#51 - Story: The World’s IP Blockchain

Tokenizing the multi-trillion-dollar asset class of intellectual property to make it programmable, sovereign, and liquid

Stanford Blockchain Review

Volume 6, Article No. 1

📚Author: Benjamin Ebner — Story

🌟 Technical Prerequisite: Low/Moderate

Blockchains After Finance

The 2008 financial crisis highlighted the ineffectiveness and flaws of an opaque, centralized system that allowed the greed of a few bad actors to nearly collapse the entire global economy. It’s no surprise that the digital currency introduced by Satoshi Nakamoto in 2009 focused entirely on decentralization, sovereignty, and verifiability. What followed was nothing short of a monetary revolution: with Turing-complete networks like Ethereum, users could deploy their funds across thousands of DeFi applications instead of relying on centralized actors. Within a decade, the value of onchain financial assets skyrocketed to over $2 trillion, underscoring the importance of true decentralized ownership.

These days, it is not primarily the financial system that is at stake; another asset class is on the brink of collapse: intellectual property. While the advent of AI has brought immense creative capabilities to users, the speed and scope of user-generated content creation are outpacing a legal system still tied to physical content production. This time, it is not banks milking subprime mortgages for every last drop of revenue, but data-hungry big tech corporations greedily extracting anything they can from their users, disregarding user sovereignty and copyright laws. What could be a digital renaissance is threatening to become a tragedy of the commons.

Ultimately, the very future of AI itself is at stake. As Chris Dixon observes in his book Read.Write.Own., artificial intelligence depends on a constant influx of human-made, high-quality content [1]. Neither low-quality content farms nor synthetic data (i.e., data fabricated by AI itself) can provide the foundation necessary to power sophisticated models. However, the current landscape of AI harms the AI-creator relationship, actively disincentivizing the creation of new content rather than encouraging creators to remain the cornerstone of AI systems. When people see their copyrights being breached by the millions, they are not motivated to continue publishing original content, depriving AI models of the very foundation they depend on for training. Thus, the quest for a better IP system is also a quest for the sustainable future of AI. Intellectual property is the key piece of the puzzle that must fall into place for success. If it doesn’t, the social and economic repercussions could be devastating.

The Fragile State of The World’s Biggest Asset Class

Thinking about the current IP landscape in economic terms, it resembles a market with enormous entry barriers, allowing only the top 1% of creators to participate. While almost everyone owns some form of intellectual property, smaller actors are excluded from this system due to the steep legal costs of copyright contracting and negotiation. Politically, the IP regime can be compared to an oligarchy, where a few big franchises, like Disney and Marvel, own the largest share of value creation. This concentration of power stifles innovation: it’s no wonder we recycle franchise after franchise, year after year.

However, there’s another issue: this system of high inertia is slow and outdated. Most copyright laws in place today were created during a time of physical production and are ill-suited to address the demands of automated, autonomous systems. AI models require vast amounts of data for training, to the extent that the manual licensing model cannot keep up. Large AI corporations don’t break IP laws because they are inherently malicious; they’ve established web scraping and copyright breaches as their de facto modus operandi because it’s more cost-effective to pay million-dollar fees than to license content manually. The lack of adaptability in our current system incentivizes the wrong behavior.

Overall, the current state of intellectual property reveals a highly centralized asset class controlled by a few dominant actors, much like how lending and borrowing were monopolized by banks before DeFi emerged. Meanwhile, the system’s inertia creates misaligned incentives. How much value are we missing out on when every one of us owns intellectual property but cannot compete? Story aims to tackle these issues by tokenizing the multi-trillion-dollar asset class of intellectual property, making it programmable, sovereign, and liquid.

A Multi-Layered, Purpose-Built Architecture

Story employs a vertically integrated architecture purpose-built for bringing intellectual property onto the blockchain. It consists of a layer 1 blockchain (Story Network), a smart contract protocol (Proof-of-Creativity Protocol), and a legal framework (Programmable IP License) [2]. These components provide a full-stack foundation for the growing IP-centered application ecosystem, enabling use cases like IPFi, permissionless licensing, automated royalty payments, and more. By innovating across the entire stack, this unique setup serves as the ideal bridge between code and law, enabling truly programmable intellectual property.

Story Network—The Infrastructure Layer

When first-generation web3 philosopher Andreas M. Antonopoulos published his seminal book on blockchain technology, he titled it The Internet of Money for a reason: money was inherently intertwined with blockchain’s birth, serving as both the object and subject of a revolutionary movement aimed at fixing a failing financial system [3]. Today, despite the diversification of use cases, financial transactions remain the lifeblood of the Web3 ecosystem, with generalized terms like “token” and “wallet” serving as vestiges that hearken back to Bitcoin’s noble founding myth. Additionally, as the “tokenization of everything” reveals, we often borrow financial approaches for non-financial uses, such as voting. This monetary-centric paradigm has worked surprisingly well—until now.

Intellectual property, however, differs vastly from money. Unlike financial assets, intellectual property is the legal manifestation of ideas, and ideas, by nature, tend to mix, morph, and evolve. They rarely exist in isolation; remixing is a defining characteristic. Intellectual property quickly forms complex parent-child relationships, often growing into intricate trees of immense depth, generating new ideas in the process. Providing attribution for intellectual property is not as simple as looping through a _balances mapping and extracting a hexadecimal public key; it requires traversing a complex tree that can expand as the IP evolves. In such cases, gas costs become the Achilles’ heel, and IP represents an extreme example of these non-financial challenges.

Story solves this issue by providing a purpose-built layer 1 blockchain optimized specifically for the handling of intellectual property. Story Network treats IP as a first-class citizen, while also bringing technical improvements to a standard EVM execution environment. It leverages precompiled primitives to traverse complex data structures, such as IP graphs, within seconds at marginal costs. Story Network can manage the growing computational demands of downstream royalty payments, efficiently distributing royalties for an IP with hundreds or even thousands of parent IPs—each of which may also have multiple parent IPs. At the same time, Story is fully EVM-equivalent, allowing developers to bring their existing applications to the platform. The consensus layer is based on the mature CometBFT stack, ensuring fast finality and low transaction costs [4].

The foundation of a dedicated layer 1 blockchain allows Story to innovate across the entire technical stack. This sets the stage for future integrations, such as a graph database within the execution environment or validator-enshrined technology, like native oracles for NFTs and off-chain real-world assets (RWAs), using Cosmos SDK vote extensions. Story also opens the door to potential rollup support with bespoke cross-chain data (e.g., Initia's model), which is crucial for Web2 applications handling millions of transactions. By introducing purpose-built infrastructure, Story demonstrates that the benefits for the entire ecosystem outweigh the overhead of infrastructure management and positions itself as the ideal foundation for the world’s IP ledger. The Proof-of-Creativity protocol is another essential element of this vision.

Proof-of-Creativity Protocol—The Smart Contract Layer

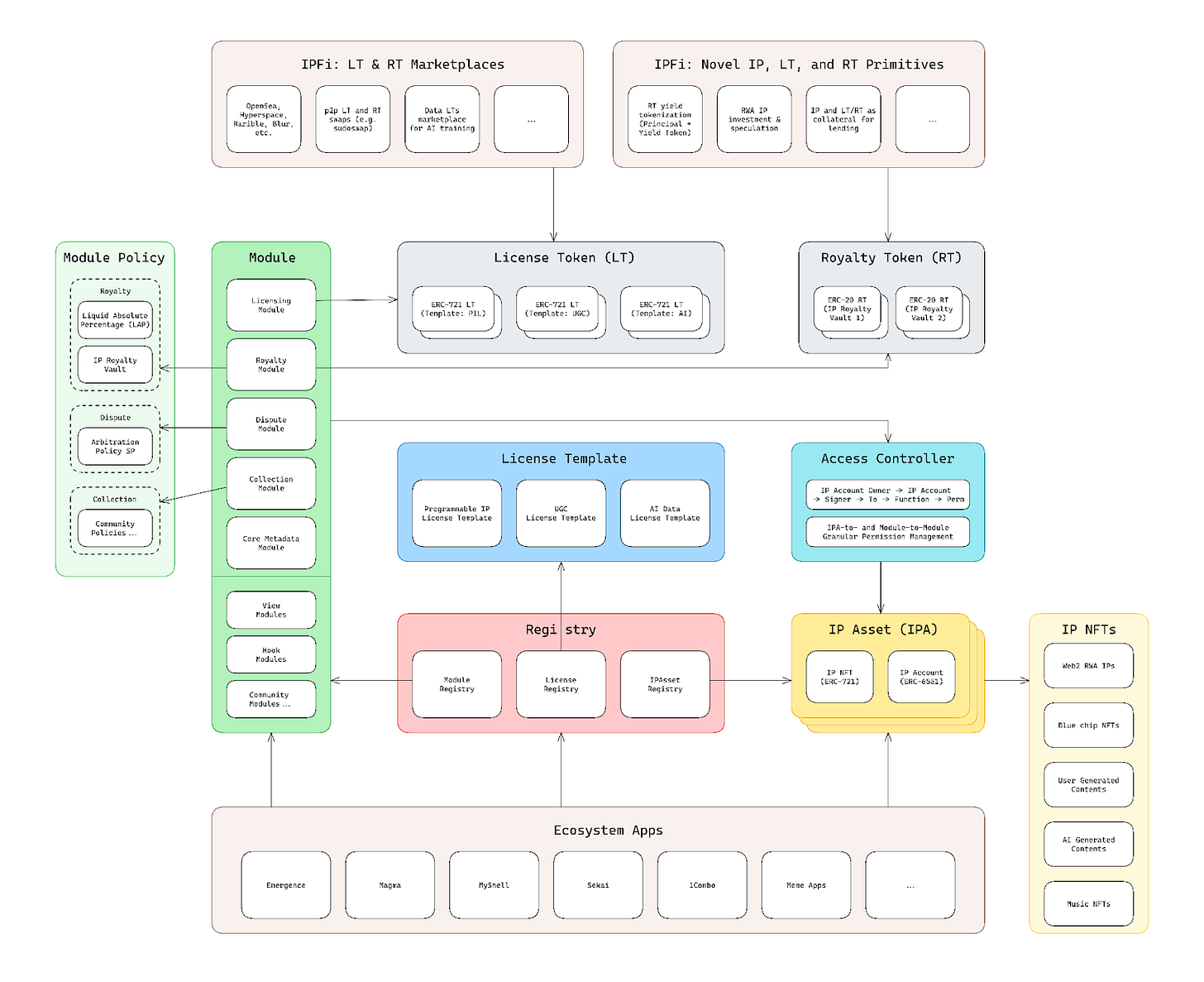

Natively enshrined into Story’s layer 1 blockchain, the Proof-of-Creativity (PoC) protocol constitutes the de facto intellectual property onramp designed to make IP programmable. This collection of interwoven smart contracts holds the logic behind all IP-related actions. Here, offchain intellectual property turns into onchain programmable IP, powered by extensible modules that define licensing flows, distribute royalty payouts, and settle disputes, among other things; it contains the registries that hold IP assets, modules, and metadata; and it provides the onchain bridgehead for the real-world legal system, as defined in the license templates. In short: The PoC Protocol is Story’s operating system, the control room for all IP assets.

Onramps are arguably the most critical pieces of Web3 infrastructure, as they allow mapping real-world assets to their decentralized counterparts, translating offchain realities to onchain transactions. It is onramps that make things we hold dear in our lives seamlessly plug and play into the benefits of decentralized technology. Circle’s USDC exemplifies how straightforward such an onramp can be for monetary assets: an external party wires US dollars to Circle, where, upon arrival, a blockchain record is created—one USDC is minted and sent to its particular owner. While the offchain asset provides a backstop for a future offramp, the onchain asset can now move freely across applications.

For intellectual property, the onramp process starts similarly. At the core of the PoC protocol lies the IP Asset (IPA), an ERC-721 representation of the registered offchain IP stored in the IPAsset registry. Whenever an offchain IP is registered, such an IPA is created. However, as discussed previously, intellectual property is much more complex than monetary assets: royalties need to be distributed, permissionless licensing has to be enabled, and disputes may be settled—in short, while a USDC token or a PFP NFT is entirely self-sufficient, the IP Asset alone, in its isolated form, demands more complex functionality baked in, namely: the IPA needs to be able to take actions, own royalty tokens, manage license tokens, and much more.

Initially, blockchain accounts were only managed by private keys in the form of EOAs. That changed when the concept of smart contract accounts was introduced. A smart contract account is, in its most basic form, a wallet powered by smart contract code, not a private key. But still, these accounts were bound to individuals or groups that triggered certain transactions. The NFT boom of 2021 saw a myriad of advanced use cases that soon highlighted the necessity of more advanced models, models that would transfer agency to the token level. ERC-6551 finally changed the user-centered paradigm by inventing token-bound accounts, i.e., smart contract accounts owned by an NFT. This empowered tokens themselves to be the agents of their actions.

IP Assets on Story are equipped with a dedicated token-bound account, the IP Account, upon registration. This modified ERC-6551 implementation gives IPAs the power to trigger actions, which is an essential precondition for IP-centric use cases like royalty payments and licensing. With IP Accounts, an IP Asset can hold its own vault of royalty tokens or carry ERC-721 license tokens that provide the backbone of permissionless licensing. The logic of the specific actions is defined in the PoC protocol’s modules, which can be considered micro-applications at IP Accounts’ disposal. The various predefined modules contain use-case-specific logic and are referenced in the Module registry. Still, developers may also craft their own modules for particular use cases.

The licensing module manages the process of permissionless licensing. Licensing means granting permission to use or sell intellectual property under specific conditions; permissionless means that this can happen without an intermediary. When creating an IP Asset, a user can attach certain license terms—derived from a license template—to their IP that specify legal boundaries like commercial usage, transferability, and much more. Attaching license terms to an IPA allows other users to permissionlessly mint license tokens. These ERC-721 tokens are the onchain, legally binding representation of owning the licensing rights to a particular IP—if you have a license token, you own the license rights to the specific IP, as defined in its license terms. An IP owner can set a price for minting these license tokens, and hooks allow for advanced use cases like automated price adjustments, and more.

The royalty module is concerned with the distribution of royalties across IP trees. When users register an IP, they can define the royalty share they expect from any derivative IP. When a derivative IP generates revenue, this revenue is distributed across its ancestor tree according to the royalty policy in place. The main way of doing this is using royalty tokens, ERC-20 tokens that represent ownership in royalty payments. The IP Assets themselves own these royalty tokens thanks to the ERC-6551-inspired IP Account implementation. While royalty tokens represent the virtual ownership of royalty payments in an IP tree, revenue tokens pose the actual monetary inflows. They are denoted in their specific currency and can be claimed using royalty tokens.

While the license and the royalty module provide the heart of the protocol, there are further preconfigured modules. The dispute module creates a way for users to raise and resolve disputes through arbitration using arbitration policies, arbitration penalties, and tags. The collection module allows the grouping of certain IPs together under the same license terms. This is particularly useful when registering large catalogs of IPs that should all adhere to similar terms, e.g. when providing training data for AI models. Also, royalty payments can be streamlined across multiple IPs using the collection module [5].

Programmable IP License—The Legal Layer

The 2008 financial crisis exposed fundamental flaws of the traditional financial system, and rightly so, Bitcoin—with Ethereum on its heels—challenged its most basic mainstays. However, as radical as the critique of Satoshi, Vitalik, and their staunch supporters turned out, the idea of an entirely detached, decentralized monetary system has never truly manifested. Today, fiat-backed currencies make up about 90% of stablecoins, contributing around 10-15% to Web3's entire market capitalization. Like it or not, the traditional financial system is still heavily intertwined with the decentralized realm by means of bridges, onramps, stablecoins, or CEXs. But that’s not necessarily a bad thing. Key innovations like true digital ownership and programmable money are enabled, while the legacy system provides a slow-moving but security-providing backstop, a sturdy foundation.

Likewise, just as Story’s vision of programmable IP poses a stark contrast to today’s real-world, analog, illiquid IP legal system, the idea is not to entirely replace it. Instead, the idea is to onramp IP to the blockchain, where advanced use cases can be achieved, while the legal system acts as a backstop in the background. Because IP is a legal concept, this onramp needs to hook into the legal system, and—ultimately—deliver on blockchain’s fundamental promise: Turning law into code, and treating code as law. The key tool to achieve this is Story’s Programmable IP License (PIL), the legal layer of its vertically integrated IP stack.

On a high level, the PIL is a universal license agreement template that bridges real-world IP with its onchain tokenization, the IP Asset. It’s a legal framework using US copyright law that allows IP owners to set rules for permissionless licensing, commercialization, and remixing of their original creations. It includes a set of parameters that the IP owner can define. Registering an IP on Story, thus, means entering the US legal system by means of the PIL, building a robust and real-world backstop to the free-flowing, onchain IP Asset. Actions taken on Story Network—e.g., license issuance—are thereby legally enforceable, intertwining code and law.

The technical hook used to interlock the legal world with the PoC protocol is the license module, specifically its license templates. License templates are the abstraction of concretely implemented license terms, which attach to an IP Asset. The smart contract defines parameters that precisely mirror the parameters outlined in the legal agreement. For example, the PIL defines “commercial use” in §1, Art. 1 in the Programmable IP License, mirrored in the IPILicenseTemplate.sol contract as the parameter bool commercialUse. The actual choices of these parameters that a user takes when registering their IP are then denoted as the license terms derived from these license templates.

The PIL is a kickstart legal agreement that already has a license template representation on Story. However, developers can bring their own legal frameworks to Story, generating their dedicated license templates in the process. Ideally, this extensibility will provide a diverse field of options to future users, just as users can choose between multiple stablecoins. This helps to preserve the overall stability of the system and ensures numerous touchpoints with the real-world legal system [6].

The Application Ecosystem

This technical foundation allows builders to capture the next wave of IP and consumer applications. As of today, 200+ teams totaling 20M+ IPs are building on Story across verticals, including IPFi, AI, and consumer.

Magma, for example, is a suite of browser-based professional design tools that brings real-time creative collaboration to its 3M+ users. Using Story-powered features, creatives can register their work as an IP Asset with a few clicks, generating a blockchain record (ERC-721 token) for their IP. With Story’s Programmable IP License as a legal bridge, they can then seamlessly set the pricing and permission terms for how their work can be used. Anyone interested in using that work can then accept these legally binding terms and license it in a single click.

The team of Mahojin—building an open and decentralized version of Hugging Face—uses Story with a focus on IP tokenization for AI. Data owners, for example, can register their work as IP Assets on Story, equipped with the license terms they favor. AI models can then license big batches of data quickly at marginal cost to train their models. Additionally, AI models themselves can be registered as IP Assets, enabling complex remixes of different models with fair and correct attribution.

Sekai is an AI storytelling platform that helps storytellers, artists, and fans co-create immersive interactive stories via simple prompts, empowering fans regardless of their creative background. IP owners can create their universe and set the contribution rules, including monetization models. Space Runners’ Ablo allows anyone in the world to customize and remix the latest fashion using generative AI tools. It uses Story to handle IP registration, creator attribution, and revenue sharing between designers and brands.

Beyond that, tokenized IP is making intellectual property accessible for financial participation, unlocking the new sector of IPFi that integrates the world’s largest asset class into the existing onchain liquidity. That’s possible because Story uses dedicated tokens to handle licensing (ERC-721) and royalties (ERC-20). Applications can tap into valuable IP assets, for example, by creating liquidity pools for a certain IP’s royalty tokens or trading its licensing tokens (liquid licensing).

Coda

This article highlighted the current issues plaguing the intellectual property regime: high inertia, fragmentation, opacity, and cost intensity. It outlined how Story addresses these challenges by bringing IP onto the blockchain, making it programmable, liquid, and sovereign. Story offers a vertically integrated solution, comprising a layer 1 blockchain purpose-built for intellectual property, a dedicated smart contract protocol, a universal IP licensing framework, and an application ecosystem spanning multiple verticals, such as storytelling, AI, and IPFi. Ultimately, Story tokenizes the multi-trillion-dollar asset class of intellectual property, transforming it into a programmable, sovereign, and liquid asset—turning the internet into an IP Legoland.

About The Author

Benjamin Ebner is a technical writer and core contributor to Story with a master’s degree in Communication. Benjamin previously worked for Dapper Labs, leading technical content marketing and educational initiatives. You can follow him on X @_bebner

Story is the world’s first IP Blockchain, onramping Programmable IP to power the next generation of AI, DeFi, and consumer applications. Over 200 teams, totaling more than 20 million addressable IPs, are building on Story across IPFi, AI, and consumer markets.

References

[2] https://docs.story.foundation/docs/what-is-story

[3] https://aantonop.com/books/iom/

[4] https://medium.com/the-interchain-foundation/cosmos-meet-cometbft-d89f5dce60dd

[5] https://learn.story.foundation/proof-of-creativity-protocol

great work and insights on Story - Sebb The Bakery Dao

꧁🔥꧂