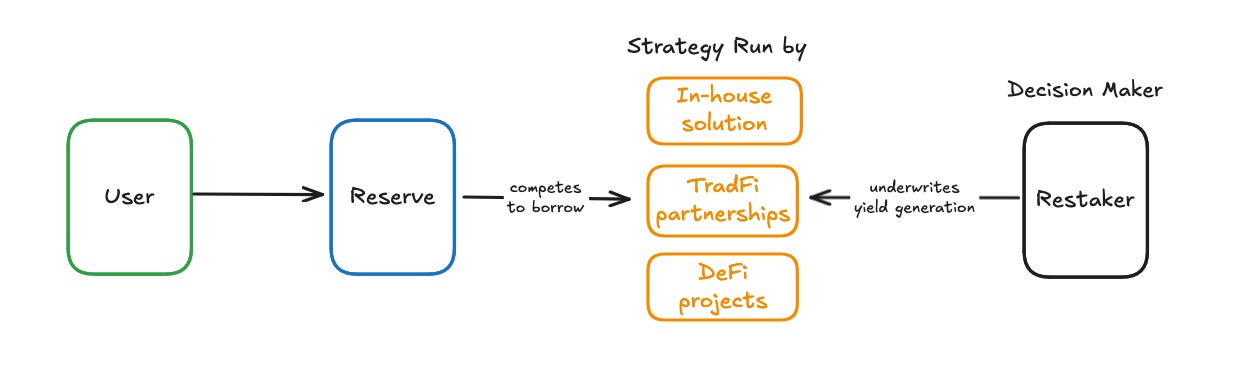

Cap is a three-sided marketplace that combines operators, restakers, and end users.

Operators are financial institutions tasked with generating yield. Their participation is regulated via smart contracts and market dynamics. Before operators can borrow any asset, the protocol first checks if they are over-collateralized as commonly seen in crypto lending markets. The difference here is that rather than the operators putting up the capital themselves, which would be capital inefficient, operators receive delegations from restakers to use locked crypto assets as collateral. This restaked collateral was previously idle, and earns yield via this new use case. It is up to the operators to convince restakers to delegate stake to them.

Capital allocation to operators is economically regulated via the interest rate set by the lending market mechanism. Rather than the team deciding how much each operator should get, operators themselves self-select in and out of the protocol based on whether they can deliver yield at the current benchmark rate. The benchmark rate is also programmatically determined- it is the sum of the deposit rate at major lending markets, plus the added utilization premium at Cap. This utilization premium is calculated as a percentage of capital borrowed, indicating the competitiveness of capital provisioning at a given market condition.

Restakers are rewarded for delegating to an operator. The rate is determined as an agreement via the restaker and operator. Similarly, end users are rewarded for providing capital, where the rate is determined by the benchmark yield. The amount they receive is recorded and distributed onchain, providing transparency to the protocol.

If operators act maliciously or a black swan event occurs, such that the borrowed amount is lost, restakers are slashed. Slashing removes cryptocurrencies held as bonds by retakers to compensate end users. The slashed funds are redistributed to the end users, ensuring recourse is always available and verifiable via code.

Incentive alignment

Since third party operators cannot borrow unless they secure delegations from restakers, the decision makers in Cap are the restakers. They have the final say over which third parties can enter the protocol to generate yield.

Restakers are incentivized to make decisions because of delegation premiums provided by operators. Restaked assets have low opportunity costs and low capital premiums because they are locked crypto assets. In other words, unlike the US Dollar that is being borrowed by the operators, these assets cannot be used to generate significant returns. Hence, they are motivated to delegate to operators on SSMs to create use out of this idle value. With the power to make decisions also comes direct exposure to the outcomes of the decisions. As such, restakers are incentivized to prioritize safety over every other metric.

We note that the north star for Cap is to become a fully permissionless, governance-minimized protocol where operators and restakers can freely participate. Yet, acknowledging that the novelty of the design, in the initial phases of the protocol, both restakers and operators would be accredited institutions and whitelisted. This functions as a safety mechanism for restakers as they would have means to enter into agreements and enforce legal recourse with their counterparty.

Trade offs

The key benefit of this model is safety. Given that decision makers maintain full exposure to their decisions, retail stablecoin holders are shielded from the risk of yield generation. All rules are enforced by smart contracts, removing the need for human arbitration between those that generate yield and those that consume it. This is a notable improvement to the regulatory protections retail investors usually enjoy in traditional finance.

Much like Type II stablecoins, latency is lowered when identifying and adopting new strategies. The system has no switching costs for reallocating capital. Unlike in Type II stablecoins, no lengthy DAO and committee deliberation are needed to allocate capital. Each restaker has the power to separately allocate capital to operators concurrently.

However, we note that this model is far more complex than previous types of stablecoins. These complexities can introduce smart contract risks borne from the reliance on code to regulate the system.

Mass adoption of interest-bearing stablecoins

Yield is far from where it needs to be in order to unlock the potential DeFi has to offer. As the stablecoin market continues to grow, there will be more and more strategy backed interest-bearing stablecoins. But unless a paradigm shift happens in the fundamental design of these stablecoins, we are again bound to face the same risks and fatigue that have prevented us from scaling in the first place. Thus, it is time to grow beyond the limitations of having human judgment in the capital allocation process and create an incentive-aligned system that is more efficient, scalable, and safe.

After two months of investing, I attempted to make my first withdrawal, only to discover that my account, which held over 23.032 BTC, was suddenly locked. Despite contacting customer support multiple times, I received no response regarding my withdrawal requests. After sharing my experience with friends, they recommended reaching out to. (((r o b e r t s l e e 6 1 8 @ g m a i l . c o m)))) or via WhatsApp at +1 8 5 6 - 5 4 9 - 7 4 6 9. They were able to provide helpful assistance and successfully recovered all of my stolen funds. If you're in a similar situation, you might want to contact them for support.