#08 - Some Ordinary Wizardry: The Future of Bitcoin

Inflections in Bitcoin's Changing Meme

Stanford Blockchain Review

Volume 1, Article No. 8

🧙♂️ Author: Tyler Whittle – Floodgate Fund

🌟 Technical Prerequisite: Moderate

Some Ordinary Wizardry: e939d4c27b09645e236493fc8b74fc70c14e5e203116ecbd0bedac2701dd91fci0

Introduction

The Bitcoin meme [1] is about to transform. While a small camp of laser-eyed maxis want to protect the sanctity of Bitcoin, change marches inexorably on. Tailwinds from Ordinals, money-ness of BTC, and declining block rewards are propelling memes beyond store of value to the forefront of Bitcoin.

However, this memetic transformation cannot occur in a vacuum. It requires new technology, and Bitcoin is about to find itself in desperate need of a scaling solution. Unlike Ethereum, Bitcoin was not initially designed to scale. Because of this, existing scaling solutions on Bitcoin remain either insufficient or unadopted.

I believe that a scaling solution will emerge in the next 12-24 months that will capture the hearts and minds of the Bitcoin community. Specifically, I believe this solution will be a zk-rollup with EVM compatibility. This architecture will leverage the Bitcoin network for consensus and settlement, enable trustless withdrawal from the L2 to the L1, and allow code to be easily ported from Ethereum. In doing so, this rollup will fuse the best of the Bitcoin and Ethereum ecosystems together and form a powerful new layer in crypto.

Inflections in Bitcoin: A Changing Meme

Bitcoin is currently experiencing a series of inflections that are going to propel its meme beyond just a store of value. The first is the transition from store of value to settlement layer. The second is a transition from store of value to money. The final inflection, halving block rewards, requires higher transaction fees on Bitcoin in order for the network to survive - this necessitates a meme that extends beyond store of value.

Store of Value to Settlement Layer: Ordinals & The NFT craze

If you spend time in crypto, you have almost certainly spotted a little wizard [2] extolling the value of Magic Internet Money in the past two months. Udi [3] and The Taproot Wizards [4] have burst onto the scene as champions of the Bitcoin NFT protocol called Ordinals [5]. This isn’t the first time NFTs have been introduced on Bitcoin - going back all the way to 2012, colored coins [6] were all the rage. But something feels different this time…

Back in 2017, the Segwit [7] fork opened Pandora’s box by extending blockspace to 4 MB. Then in 2021, the Taproot fork allowed a single transaction’s witness data to be of arbitrary size as long as it fit inside a single 4 MB block. Combined, these changes to Bitcoin enabled the Ordinals protocol and fully on-chain NFTs like the Taproot Wizards to spring into existence [8]. Turns out that Ordinals might just be the shot heard round the world in a war for the future ideology of Bitcoin.

Figure 1: The first Taproot Wizard inscribed on Ordinals - note the 3.92 MB size!

One one side, you have loud and proud “orthodox” Bitcoin Maxis. This camp [9] believes that the sanctity of Bitcoin is being violated by a bearded band of Taproot Wizards. They believe that Bitcoin blockspace should solely serve to transfer Bitcoin between one user and another. The Bitcoin whitepaper is their only gospel, and anyone who acts against the word of Satoshi must be excommunicated. Seeing a meme of a Wizard take up a whole block [10] sends their laser eyes into a frenetic overdrive.

Meme 1: How I imagine the battle between Maxis and Degens playing out.

On the other side, you have what I call the crypto degens. This camp has traveled to the promised land of smart contracts, NFTs, and Defi protocols on Ethereum. They found out that it can, in fact, be pretty damn cool to own an ape that is bored in a yacht club. Inspired by the Taproot Wizards, some of these users are even transferring their highly-valuable apes [11] over to the Bitcoin network. The Ordinals movement shows no signs of slowing down. You can now go to the equivalent of Hogwarts [12] in crypto (see some of the magic here!! [13]). New innovations like BRC-20 [14] are coming out of the community on a daily basis. The prevailing wisdom seems to be that if Bitcoin is the most secure and decentralized blockchain, then why should its users not share in the forbidden fruits enjoyed by other chains?

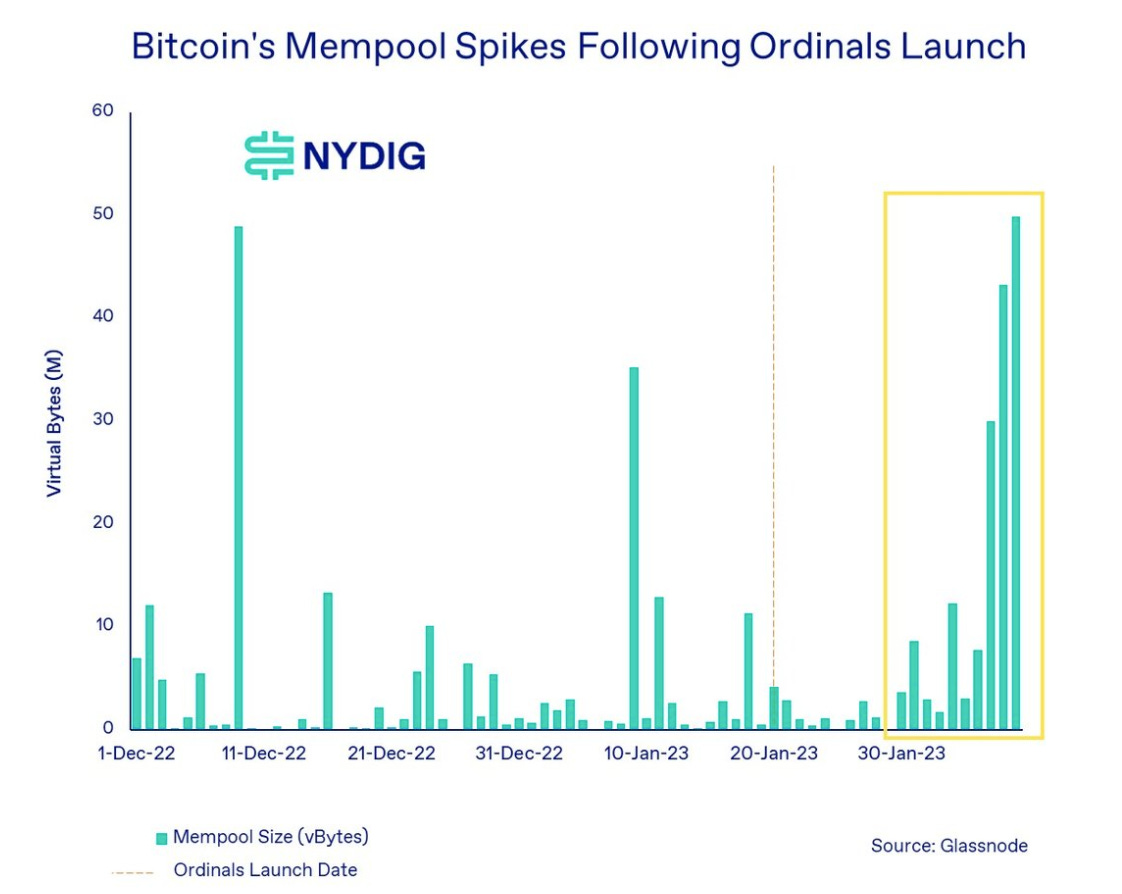

One thing is for certain, Ordinals put the first blip [15] on the Bitcoin blockspace demand chart we’ve seen in a while. More importantly though, if there is latent demand for more functionality like NFTs, then Bitcoin will no longer be just a store of value. It will start to look like a settlement layer for crypto primitives - and a direct competitor to Ethereum.

Figure 2: Analysis from NYDIG shows how blockspace demand spiked following the launch of Ordinals.

Ultimately, I think that the Bitcoin Maxis actually comprise a minority of Bitcoin users, and that the crypto degen movement will take hold over the Bitcoin community in the next year. Ordinals will continue to gain momentum, and it will spark further innovations on Bitcoin. However, in order to achieve the full potential of a settlement layer, more change is going to be necessary. Script [16] is not a Turing complete language, and thus arbitrary smart contracts are not possible directly on Bitcoin. In order for this movement to reach its full potential, a scaling solution that offers arbitrary code execution must emerge and be adopted.

Store of Value to “Adopted” Money: The Rise of BTC Money-ness

Let’s take a step back and talk about the existing predominant meme of Bitcon: store of value. What functionality does a store of value need? Well, it needs to allow transactions in and out of it with relative ease, it needs a safe storage solution, and it needs to hold its value over time. For example, when the economy is failing, people flock to gold. Gold is a good store of value because there is a relatively fixed supply, it is easy to acquire on markets, and there are trusted third parties that will hold it for you. Most importantly though, society has decided to believe it is a store of value.

Bitcoin does all the things required of a store of value splendidly. Anyone with a computer is capable of acquiring Bitcoin. There will only ever be 21M Bitcoin mined. It’s easy to send Bitcoin to another individual, and there are exchanges to go between Bitcoin and fiat in many countries. Bitcoin is secured by an ECDSA encryption algorithm [17] that is provably hard to break. Lastly, Bitcoin has made great strides in society’s belief that it is valuable [18]. Check out this paper [19] for an in-depth analysis on why Bitcoin exhibits characteristics of a store of value in the long-term.

Figure 3: The value placed on Bitcoin has increased tremendously in the past 5 years as indicated by the price in USD.

When we talk about money however, store of value is just one function. The other functions of money [20] are medium of exchange and unit of account. These two functions of money are pretty tightly coupled [21]. For Bitcoin to evolve past a store of value and into money, we would have to see movement along these dimensions.

Bitcoin has many of the characteristics of a medium of exchange. However, a big impediment to becoming a medium of exchange for Bitcoin is the price and time required to conduct a transaction. As of writing, the gas required for an average transaction on Bitcoin was $1.73 [22], and settlement time is around 10 minutes. If you are sending thousands of dollars, this feels totally reasonable. However, if you are looking to make a $10 purchase, a 17% fee and waiting for 10 minutes for the transaction to complete feels ridiculous.

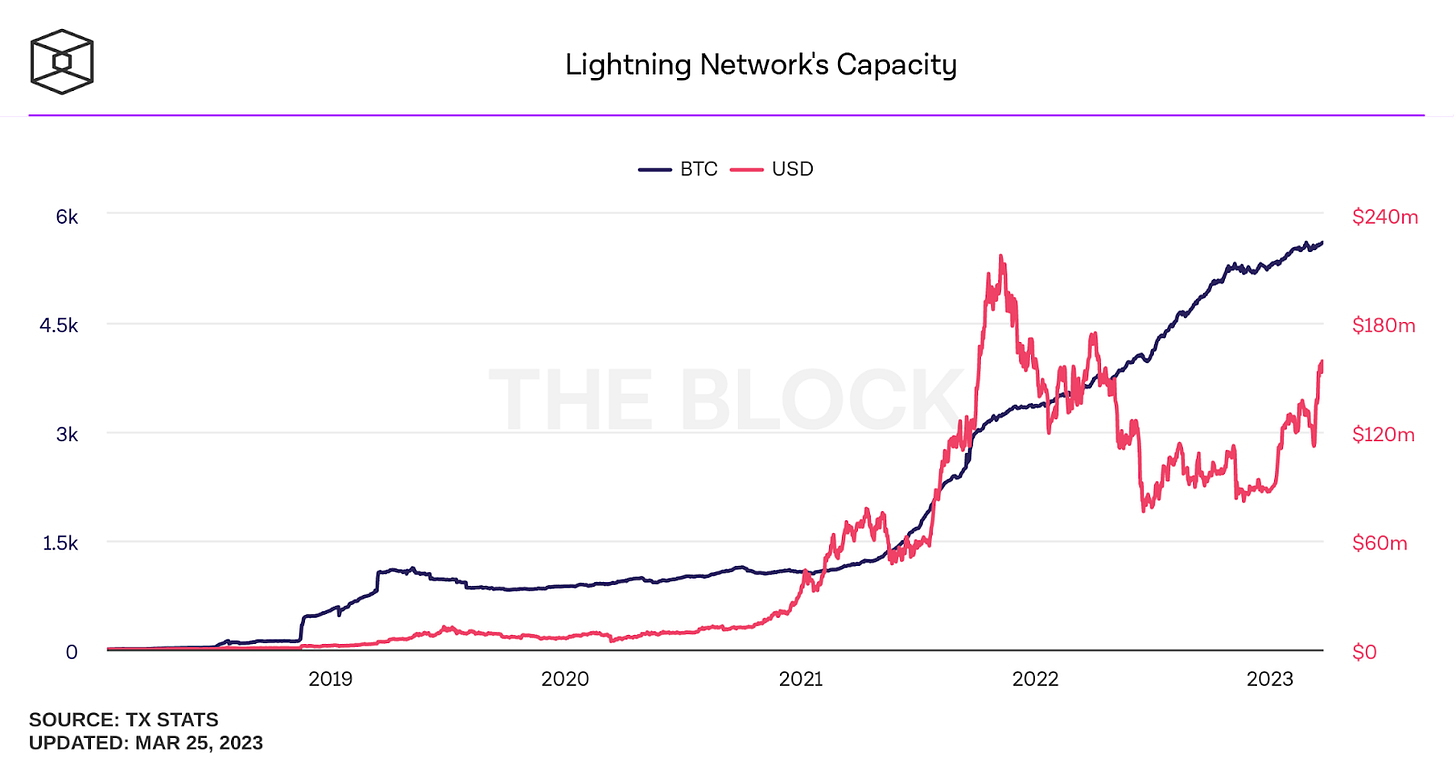

Fortunately, solutions are starting to emerge. Companies like Strike [23] and Cash App [24] are taking advantage of the Lightning Network [25] to push Bitcoin forward as a medium of exchange. For example, you can get paid in Bitcoin on Strike, and you can easily send Bitcoin between friends on Cash App. Along with that, Strike just announced Bitcoin will now be used as an intermediary currency for transfers between the US and Philippines through a partnership with Pouch [26]. As use cases like this continue to mount, Bitcoin will further entrench itself as a viable medium of exchange.

Figure 4: Lightning network capacity and utilization continues to steadily climb.

As for growing into a unit of account, that may take more time. My corner store isn’t listing candy bars in satoshis at the moment, and I don’t think it will be anytime soon. But in other countries, we can see glimpses of movement in this direction. El Salvador is the prime example, where Bitcoin has been designated as legal tender by the government. All businesses are required to accept Bitcoin [27] as a form of payment. This pushes it towards being a unit of account, but ultimately achieving this status will be out of reach until the underlying volatility of Bitcoin tamps down. Units of accounts need to be in stable denominations. No one wants to find that their price of a dozen eggs moved from 50 satoshis to 500 satoshis overnight.

Figure 5: The volatility of Bitcoin remains high relative to USD.

Finally, it’s clear there is demand from Bitcoin holders to treat Bitcoin as something beyond just a store of value. For example, there are ~160k Bitcoin [28] that have been wrapped onto Ethereum representing over $3.2B. These are being used across the Ethereum ecosystem to do everything from providing liquidity in Defi protocols to buying NFTs. The main point is that holders are looking for ways to gain leverage on their Bitcoin - essentially treating it as a standard of deferred payment [29] (another emergent property of money!). However, these users are being forced into other ecosystems to attain this functionality. If Bitcoin had a thriving financial ecosystem, then this $3.2B would likely remain on the Bitcoin network rather than being risked in cross-chain bridges. In fact, I suspect we’d see a lot more than just $3.2B being put to work if Bitcoin offered native Defi products.

Figure 6: Over 150k Bitcoin are currently wrapped as wBTC on Ethereum.

I believe the impediments preventing Bitcoin from achieving all the functions of money will erode in the coming years. Transactions costs will be slashed. Smart contract functionality will be achieved. Volatility will come down. And while volatility will have to come with time and adoption (for things to be natively denominated in BTC), the first two challenges are readily solvable with Bitcoin scaling solutions.

The Decline of Block Rewards: The Need for Fees

A final inflection in Bitcoin is its slow march towards 0 BTC block rewards. Right now, each new block mined comes with a 6.25 BTC reward. In mid-2024 [30], this will undergo a “halving” to 3.125 BTC. Every 210,000 blocks, this reward will continue to half until all 21M Bitcoin have been mined.

This isn’t a new trend - it’s been known since the Bitcoin network started - but it is relevant to the meme needing to evolve past a store of value. When played out to its conclusion, it becomes clear that Bitcoin faces an existential long-term threat. Eventually network fees have to compensate miners for running the network, or the number of miners will drop off precipitously. This would be catastrophic for network security if it ever occurred.

The existing gas fees paid to miners is around 0.1 BTC/block [31]. If you look at the 10k’s of Riot Platform (RIOT) [32] or Cipher Mining (CIFR) [33], you’ll see that they have a breakeven rate of around a Bitcoin price of ~$13.5k while block rewards are at 6.25 BTC/block. When block rewards half, that breakeven price will essentially double to $27k. In the past, every time there has been a Bitcoin halving, the price has significantly jumped - presumably due to a decreased growth in supply while demand remains constant. However, this trend cannot continue forever.

Figure 7: This historical price chart of BTC using a logarithmic scale shows the jump in price following past halvings.

At some point, transaction fees will have to have to comprise the lion’s share of block rewards. These fees will have to be sufficient to cover mining costs, otherwise the Bitcoin network will fail to operate. With the next halving coming in 2024, and Bitcoin price sitting around ~$24k, it will be interesting to see if the doubling trend continues.

Regardless of whether it is this halving or a future one, one thing is clear - Bitcoin must find ways to increase transaction fees in order to survive. Fortunately the equation is pretty simple: more transaction volume means higher transaction fees. The store of value meme will be insufficient to create an equilibrium where miners are compensated sufficiently to continue running the network - when something is treated as a pure store of value, the more people hoard it and the less liquidity the market sees. Thus, I expect the mining community to put its full weight behind changes in Bitcoin that can propel the meme past a store of value and into something that drives greater transaction volume.

The Missing Link: Layer 2s

Let’s quickly review what we just discussed about the meme of Bitcoin evolving.

For the meme to become settlement layer – Greater functionality is needed beyond what is possible on Bitcoin itself

For the meme to become money – A faster and cheaper execution layer is needed

For miners to remain profitable as block rewards go to zero – the meme must be more than store of value

Now let’s ask why an L1 blockchain would need an additional layer. Fortunately, it’s not complicated. It comes down to two simple reasons:

(1) Cost – There is significant latent demand for users to execute transactions, but this demand remains suppressed due to the high cost of blockspace.

(2) Extensibility – The L1 is unable to provide functionality that is demanded by the users due to design constraints.

I believe we are encountering Reason #2 in Bitcoin. From the meteoric rise of Ordinals to the billions of dollars locked in wBTC, we can clearly see that there is a strong latent demand for crypto primitives like NFTs and Defi within the Bitcoin community. The convergence of inflections mentioned above will propel this desire to the forefront of the Bitcoin community.

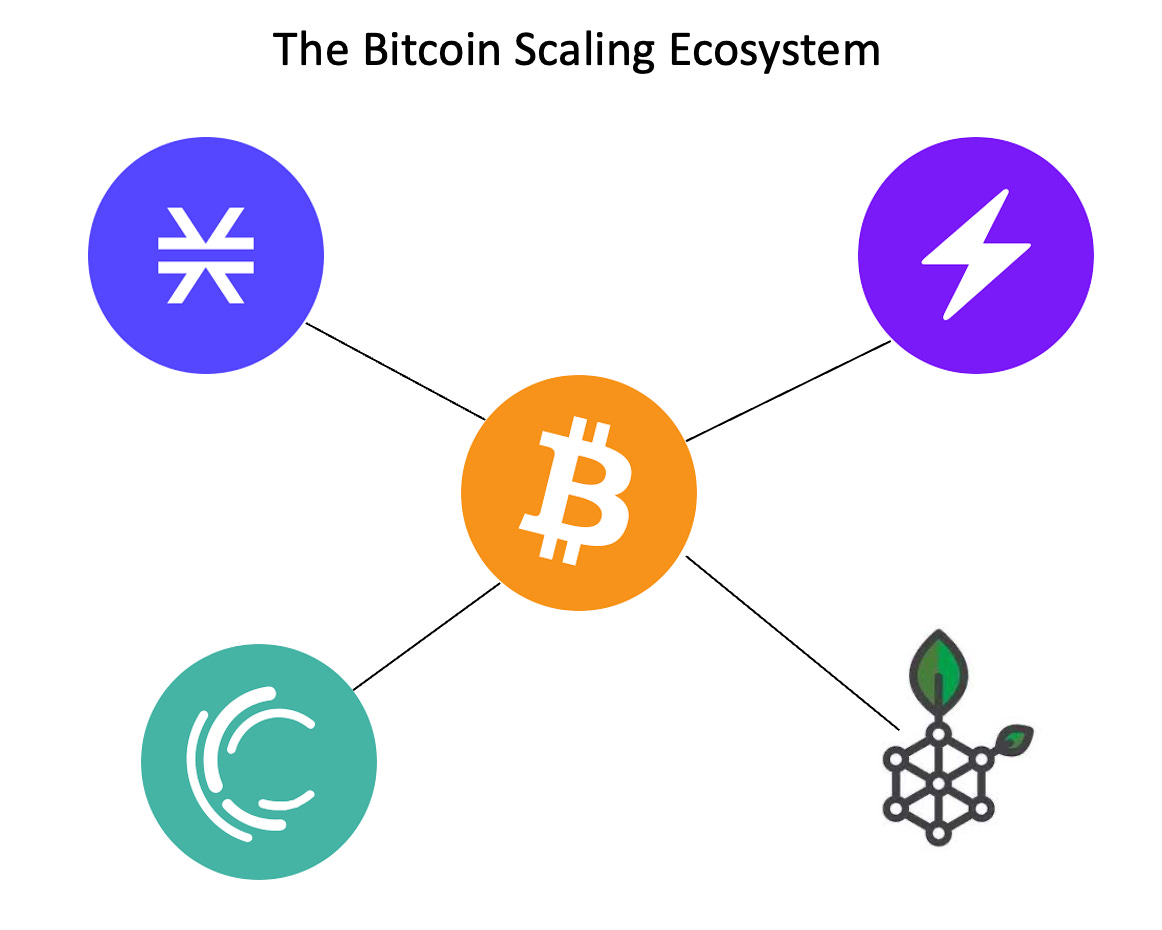

So what will a winning Bitcoin scaling solution look like? Fundamentally, I believe it needs to solve both the problems of cost and extensibility. With that being said, scaling solutions [34] (L2s, sidechains, connected L1s) for Bitcoin already exist - many of which have been around for years. The two most notable projects are Lightning and Stacks.

Figure 8: The four major players in Bitcoin scaling are Stacks, Lightning, Liquid, and RSK.

Lightning solves the problem of high transaction costs. It is a layer 2 built on top of Bitcoin that allows users to open funded payment channels and transact between each other on the Lightning Network. After completing all their transactions, the final value of Bitcoin held by each party ultimately settles back on the Bitcoin network. This allows for significantly reduced txn fees. While impending upgrades [35] will allow for some nifty new payment options, Lightning does not allow for arbitrary smart contracts. This means that while Lightning admirably tackles the challenge of lowering transaction costs, it does not enable constructs such as NFTs or DeFi protocols to be built on the network.

Stacks [36] is the largest scaling solution on Bitcoin by TVL and aims to solve both the problem of cost and functionality. The architecture is actually an L1 that inherits (some of) the security properties of Bitcoin through a unique consensus mechanism called Proof of Transfer (PoX) [37]. Stacks also has its own language called Clarity [38] that can read changes in Bitcoin’s global state and allows for arbitrary smart contracts to be written. However, I believe the security model of Stacks and independent language requirement continue to stymie any chance of real adoption.

Even though these are the two largest Bitcoin scaling solutions, Stacks only has a TVL of $415M and Lightning has ~$133M [39] BTC bridged. This comprises < .12% of the total market cap of Bitcoin. (Recall that wBTC has ~$3.2B locked up in the Ethereum ecosystem). Compare this to Arbitrum and Optimism on Ethereum where the amount of ETH bridged [40] is ~2.5% (~$5B) of the total circulating supply [41]. Furthermore, the L2s on Ethereum are seeing significant activity. Arbitrum recently surpassed Ethereum [42] in terms of the number of daily transactions. While Ethereum is seeing a vibrant and rapidly growing L2 ecosystem, Bitcoin appears to be lagging far behind. However, I believe that is about to change…

The Winning Formula for Scaling Bitcoin

While there are inflections driving towards a scaling solution on Bitcoin, I don’t believe any of the current solutions are satisfactory. Lightning is great if you just want to transact back and forth cheaply, but it lacks functionality beyond scaling transactions. Stacks is its own L1 with a novel consensus mechanism that posts hashes of its data back to Bitcoin - it doesn’t actually utilize BTC. Liquid and RSK are sidechains and therefore rely on their own security [43]. The current scalability scene for Bitcoin is very much like the scalability scene of Ethereum in 2017, when sidechains and plasma bridges were the talk of the town. The problem here is that this negates much of the benefit that comes from operating on the most secure network in crypto.

I believe a successful scaling solution on Bitcoin will exhibit the following properties:

Inherit the security of PoW consensus from Bitcoin (enabled by a rollup, not sidechain)

Provide a trustless bridge & full data availability on Bitcoin (enabled by an optimistic or zk-rollup)

Create ease of programming & portability (enabled by EVM compatibility)

Below I dive into why each of these properties is critical. In the long term, I believe the winning L2 on Bitcoin will be an EVM-compatible zk-rollup.

Leveraging PoW Consensus

The cornerstone of the Bitcoin community is its deep-seated belief in the proof-of-work (PoW) [44] consensus mechanism. I’m not going to go into great detail on the differences [45] between proof-of-work and other consensus mechanisms. Instead, I just want to hammer home that Bitcoin derives its security from PoW, and that is a crucial part of Bitcoiners’ identity.

Given that, I believe any scaling solution that will be mass adopted by the Bitcoin community leverage PoW consensus. This is not achievable by a sidechain or independent chain, as these solutions would have to develop their own consensus mechanisms. Instead, it is only achievable by a rollup. By definition, rollups inherit the consensus mechanism of their parent chain. Thus, I believe that the winning solution for scaling Bitcoin must be a rollup that fully leverages PoW consensus.

Trustless Bridge & Full Data Availability

Another key tenant in the Bitcoin ideology is owning your own coins. It’s no wonder then that the community largely views bridges as dangerous - and rightfully so [46]. Over $1.3B has been lost to bridge hacks since January of 2022. One of the reasons I think we haven’t seen true adoption of a Bitcoin L2 is because of the lack of native trustless bridges. Trustless bridges [47] are simply bridges that are run by smart contracts rather than requiring a trusted 3rd party to custody assets. However, when trustless bridges span blockchains with different security properties, the security of the bridged assets depends on the weakest chain. Only rollups (not sidechains or other L1s) allow for native trustless bridges that only rely on the underlying security of Bitcoin.

However, trustless bridges are only half of the solution. Along with trustless bridges, the L2 needs to have full data availability on the L1. Full data availability [48] means that anyone can reproduce the L2 state with only the data on the L1. Practically it means two things.

First, any user can exit the L2 protocol only by interacting with the L1. This allows any user (even in the absence of a cooperative L2) to generate a proof of their account and withdraw the funds locked in the rollup. Second, the rollup can use BTC as its native token. I believe this ethos will resonate strongly with the Bitcoin community.

Appeasing the community becomes important when we consider what it would take to create an optimistic or zk-rollup on Bitcoin. Each of these types of rollups would require a new opcode [49] to be introduced into Script. New opcodes mean a soft fork of Bitcoin. A soft fork of Bitcoin means a community vote. Ultimately, this is why any L2 rollup and subsequent bridge must resonate with the Bitcoin community; it is going to take the full backing of Bitcoin developers to get a new opcode accepted. In my opinion, zk-rollups fit best with the Bitcoin ethos given the emphasis on cryptographic over economic security.

EVM Compatibility

The final component I believe will play a critical role in a successful Bitcoin L2 will be the choice of execution environment. As of now, there is no singular smart contract language that unifies the Bitcoin scaling ecosystem. Script is the native language for Bitcoin, but prohibitively restrictive in its capabilities. Clarity [50] was created by the Stacks team, but remains relatively unadopted. Two options outside of Bitcoin currently rule them all: Solidity and Rust.

I believe that a zk-rollup with a zkEVM runtime will be the holy grail for Bitcoin scaling solutions. The zkEVM runtime is important because the Ethereum ecosystem currently has the lion’s share of developers. A Bitcoin L2 that can offer developers the option to port their code directly from Ethereum to Bitcoin means minimal friction in onboarding developers (and subsequently users). In crypto it is just as much about the community as the products, and a zkEVM runtime will result in an enormous competitive advantage in onboarding the developer community. Communities also have flywheels, and I would expect these network effects to quickly propel such a rollup far ahead of its competition.

The Future of Bitcoin

I want to conclude by highlighting the progress that has been made thus far towards a zk-rollup on Bitcoin. Trey Del Bonis published a lengthy article [51] detailing how a zk-rollup on Bitcoin could be built back in early 2022. John Light [52] spent 4 months as a zk-rollup research fellow [53] conducting in-depth research [54] on the technical challenges, benefits, and risks of a Bitcoin zk-rollup. There are rumblings [55] in the Bitcoin community of introducing an opcode to verify snarks/starks. And startups such as Alpen Labs [56] are beginning to emerge to take on this great challenge.

I believe the inflections discussed in this article are going to transform the meme of Bitcoin. The resulting change will create a massive demand for scaling solutions. When those floodgates burst open, I expect a zk-rollup to be the solution that successfully ushers in a new era for Bitcoin.

About the Author

Tyler is an investor and community wizard at Floodgate where he is the creator of Outliers and Reactor. Prior to Floodgate, he completed his PhD in entrepreneurship and organizations at Stanford. Tyler possesses an unerring belief that crypto will revolutionize the internet and money itself. Some highlights of his journey thus far include building DAO Masters, incubating companies like Modulus Labs, and watching the Outliers become leaders within the crypto ecosystem.

References

[1] Many readers will be most familiar with internet memes, but the concept of memes actually predates the internet! https://en.wikipedia.org/wiki/Meme

[2] https://knowyourmeme.com/memes/magic-internet-money-bitcoin-wizard

[3] https://twitter.com/udiWertheimer

[4] https://www.taprootwizards.com/

[5] https://docs.ordinals.com/

[6] https://cryptoadventure.com/a-brief-history-of-colored-coins-what-made-them-special/

[7] https://github.com/bitcoin/bips/blob/master/bip-0141.mediawiki

[9] https://nftevening.com/taproot-wizards-huge-win-enrages-bitcoin-maximalists

[11] https://decrypt.co/121298/bored-ape-owner-burns-169k-nft-ethereum-bitcoin

[12] https://school.taprootwizards.com/

[14] https://decrypt.co/123123/people-are-minting-brc-20-meme-coins-on-bitcoin-via-ordinals

[15] https://viewemail.nydig.com/ordinals-and-the-case-of-the-missing-fees

[16] https://en.bitcoin.it/wiki/Script

[17] https://en.wikipedia.org/wiki/Elliptic_Curve_Digital_Signature_Algorithm

[19] https://link.springer.com/article/10.1007/s00181-020-01990-5

[20] https://www.projectfinance.com/functions-characteristics-of-money/

[21] https://www.cgm.pitt.edu/sites/default/files/PPE/S20PPE/1805134.pdf

[23] http://strike.me

[25] https://lightning.network

[26] http://pouch.ph

[27] https://www.nber.org/digest/202207/el-salvadors-experiment-bitcoin-legal-tender

[28] https://dune.com/eliasimos/btc-on-ethereum_1

[29] https://en.wikipedia.org/wiki/Money#Standard_of_deferred_payment

[30] https://bitcoinblockhalf.com/

[32] https://www.riotplatforms.com/investors/sec-filings/annual-reports

[33] https://investors.ciphermining.com/financial-information/sec-filings

[34] https://www.hiro.so/blog/building-on-bitcoin-project-comparison

[35] https://bitcoinmagazine.com/technical/bolt12-lnurl-and-bitcoin-lightning

[38] https://clarity-lang.org/

[39] https://defillama.com/protocol/lightning-network?denomination=BTC

[40] https://dune.com/gm365/L2

[41] https://messari.io/asset/ethereum/metrics/supply

[43] https://www.web3.university/article/sidechains-vs-layer2s

[44] https://en.wikipedia.org/wiki/Proof_of_work

[46] https://de.fi/rekt-database

[47] https://cointelegraph.com/news/defi-security-how-trustless-bridges-can-help-protect-users

[48] https://medium.com/blockchain-capital-blog/wtf-is-data-availability-80c2c95ded0f

[49] https://wiki.bitcoinsv.io/index.php/Opcodes_used_in_Bitcoin_Script

[51] https://tr3y.io/articles/crypto/bitcoin-zk-rollups.html

[52] https://twitter.com/lightcoin

[53] https://hrf.org/zkrollups

[54] https://bitcoinrollups.org/

[55] https://lists.linuxfoundation.org/pipermail/bitcoin-dev/2022-November/021153.html