#60 - Cross-chain MEV: Challenges and Solutions

An Analysis of Multi-Chain Value Extraction in Decentralized Finance

Stanford Blockchain Review

Volume 6, Article No. 10

✍🏻 Author: Billy Gao — Stanford Blockchain Club & Pantera Capital

⭐️ Technical Prerequisite: Intermediate

The rise of interconnected blockchains has unleashed a powerful new form of value extraction, the cross-chain MEV. Cross chain MEV refers to the profits that can be extracted by exploiting inefficiencies, price discrepancies, or transaction dynamics across multiple blockchain networks. With the rise of cross-chain bridges and multi-chain protocols, MEV has grown from a single-chain concept into a multi-chain opportunity that reshapes how liquidity and assets flow within DeFi. To grasp its full potential and implications, we must delve deeper into what cross-chain MEV is, how it works, and the challenges and opportunities it presents.

A glossary below provides definitions to assist in understanding this article! For our readers new to blockchain, please use it as a resource.

Understanding Cross-Chain MEV

At its simplest, cross-chain MEV builds on MEV as it was first understood in single-blockchain environments like Ethereum. Initially, MEV—short for Miner Extractable Value—described profits miners could earn by reordering, including, or excluding transactions within a block to maximize their gains. Over time, as validators replaced miners and the term evolved to Maximal Extractable Value, the scope expanded to include strategies such as front-running, back-running, and arbitrage.

Cross-chain MEV extends these opportunities to a multi-chain context. When interconnected blockchains facilitate the movement of assets and liquidity between them, they create inefficiencies, which would be price differences for the same asset on different chains, imbalanced liquidity pools, or gaps in transaction ordering. Cross-chain MEV capitalizes on these inefficiencies, allowing traders, liquidators, and arbitrageurs to profit by executing strategies that span multiple blockchains. As a simple example, if a token trades for $10 on Ethereum but $9.50 on Polygon, a trader can buy the token on Polygon, bridge it to Ethereum, and sell it there for a profit.

This interconnected nature of blockchains means that cross-chain MEV is no longer limited to isolated opportunities on a single network. It's about identifying and exploiting inefficiencies across a web of blockchains while managing the complexities of bridging delays, transaction fees, and security vulnerabilities.

The Role and Benefits of Cross-Chain MEV

Cross-chain MEV plays a crucial role in enhancing market efficiency, especially within the DeFi ecosystem. By capitalizing on price discrepancies and liquidity imbalances, arbitrageurs help align prices and redistribute liquidity across chains. For instance, without arbitrage, a token might remain overvalued on one chain and undervalued on another, creating fragmented markets. Cross-chain MEV resolves these inefficiencies, ensuring that prices converge and liquidity flows where it is needed most. This alignment benefits not only traders but also DeFi protocols and their users, as it fosters a more stable and predictable financial environment.

It is this exact competitive nature of cross-chain MEV that drives innovation in the blockchain space. Traders, developers, and protocol designers are constantly pushing the boundaries of technology to identify opportunities, optimize execution, and mitigate risks. For example, advanced algorithms, real-time analytics tools, and automated bots are being developed to detect and act on cross-chain MEV opportunities. Additionally, protocols are integrating MEV-aware features to enhance user experience and security. This continuous pursuit of efficiency and innovation benefits the broader blockchain ecosystem, as the tools and techniques developed for cross-chain MEV often have wider applications.

Certain forms of cross-chain MEV, such as liquidations, are vital for the stability of DeFi protocols. When a borrower's collateral falls below the required threshold on a lending platform, liquidators step in to repay the loan and claim the collateral. In a multi-chain context, liquidators may need to bridge assets from one chain to another to complete this process. By enabling these activities, cross-chain MEV helps prevent bad debt from accumulating and ensures that lending platforms remain solvent.

Key Challenges

Despite its potential, cross-chain MEV introduces numerous challenges. One of the most critical challenges in cross-chain MEV is transaction latency. Unlike single-chain operations that execute near-instantaneously, cross-chain transactions often require bridging mechanisms that introduce significant delays. These delays can span several minutes to hours, creating substantial risks in fast-moving markets. For instance, a trader identifying a price discrepancy between Ethereum and Polygon might initiate an arbitrage strategy using a cross-chain bridge. However, by the time the transaction is finalized, market conditions may shift, erasing the profit margin or even resulting in a loss. This unpredictability makes cross-chain MEV inherently risky and often inaccessible to those without precise timing tools and real-time data. Moreover, high latency discourages smaller participants from engaging in cross-chain MEV, as they lack the resources to mitigate timing risks effectively. Larger players with access to private bridging solutions or faster infrastructure gain a disproportionate advantage, exacerbating centralization risks.

Another significant issue is the lack of atomicity in cross-chain operations. Atomicity ensures that a transaction either executes completely or fails entirely. In cross-chain MEV, this is crucial for preventing partial execution, where one leg of a transaction completes, but another fails. For example, a trader might buy an asset on one blockchain but be unable to sell it on another due to delays or errors in the bridging process. This creates stranded transactions where assets are locked in a bridge or on a destination chain, resulting in financial losses. The inherent differences in block times, consensus mechanisms, and transaction ordering rules between blockchains make achieving atomicity challenging. While atomic swaps provide some solutions, their scope is limited, and implementing them across heterogeneous blockchain networks remains complex.

Security vulnerabilities also plague cross-chain MEV, particularly due to the reliance on cross-chain bridges. These bridges, which enable interoperability between blockchains, are often the weakest link in the ecosystem and frequent targets for hackers. Bridge exploits have led to billions of dollars in losses, shaking trust in cross-chain operations. In 2022, bridge exploits accounted for approximately 69% of all cryptocurrencies stolen, amounting to nearly $2 billion across 13 separate incidents. Notable examples include the Ronin Bridge hack, where attackers stole $622 million, and the Wormhole Bridge exploit, resulting in a $320 million loss. The vulnerabilities arise from several factors, including smart contract bugs, centralized control, and consensus conflicts between connected blockchains. For example, poorly coded bridge contracts can be exploited to drain funds, while bridges controlled by a small group of validators create single points of failure. Differences in consensus mechanisms can also introduce inconsistencies that attackers can exploit. These vulnerabilities deter participants from engaging in cross-chain MEV strategies reliant on bridges, limiting the potential of multi-chain operations.

The issue of centralization risks further complicates cross-chain MEV. Large trading firms, institutional investors, and specialized MEV extraction platforms dominate the space, leveraging their advanced tools, substantial capital, and sophisticated infrastructure to gain a competitive edge. This creates an uneven playing field, where smaller participants are unable to compete effectively. Centralized entities may exploit their position to influence transaction ordering, fee structures, or even bridge operations, undermining the fairness of the ecosystem. This concentration of power contradicts the decentralized ethos of blockchain technology and raises concerns about equity and accessibility. Addressing these risks is critical to ensuring that cross-chain MEV opportunities remain inclusive and do not lead to systemic imbalances.

Fragmented infrastructure across blockchain networks presents another hurdle. Each blockchain operates with its own protocols, consensus mechanisms, and fee structures, creating a fragmented environment that complicates cross-chain MEV strategies. Traders must navigate these differences to execute their strategies effectively, which adds complexity and increases the likelihood of errors. For instance, a trader attempting a multi-chain arbitrage strategy may encounter inconsistent fee structures, divergent block times, and protocol-specific rules. These challenges require significant time and resources to overcome, limiting the scalability of cross-chain MEV and reducing its accessibility to smaller participants.

Additionally, ethical and regulatory concerns are increasingly relevant in the context of cross-chain MEV. While certain forms of MEV, such as arbitrage, contribute to market efficiency, others—like front-running and sandwich attacks—are seen as exploitative and detrimental to fairness. From a regulatory perspective, some MEV activities may be viewed as akin to insider trading or market manipulation, particularly in jurisdictions with strict financial regulations. This uncertainty creates additional risks for participants, who must navigate a shifting legal landscape while engaging in cross-chain MEV. Ethically, the concentration of MEV opportunities among a few large players exacerbates inequities within the DeFi ecosystem, undermining the principles of inclusivity and fairness that underpin blockchain technology.

The accumulation of noise and errors adds yet another layer of complexity. In cross-chain MEV strategies, each bridging operation or transaction introduces potential rounding errors, slippage, or discrepancies in token valuations. Over time, these inaccuracies can accumulate, eroding profit margins and creating inconsistent outcomes. Mitigating these issues requires robust risk management frameworks and precise execution, which are challenging to implement in the fragmented and volatile multi-chain environment.

These challenges collectively underscore the complexity of cross-chain MEV and its impact on the broader DeFi ecosystem. Addressing these obstacles is essential to ensure that cross-chain MEV evolves into a force for innovation and efficiency, rather than a source of instability or inequality. To unlock the full potential of cross-chain MEV while addressing its challenges, the community has developed and continues to refine innovative solutions. These advancements focus on improving speed, security, and fairness, making cross-chain MEV more sustainable and accessible.

Emerging Solutions

Enhanced bridging mechanisms are a cornerstone of these solutions. Traditional bridges, often slow and prone to vulnerabilities, are being replaced with faster and more secure alternatives. For instance, developers are introducing bridging protocols that optimize block confirmations, enabling faster transaction finality. Some advanced bridges allow partial confirmations on the destination chain, expediting asset transfers without compromising security. Integration with Layer-2 solutions, such as rollups, further enhances these mechanisms. By batching transactions, rollups reduce fees and time-to-finality, making cross-chain MEV strategies more cost-effective. Additionally, dynamic fee structures on bridges adapt to network conditions, lowering costs during periods of low activity and making MEV opportunities more accessible to smaller participants.

Atomic transactions and advanced protocols are also pivotal. Hash Time-Locked Contracts (HTLCs) provide a widely adopted solution for enabling atomic swaps between blockchains. These contracts ensure that transactions execute fully or fail entirely, preventing scenarios where assets are stranded mid-operation. Cross-chain consensus protocols like Cosmos' Inter-Blockchain Communication (IBC) enable direct and secure communication between blockchains, allowing for atomic interactions and reducing the complexity of cross-chain operations. Emerging solutions focus on composable atomicity, enabling multiple atomic operations to execute simultaneously across chains. This innovation reduces risks and enhances the efficiency of complex multi-chain strategies.

To address the centralization risks associated with transaction sequencing, decentralized sequencers and fair order execution mechanisms are being explored. Decentralized sequencers distribute transaction ordering power among multiple participants, eliminating single points of control and reducing the risk of biased ordering. Some protocols implement auction systems for transaction ordering, allowing participants to bid for inclusion in blocks. This transparent and competitive process ensures fairness while preventing undue influence by centralized entities. Randomized sequencing introduces another layer of fairness by selecting transaction orders randomly, reducing the likelihood of manipulation.

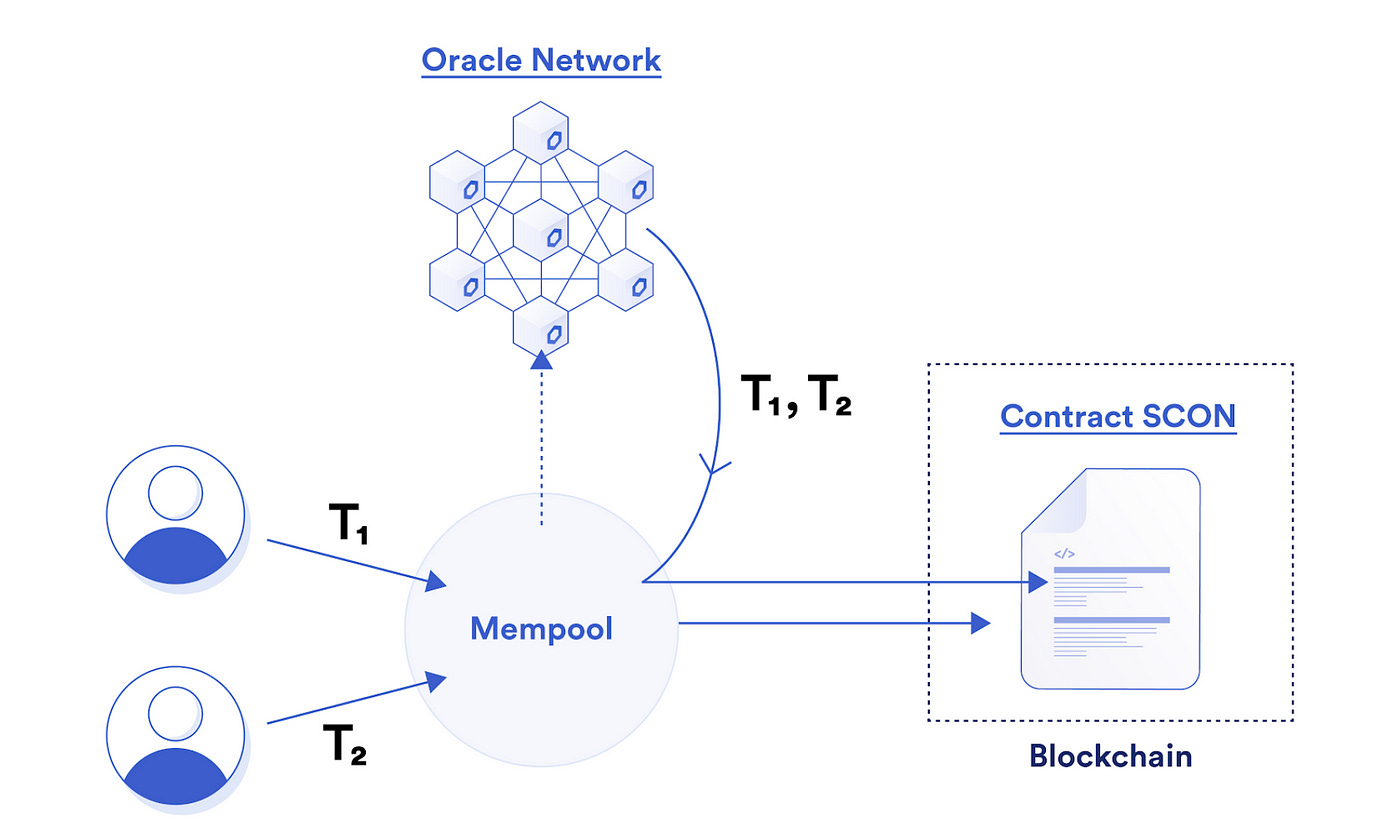

MEV-resistant protocol designs further enhance the ecosystem's resilience. Encrypted mempools, for example, conceal transaction details until they are executed, preventing malicious actors from exploiting pending transactions. Threshold encryption delays the visibility of transaction data until specific conditions are met, thwarting exploitative practices like front-running. Fee-burning mechanisms, such as those introduced in Ethereum's EIP-1559, reduce the financial incentives for MEV extraction, aligning participant behavior with network health.

Interoperability standards play a critical role in reducing fragmentation across blockchains. Standardized bridge designs ensure consistent operation across networks, minimizing bugs and vulnerabilities. Unified messaging protocols, such as LayerZero and Polkadot's XCMP, enable seamless data and asset exchanges between blockchains, simplifying cross-chain MEV operations. Interoperable smart contracts automate trustless interactions between chains, improving efficiency and reducing manual intervention.

Finally, AI and machine learning are revolutionizing cross-chain MEV by enhancing decision-making and execution. AI algorithms analyze large datasets across multiple blockchains in real-time, identifying arbitrage opportunities or liquidation risks faster than human traders. Predictive modeling anticipates market conditions, such as price movements or network congestion, enabling traders to adapt proactively. Automated bots powered by AI execute complex strategies with precision, ensuring timely and accurate multi-chain operations.

These solutions collectively transform cross-chain MEV, addressing its challenges while unlocking new opportunities for traders, developers, and DeFi protocols. As these innovations mature, they pave the way for a more interconnected, efficient, and equitable blockchain ecosystem.

Conclusion

To conclude, cross-chain MEV represents a transformative force in the DeFi landscape, offering lucrative opportunities and driving technological innovation. However, it also presents significant challenges that must be addressed to ensure its potential is realized equitably. By integrating enhanced bridging mechanisms, atomic transaction protocols, decentralized sequencing, and MEV-resistant designs, the blockchain community can mitigate these challenges and create a more sustainable and inclusive ecosystem. As blockchain networks continue to interconnect, cross-chain MEV will remain a critical driver of efficiency and evolution, shaping the future of decentralized finance.

Glossary

Arbitrage: The practice of taking advantage of price differences for the same asset across different markets.

Atomicity: A property in computing and blockchain where a transaction either completes entirely or not at all, with no partial execution.

DeFi (Decentralized Finance): Financial services and products built on blockchain technology that operate without traditional intermediaries.

Front-running: The practice of entering into a transaction based on advance knowledge of pending transactions.

Layer-2: A secondary framework or protocol built on top of an existing blockchain that helps with scaling and transaction speeds.

Liquidity: The ease with which an asset can be converted to cash or traded without affecting its market price.

MEV (Maximal Extractable Value): The maximum value that can be extracted from block production in excess of the standard block reward and gas fees.

Mempool: A waiting area for transactions that have been broadcast to a blockchain network but not yet confirmed.

Rollups: A scaling solution that processes transactions outside the main blockchain while maintaining security through the main chain.

Sandwich Attack: A type of front-running where an attacker places one transaction before and one after a target transaction.

About The Author

Billy Gao (@__billygao) serves as the Head of Governance for the Stanford Blockchain Club, an analyst at Pantera Capital, and is a sophomore studying computer science. He has experience in the blockchain ventures industry, especially in Hong Kong, having worked with venture capital firms with a focus on DeFi.

.