#47 - Uniswap's BNB Chain Deployment Saga

A Tale of Two Bridges-How Decentralized is Governance, Really?

Stanford Blockchain Review

Volume 5, Article No. 7

📚Author: Billy Gao — Stanford Blockchain Club

🌟Technical Prerequisite: Intermediate

Introduction

In early 2023, the Uniswap community faced a pivotal decision on deploying the Uniswap V3 protocol on the BNB Chain. This proposal [1] ignited intense debate and a clash of interests involving stakeholders such as LayerZero, Wormhole, and Andreessen Horowitz. The saga provided a unique cross-section into the complexities of decentralized governance, the influence of venture capital in the DeFi space, and broader implications for the future of blockchain governance.

The strategic and financial implications of deploying Uniswap V3 on the BNB Chain, coupled with the technical debate over bridge technologies, highlight the intricate balance needed between innovation, security, and community engagement. This decision underscores the necessity for comprehensive governance reforms to mitigate the disproportionate influence of large stakeholders like a16z, ensuring fair and decentralized decision-making. This case exemplifies the broader challenges facing DeFi projects in maintaining transparency, fostering decentralized governance, and advancing cross-chain interoperability.

Setting the Scene

The proposal to deploy Uniswap V3 on the BNB Chain emerged in early 2023. Proponents suggested that expanding to the BNB Chain would allow Uniswap to tap into a new user base, which in turn means that Uniswap could leverage lower transaction costs, and benefit from faster transaction speeds compared to Ethereum. The initial temperature check on this proposal garnered overwhelming support from the community, indicating a strong desire for Uniswap to diversify its platform presence and enhance its competitive edge in the DeFi ecosystem.

Deploying on the BNB Chain was seen as a strategic move to capitalize on Binance's vast ecosystem. The BNB Chain offered lower gas fees and faster transaction speeds compared to Ethereum, making it an attractive option for both users and developers. Proponents highlighted that this move could democratize access to Uniswap’s offerings, making it more accessible to a broader range of users who might have been deterred by Ethereum’s high transaction costs.

Lowered transaction costs were a significant factor driving the proposal. On Ethereum, gas fees can be extremely high, especially during periods of network congestion. The BNB Chain's lower fees were expected to attract more users to Uniswap, increasing its liquidity and trading volume. Additionally, the faster transaction speeds on the BNB Chain would improve the overall user experience, making it more competitive with other DEXs already operating on Binance's network.

Another motivation was the potential to tap into Binance's extensive user base. Binance, one of the largest cryptocurrency exchanges in the world, had a thriving ecosystem with millions of active users. This strategic expansion was seen to enhance Uniswap’s market presence and solidify its position as a leading DeFi platform. Deploying Uniswap on the BNB Chain can significantly expand Uniswap's user base by tapping into BNB's large and growing community, leveraging its high transaction speeds and low fees. The integration can enhance liquidity and trading volume, providing Uniswap with a potential $1 billion in TVL and attracting 1-2 million new users [1]. Moreover, it offers opportunities for collaboration within BNB’s ecosystem, improved DeFi infrastructure, and the possibility of integrating with Binance’s extensive range of products and services, boosting Uniswap’s overall adoption and functionality.

The Fireworks

The initial temperature check showed strong support for the deployment, with 20 million votes in favor and participation from 6,495 UNI holders, the highest in Uniswap governance history. This strong endorsement highlighted the community’s interest in expanding Uniswap’s reach, leveraging BNB Chain's lower transaction costs and faster speeds, and enhancing its competitive edge in the DeFi space. The proposal projected a significant boost in liquidity and market presence, with a potential $1 billion increase in TVL and the acquisition of 1-2 million new users [2].

Overwhelming approval from the Uniswap community signaled a collective interest in expanding Uniswap’s reach and enhancing its competitive edge within the DeFi space. Many community members saw the deployment as a way to diversify Uniswap’s platform and reduce its dependence on Ethereum. This sentiment was driven by a desire to mitigate the risks associated with high Ethereum gas fees and network congestion, which had become significant pain points for users.

A critical component of the deployment was the selection of the bridging technology that would facilitate interoperability between Uniswap on the BNB Chain and Ethereum. Two primary contenders emerged: Wormhole and LayerZero. This decision was not merely technical, it also had strategic and financial implications.

LayerZero, despite being newer to the scene, had quickly gained traction due to its innovative approach to cross-chain communication. LayerZero’s ULN architecture promised to reduce the attack surface and improve transaction speeds. For a16z, which had invested heavily in projects prioritizing security and scalability, LayerZero represented a forward-looking choice that could enhance Uniswap’s security posture and future-proof its interoperability capabilities.

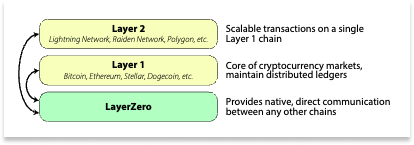

LayerZero is a cross-chain communication protocol designed to provide seamless interoperability between different blockchain networks using its Ultra Light Node (ULN) architecture, allowing efficient and secure cross-chain transactions without the need for full nodes. ULN operates by leveraging a decentralized system of oracles and relayers to validate transactions. Oracles provide data from different blockchains, while relayers transmit this data, ensuring security and trustlessness by requiring both parties to verify transaction details before processing. This method supports arbitrary message passing, enhancing flexibility for diverse applications.

LayerZero has garnered significant backing from major investors, including a16z, whose financial support leads to a problematic debate. Despite some allegations of vulnerabilities by competitors, specifically potential exploits involving message transmission without proper verification, LayerZero maintains robust security configurations to prevent unauthorized data passage. These allegations have not significantly impacted LayerZero’s adoption, as demonstrated by its competitive position in the Uniswap bridge evaluation.

On the other side of the coin, the proposal to deploy Uniswap V3 on Sei uses Wormhole for cross-chain message passing. Wormhole is a well-established cross-chain bridge known for its robustness and reliability in facilitating secure and efficient cross-chain transactions. It employs a decentralized network of guardians to verify and facilitate transactions, ensuring security and trustlessness. Despite a significant security breach in February 2022, where 120,000 wrapped Ether worth approximately $321 million was stolen [3], Wormhole has since implemented substantial security improvements.

Its validator set comprises reputable entities and robust security thresholds, making it a trusted solution within the DeFi ecosystem. Wormhole supports Uniswap deployments on several chains, including BNB, Celo, Gnosis, Rootstock, and Moonbeam, ensuring secure and reliable cross-chain communication. The use of Wormhole in Uniswap’s Sei deployment aims to maintain high security and efficiency in Uniswap's cross-chain operations, enhancing interoperability and functionality across different blockchain networks.

Stanford Blockchain Club (SBC) provided our analysis of deploying Uniswap V3 on the BNB Chain at the time, evaluating LayerZero and Wormhole for cross-chain governance. We recommend a temporary adoption of LayerZero, conditional on resolving specific issues, while advocating for a long-term solution involving multi-message aggregation. Both LayerZero and Wormhole have governance risks: LayerZero's 2/2 multisig includes Uniswap and LayerZero Labs, and Wormhole's 1/1 multisig involves 19 validators. Despite improvements, neither bridge fully meets our standards, underscoring the need for continuous evaluation and development.

LayerZero's ULN architecture allows efficient cross-chain transactions without full nodes, using decentralized oracles and relayers for validation. Its temporary adoption is suggested if it resolves certain issues, aiming for a long-term multi-message aggregation solution for better scalability and security. Wormhole, despite its significant security improvements following a major breach in 2022, still presents governance risks. It uses a 1/1 multisig setup with 19 validators but requires continuous assessment and development to meet our criteria. The full detailed post can be found here [4].

a16z has heavily invested in LayerZero, citing the ULN architecture which enables efficient and secure cross-chain transactions, addressing the Bridging Trilemma and enhancing dApp interoperability as a key factor [5], leading a $135 million funding round alongside FTX and Sequoia Capital. This strategic investment aligns a16z’s interests with LayerZero’s success, positioning the protocol as a key part of a16z's portfolio. Additionally, Uniswap Labs, the developer of the decentralized exchange Uniswap, raised $165 million in a Series B funding round led by a16z with participation from Polychain Capital [6]. The significant investments in both LayerZero and Uniswap highlight a16z's influential role in the DeFi space and the potential conflict of interest given their vested interests in both protocols.

In January 2023, the proposal was voted in an off-chain temperature check conducted on Snapshot. The community preferences indicated a strong preference for Wormhole over LayerZero and other contenders with Wormhole receiving 28M votes when compared to the 17M of LayerZero [7]. Despite Wormhole's past security issues, the community showed confidence in Wormhole’s subsequent improvements and security measures.

Wormhole won the initial vote to become the designated bridge for Uniswap’s deployment on the BNB Chain. Wormhole's technology leveraged a decentralized network of guardians who validated cross-chain transactions, ensuring security and trustlessness. This model had been successfully implemented in other projects, providing confidence in its ability to handle Uniswap’s cross-chain needs. The vote indicated a preference for Wormhole’s proven technology and its potential to provide a seamless user experience across chains.

During the temperature check phase, a16z did not participate due to technical constraints related to its custodian service. Representatives from a16z expressed their strong support for LayerZero after evaluating various bridge proposals and clarified that they would have voted their 15 million UNI tokens in favor of LayerZero if they had been able to participate, which would have swung the voting in favor of LayerZero. This absence highlighted the complexities and potential limitations of decentralized governance mechanisms. Despite being unable to vote in the current Snapshot due to infrastructure limitations, a16z assured participation in future on-chain and Snapshot votes and requested to be considered in the temperature check for LayerZero.

This is a significant swing in the voting procedure as the 15 million tokens held by a16z is sufficient to change the outcome of the initial snapshot vote, making LayerZero the winner instead. This is especially worrying as a16z potentially holds over 55 million UNI tokens which could allow them to unilaterally reach a voting quorum [8], making it a substantial force in Uniswap’s governance. These substantial holdings raise significant concerns about the decentralization of Uniswap governance, highlighting the power venture capital can wield in decentralized platforms.

Dust Settles

At the end, vote on Uniswap Proposal #31 involving deploying Uniswap v3 on the BNB Chain with Wormhole as the bridge, decided by the snapshot vote, concluded with 55.9 million UNI tokens (65.89%) in favor and 28.9 million UNI tokens (34.11%) against. Prominent delegates such as GFX Labs and many others supported the proposal, while a16z opposed it, preferring the LayerZero bridge as they have previously stated in their posts [9]. Despite the opposition, the proposal passed, reflecting the community’s support for Uniswap's expansion onto the BNB Chain.

A16z opposed the decision to use Wormhole. They cited their rationale behind the vote for two reasons. Firstly, they advocate for a structured, comparative assessment process for selecting bridge providers, which they felt was not adequately conducted for this vote. They support an independent third-party evaluation to ensure a fair process. Secondly, they have security concerns with the Wormhole bridge, which has experienced significant vulnerabilities and exploits. They also note that the Uniswap DAO would lack control over the bridge if Wormhole were selected [10].

TL;DR: On January 31, 2023, Wormhole won the initial temperature check vote for Uniswap V3's BNB Chain deployment with 62% of the votes. Despite a16z's opposition and advocacy for LayerZero, resulting in a heated debate from February 1-5, the final on-chain vote from February 4-10 saw overwhelming community support for Wormhole. The proposal passed with over 45 million votes in favor, while the opposition, led by a16z, managed around 15 million votes against.

The governance vote for the BNB Chain deployment highlighted the challenges and intricacies of decentralized decision-making. The final vote was a testament to the power dynamics within decentralized organizations and the influence of major stakeholders. The voting process seemed extremely dire, especially during the earlier stages of the voting process, where a16z 15 million plus votes constituted most of the votes casted.

Concerns about decentralization and venture capital influence over DeFi protocols like Uniswap have seemingly proved themselves to be well-founded and decreasingly farfetched. Many community members were frustrated by what they perceived as undue influence by a16z, arguing that it undermined the principles of decentralization. It was argued that a16z’s substantial voting power, derived from its significant holdings of UNI tokens, allowed it to disproportionately influence the outcome. This raised concerns about the centralization of power within Uniswap’s governance structure and the potential for conflicts of interest. The debate underscored the need for governance reforms to ensure a more balanced and inclusive decision-making process.

A significant factor in the final vote was a16z’s delegation of UNI tokens to third parties, many of whom supported the Wormhole proposal at the end, including but not limited to SBC. A representative for a16 mentioned that they have delegated over 40 million additional tokens to third parties. Theoretically, a16z could, in future votes, reclaim those UNI tokens, and the votes, for itself [11]. This delegation strategy, while common in decentralized governance, underscored the complexities and potential conflicts of interest within such systems. The broader crypto community closely monitored these events, raising questions about the influence of large token holders and the true decentralization of Uniswap’s governance.

The contentious vote brought to light broader issues regarding transparency and the effectiveness of decentralized governance. Critics pointed out that the influence of large stakeholders like a16z could sway decisions in ways that might not always align with the broader community’s interests. This sparked discussions about potential reforms to ensure more equitable decision-making processes in the future.

Proposals for governance reforms included introducing quadratic voting to reduce the influence of large stakeholders, implementing delegation mechanisms to empower smaller token holders, and enhancing transparency through detailed disclosures of voting power and interests. These reforms aimed to uphold the principles of decentralization while ensuring that governance decisions were fair and representative of the entire community. In the following section, we will delve into the various perspectives on the saga, providing an in-depth analysis of the community's suggestions and their potential impact on future governance reforms.

So…

The decision to deploy Uniswap V3 on the BNB Chain carries significant strategic implications for Uniswap and the broader DeFi landscape. Expanding to the BNB Chain aims to attract a broader user base, increase trading volumes, improve liquidity, and enhance the overall user experience. This move leverages Binance's extensive user base, lower transaction costs, and faster transaction speeds, positioning Uniswap to capture a larger market share.

Integrating with the BNB Chain aligns with the broader trend of multi-chain deployments among leading DeFi projects. This strategy underscores the growing importance of cross-chain interoperability, which is critical for maintaining and enhancing market competitiveness. By operating on multiple chains, Uniswap can better compete with other decentralized exchanges within the Binance ecosystem, such as PancakeSwap, and tap into the benefits of lower fees and faster transactions offered by other blockchains.

However, this expansion is not without risks. Security concerns associated with transitioning to a new blockchain are paramount. Ensuring the integrity and reliability of the bridging technology is crucial to maintaining user trust and platform security. Any security breach or failure in the bridging technology could severely damage Uniswap’s reputation and user trust. Therefore, thorough vetting and continuous monitoring of the chosen bridging technology are essential to safeguard against potential breaches.

Financial interests of stakeholders, particularly those with substantial investments in Uniswap, also play a critical role in this decision. The choice of bridge technology impacts the security, performance, and user experience of Uniswap’s cross-chain operations, ultimately affecting its market position and profitability. For major investors like a16z, this choice is not just technical but strategic, influencing the financial performance of their investments.

Community engagement is crucial for the success of this strategic move. Actively involving the community in decision-making processes through regular updates and forums can help gather valuable feedback and ensure alignment with user needs and preferences. Fostering a strong sense of community involvement and ownership can enhance user trust and support, leading to more informed and accepted decisions.

The decision to deploy Uniswap V3 on the BNB Chain introduced a critical debate over the choice of bridging technology, with significant implications for security, performance, and decentralization. Wormhole and LayerZero each presented unique advantages and challenges, making the selection a complex decision with strategic and financial ramifications.

Security was a primary concern in selecting a bridge. Wormhole, despite a significant breach in February 2022, has since implemented substantial security improvements. Its decentralized network of guardians and robust validation mechanisms have proven effective in securing cross-chain transactions. LayerZero, with its innovative ULN architecture, minimizes the attack surface and enhances security through a decentralized system of oracles and relayers. Both solutions offer strong security features, requiring careful evaluation to determine the best fit for Uniswap’s needs.

Performance and scalability were also critical factors. Uniswap’s expansion necessitates a bridge capable of handling high transaction volumes while maintaining fast transaction speeds. Wormhole’s established performance in managing substantial transaction volumes makes it a reliable choice. LayerZero’s ULN architecture, with its potential for improved scalability and efficiency, offers a promising alternative. Balancing proven reliability with the benefits of innovative technology is essential.

Decentralization and governance were key considerations. Wormhole’s decentralized guardian network supports trustlessness, though its 1/1 multisig setup requires ongoing scrutiny. LayerZero’s ULN architecture offers potential advantages in transaction efficiency and flexibility, but its 2/2 multisig setup and alleged security vulnerabilities need to be addressed to align with Uniswap’s decentralization goals.

To address these concerns, Uniswap should implement regular assessments by independent security experts to identify and mitigate potential vulnerabilities of its bridging solutions, ensuring the highest security standards. Exploring a hybrid model that leverages the strengths of both LayerZero and Wormhole could provide a more robust solution, enhancing security and decentralization. Developing a contingency plan to switch or integrate multiple bridging technologies based on performance and security assessments is also crucial. This plan ensures Uniswap remains adaptable and resilient in the face of evolving security threats, better protecting users and assets while fostering community trust.

Once again, engaging the community in selecting and evaluating bridging technologies is vital. Transparent discussions and voting can enhance community trust and ensure decisions align with the broader interests of Uniswap’s stakeholders. Effective governance mechanisms, including inclusive voting processes and detailed disclosures, can help maintain the integrity of decision-making and uphold decentralization principles.

A Way Forward

The decision to deploy Uniswap V3 on the BNB Chain highlighted the critical need for governance reforms within Uniswap. The substantial involvement of venture capital firms, particularly a16z, in the decision-making process exposed issues related to centralization, transparency, and community trust. While VCs provide essential funding, expertise, and resources that drive innovation and growth, their substantial influence raises concerns about the decentralized ethos of Uniswap and other DeFi projects.

Uniswap's governance process has demonstrated both the strengths and weaknesses of decentralized decision-making. Large stakeholders with substantial voting power can significantly influence outcomes, as seen with a16z’s holdings of UNI tokens and their strategic interests in LayerZero. This situation underscores the need for reforms to mitigate these risks and ensure equitable decision-making.

To address these concerns, several governance reform proposals have emerged. One key suggestion is implementing more inclusive voting processes, such as quadratic voting, which reduces the disproportionate influence of large token holders by making each additional vote cost exponentially more. This system can help ensure smaller token holders have a more significant voice in governance decisions. Uniswap could pilot this system on less critical proposals to test its impact and functionality, gather data, and address any practical issues. An education campaign to inform the community about quadratic voting, with guides, webinars, and interactive sessions, would support broader adoption.

Introducing a capped voting weight for individual entities or wallets is another critical reform. By capping the voting weight, Uniswap can prevent any single stakeholder from wielding excessive power, promoting a more decentralized decision-making process. This cap could be based on a percentage of the total voting power, ensuring fairness and preventing domination by a few large entities.

Improving delegation mechanisms can empower smaller token holders by enabling them to delegate their votes effectively. Establishing accountability measures for delegates, such as performance reviews and the ability for delegators to retract their votes if delegates do not act in their best interests, can ensure that delegates act responsibly. Introducing incentives for active participation, such as governance rewards and recognition for effective delegates, can further encourage smaller token holders to engage in governance.

Enhancing transparency and accountability is also crucial. Requiring major stakeholders, including VCs, to fully disclose their voting power and any potential conflicts of interest can provide greater transparency and ensure decisions are made in the community's best interest. Detailed disclosures should be publicly accessible, helping maintain trust within the governance process. Regular audits by independent third parties can verify disclosed information and voting behaviors, maintaining the governance process's integrity.

Finally, education campaigns and community feedback mechanisms are vital. Launching comprehensive education campaigns to inform the community about governance mechanisms, and establishing dedicated platforms for community feedback can ensure that governance processes remain aligned with the community’s interests and needs, especially for newcomers of the governance ecosystem. Regular community engagement to discuss governance issues and audit findings, can provide a platform for direct community input and ensure that governance processes are effective and aligned with decentralized principles.

Conclusion

The decision to deploy Uniswap V3 on the BNB Chain marks a pivotal moment for Uniswap, highlighting both opportunities and challenges in expanding its DeFi presence. Strategically, this move allows Uniswap to tap into Binance's extensive user base, thereby increasing liquidity and trading volumes. However, it also underscores the necessity of addressing significant security concerns and ensuring the integrity of the bridging technology to maintain user trust and platform security.

The governance process surrounding this decision brought to light the substantial influence of venture capital firms like a16z, raising concerns about centralization and transparency. This has sparked a critical dialogue about the need for governance reforms to uphold decentralization, ensure equitable decision-making, and foster community trust. Proposed reforms include implementing quadratic voting to amplify the voices of smaller stakeholders, introducing capped voting weights to prevent domination by large entities, and improving delegation mechanisms to empower smaller token holders through accountability measures and incentives. Enhancing transparency is essential for maintaining trust within the governance process. Launching comprehensive education campaigns and establishing community feedback mechanisms will ensure that governance processes remain aligned with the community’s interests and needs.

Moving forward, Uniswap should continue exploring multi-chain deployments to enhance resilience and adaptability. By addressing the complexities and potential conflicts of interest within its governance framework, Uniswap can strengthen its position as a leading DeFi platform and build a more sustainable ecosystem. Continuous improvement and community involvement will help Uniswap uphold its decentralized ethos while navigating the evolving DeFi landscape.

The Uniswap BNB Chain deployment saga serves as a microcosm of broader challenges in DeFi, including decentralized governance, interoperability, and venture capital influence. The lessons learned will shape future decisions within the DeFi ecosystem, highlighting the need for innovative governance mechanisms to uphold decentralization while accommodating the practical realities of sustaining a vibrant DeFi ecosystem.

About The Author

Billy serves as the Head of Governance for the Stanford Blockchain Club and is a rising sophomore studying Computer Science. He has experience in the blockchain ventures industry, especially in Hong Kong, having worked with venture capital firms with a focus on DeFi.

References

[1]: https://gov.uniswap.org/t/rfc-update-deploy-uniswap-v3-1-0-3-0-05-0-01-on-bnb-chain-binance/19734

[2]: https://gov.uniswap.org/t/temperature-check-should-uniswap-v3-be-deployed-to-bnb-chain/20046

[3]: https://cointelegraph.com/news/wormhole-token-bridge-loses-321m-in-largest-hack-so-far-in-2022

[4]: https://gov.uniswap.org/t/rfc-update-deploy-uniswap-v3-1-0-3-0-05-0-01-on-bnb-chain-binance/19734/77

[5]: https://a16zcrypto.com/posts/article/investing-in-layerzero/

[8]: https://protos.com/why-does-a16z-want-to-strengthen-its-grip-on-uniswap/