#41 - Electric Capital: 2023 Crypto Insights

Avichal Garg and Maria Shen on Crypto Developer Activity, Crypto Social, and NFTs

Stanford Blockchain Review

Volume 5, Article No. 1

📚Interview Guests: Avichal Garg and Maria Shen

Author: Kole Lee- Stanford Blockchain Club

🌟Technical Prerequisite: Low

For this article, I interviewed Avichal Garg and Maria Shen of Electric Capital to get their insights on where the future is headed for crypto. This article is a long-form exploration of our discussions, drawing upon their experience in crypto and trends they have noticed throughout their research to build a sense of what will occur in the coming years for crypto.

This article focuses on 3 major topics from our discussion: Developer Activity, Crypto Social, and NFTs.

Developer Activity

Every year, Electric Capital publishes their Annual Developer Report, which is read by hundreds of thousands seeking the most meaningful insights into crypto developer activity across various ecosystems.

To compile this report, Electric fingerprints over 480 million crypto-related code commits across more than 800 thousand repositories [1]. This extensive analysis provides valuable insights into crypto developer activity. Additionally, Electric maintains an open-source Crypto Ecosystems Taxonomy that users can contribute to, and collaborates with major foundations like Optimism, NEAR, and Solana to include the latest data on chains and ecosystems.

Why the developer report? The developer report began in 2018, following the 2017 ICO craze, with the aim of cutting through the noise in the crypto space. Given crypto tremendous volatility, undue importance is often placed on the wrong quantitative measures, like price action, to gauge progress. However, this approach is misguided.

If we believe crypto is a fundamentally game-changing technology where developers can build entirely new applications, the key behavior to measure is not price action but developer engagement. We should focus on the people who are committed to making long-term investments in crypto, dedicating their time to building infrastructure and applications for users.

Which ecosystems are developers choosing to build on? How is the US faring in crypto developer activity? Which types of infrastructure and applications are developers currently most excited about? By answering these questions, the Annual Developer Report provides powerful information to help new developers decide which blockchain to build on, assist governments in making better crypto policy decisions, and guide investors to areas where innovation is truly bubbling.

Here are three favorite insights utilizing Electric’s Developer Data:

Insight #1: The Future Is Multichain

The future is clearly multichain. More than 30% of developers now support more than one chain, up from just 3% in 2015, marking a 10x increase. Additionally, developers supporting 3 or more chains have grown to 17% of all developers in 2023, an all-time high.

With Electric’s Developer Report, one can delve even deeper into developer behaviors. The 2023 network graph illustrates which crypto ecosystems have overlapping developers. It may not be surprising to see that Ethereum shares a significant number of developers with Layer 2 solutions like Optimism and Polygon, as well as EVM-compatible chains like BNB and Avalanche. However, it may be interesting to discover the extent of the overlap between Polkadot and Cosmos developers or to learn that many Solana developers also work on Bitcoin.

These types of insights can be quite powerful for various use cases. Teams can use them to determine which chain to expand their developer infrastructure to next. Ecosystem teams can identify the types of developers building on their chain, and investors can focus their attention on a specific subset of crypto ecosystems.

Insight #2: The US is Losing Developer Share

By analyzing self-reported GitHub location data and their commits to repositories, it becomes easier to gain insights into developer activity in different regions. For 2023’s data, Europe and Central Asia account for the majority of developer activity (36%), with North America accounting for the second most activity (28%). While France and Germany each have over a 5% share of crypto developers, India alone accounts for 12% of 2023 crypto developers.

Electric not only gathers insights from the current year’s regional developer data but also provides insights into regional behaviors over time. One of the most interesting findings is that while the overall developer ecosystem has grown, the US is losing significant developer share. Innovation in crypto is increasingly concentrated outside of the US.

This data, which highlights the clear problem of U.S. innovation moving offshore, has been cited by policymakers in the House of Representatives to push for regulatory clarity for U.S. developers and crypto companies [2].

Insight #3: The Advent of Bitcoin L2s and Base

Electric’s data shows significant developer growth in two major ecosystems: Bitcoin and Base.

Bitcoin is an excellent example of how Electric identifies meaningful signals amidst the noise when measuring crypto progress. Despite extreme volatility, Bitcoin development has remained consistently strong over time: every year since 2017, over a thousand new developers have joined the Bitcoin ecosystem. Furthermore, with the growth of Bitcoin Ordinals, which have caused transaction volumes to spike, and excitement around innovations like Fraud Proofs and proposals such as OP_CAT, there has been a noticeable increase in developer activity focused on Bitcoin scaling solutions [3].

Another ecosystem to watch in 2024 is Base. Since its launch over a year ago, Base has grown to have a thousand monthly active developers, which is unprecedented for new crypto ecosystems.

Overall, crypto is experiencing fragmentation across developer ecosystems. The advent of Bitcoin Layer 2s and new chains like Base means a lot of experimentation will occur. Fragmentation seems like it will continue until developers figure out what truly works, ultimately leading to consolidation as they focus on a more specific subset of chains.

Crypto Social

With the improvement of crypto infrastructure, the surface area of possibilities for users has dramatically expanded. While a previous transaction to buy an NFT on Ethereum’s L1 in 2021 could have cost hundreds of dollars, low gas fees and higher throughput using L2s like Base enable new experimentation, especially for social use cases.

Because crypto now offers a better user experience for applications that require more interactive on-chain moments, social applications have seen widespread adoption across the crypto space. Friendtech, a social application that enables creators to create gated chat rooms for fans, and Farcaster, a decentralized social media protocol that allows clients to be built on top of it, are two such popular applications.

BasePaint

However, crypto is still in its early stages. Crypto social is reminiscent of social media in 2003—a period marked by massive experimentation. There are fun applications such as Basepaint, a shared pixel canvas application. In Basepaint, users can mint brushes to contribute to the canvas, and after 24 hours, an Open Edition is minted. The profits from this Open Edition are then distributed proportionally to the artists based on the number of pixels they contributed [4].

WorldPvP

Another example is WorldPvP, a Base social application and experiment where 221 countries, each represented by their own ERC-20 token, compete to see who can achieve the highest market cap and control the nuke. Players aim to increase the market cap of their token through strategic trading and alliances to avoid getting nuked.

The liquidity from the nuked country’s ERC-20 pool is then used to buy back half of the nuke's country, with the remaining distributed to a randomly chosen nation. This game continues for 30 days until a country is crowned the ultimate victor [5].

Observing experiments like Basepaint, it seems that fewer iterations are needed to find what works, and with the success of Friendtech and Farcaster, applications are becoming increasingly mature. On-chain experiments like WorldPvP suggest that the next social application could be even more gamified than its Web2 counterparts.

NFTs

Electric, which is also a lead investor in MagicEden, the leading NFT marketplace, has several insights into the NFT ecosystem. Here are two we discussed.

NFTs Are Multichain

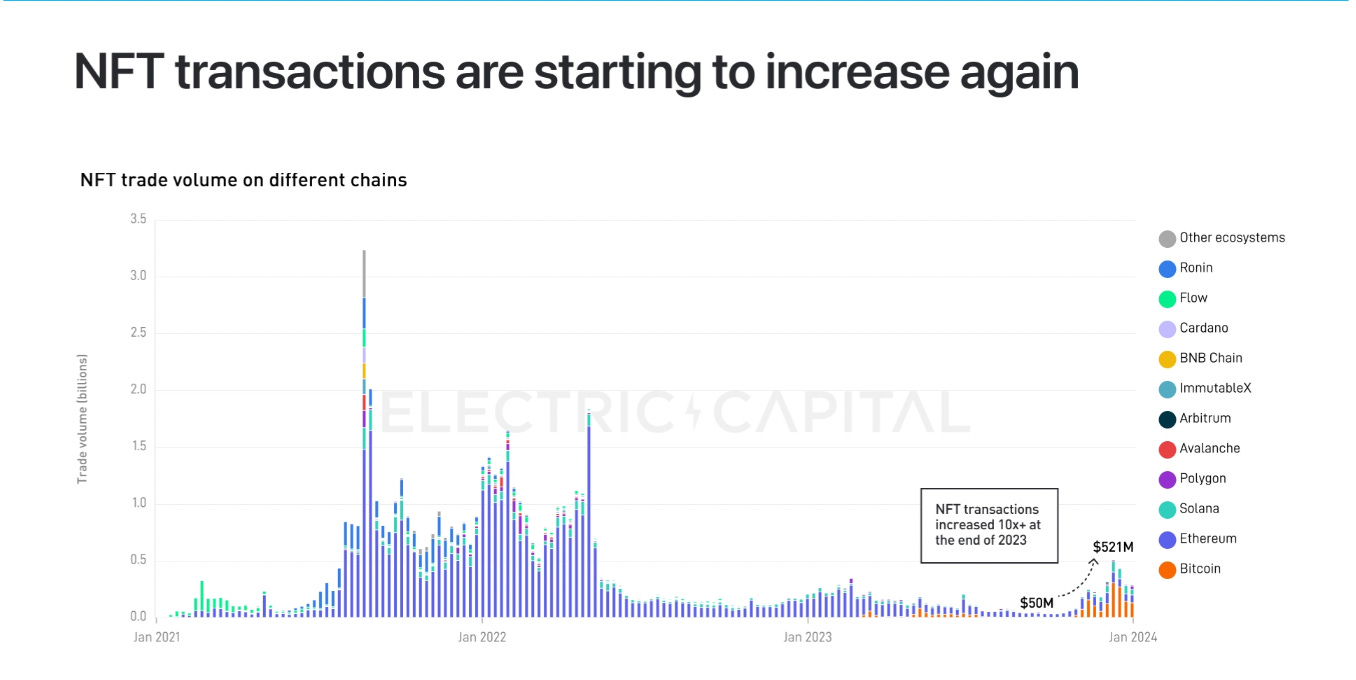

NFTPulse, a tool built by Electric to quantify and display the latest NFT-related data across ecosystems, demonstrates that NFT volumes are increasingly multichain [6]. While Ethereum NFT volumes dominated in 2021 and 2022, the rise of Solana and Bitcoin Ordinals in late 2023 challenged the notion that Ethereum would remain the dominant player. At times, weekly NFT volumes from Bitcoin Ordinals have even surpassed those of Ethereum.

Even though the UX of buying a NFT on different blockchains differ, NFTs represent digital culture. With the advent of Ordinals, people who enjoy supporting and being part of the Bitcoin ecosystem can buy and sell Bitcoin NFTs. As Solana grows and develops its own unique culture, Solana NFTs have become increasingly popular within the Solana community.

It Is Hard To Be Bearish NFTs

It is quite hard to be bearish on NFTs. As we move towards a more digital world, the need for ownership of digital objects becomes essential. We are in the early stages of EU laws mandating that all fashion goods and consumer products must be fitted with “Digital Product Passports” or NFTs for authenticity and verification of ownership by 2026 [7]. Furthermore, while markets may be very cyclical, NFTs, due to their nature as digital objects, will serve as the foundation for digital music, real estate, collectibles, and luxury goods.

Emotional Connection

NFTs differ from fungible tokens because they can create a deep emotional connection with the holder. A used teddy bear bought for $20 may be worth less than $20 to most people; however, to the owner, that specific teddy bear may hold much greater value. NFTs, which include digital art and profile picture collections, behave similarly for their owners.

NFT owners often form emotional bonds with their holdings. Avichal and Maria, both NFT enthusiasts, understand this deeply from their personal experiences. For them, NFTs are more than just tradable financial assets. Avichal co-owns several Fidenzas by artist Tyler Hobbs and proudly displays physical prints in his home [8]. Maria owns a Milady and even commissioned a custom portrait of it, highlighting the personal significance these digital assets can hold [9].

Conclusion

Many of the payment rails and systems we use today, such as automated clearing houses and credit card systems, were established in the 60s and 70s [10]. Crypto fundamentally reimagines these systems, allowing one to solve new problems and opening up the design space for entirely new applications.

With the advent of low-gas fee and higher throughput blockchains like Base, we are witnessing a wave of exciting experimentation in crypto social. Early successes like Friendtech and Farcaster, along with innovative experiments like Basepaint and WorldPvP, make this era feel reminiscent of social networks back in 2003. The increasing importance of NFTs, which are essentially digital objects, seems inevitable in a world that is becoming more and more digital. This is an incredibly exciting time for crypto, and Electric is eager to see how it all unfolds.

About the Authors

Kole Lee

Kole Lee is an undergrad studying Computer Science at Stanford University. He is the Co-Chief Editor of the Stanford Blockchain Review. Previously, he worked at blockchain analytics company Nansen and did software engineering at NFT startup Tonic.

Avichal Garg

Avichal is a co-founder and partner on the investment team at Electric Capital, and a Stanford alumni. He co-founded Electric Capital in 2018 and has grown it to one of the largest crypto venture firms globally. Electric is an investor in many of the leading web3 protocols and companies such as Bitwise, Bitnomial, dYdX, Eigenlayer, Espresso, Frax, Kraken, Magic Eden, NEAR, and Solana. Prior to starting Electric, Avichal was a successful entrepreneur with executive experience at Google and Facebook, which acquired his previous company. As an angel investor, Avichal has invested in 15 unicorns and 5 decacorns including Airtable, Boom Supersonic, Color Genomics, Cruise, Deel, Figma, Newfront Insurance, Notion, Nova Credit, Pulley, and others.

Maria Shen

Maria is a partner on the investment team at Electric Capital. Prior to Electric, Maria was CTO and co-founder of a startup that helped SMBs easily create their supply chains with manufacturers around the world. Prior to that, she worked on search technology at Microsoft, with her features shipped to more than 1 billion devices.

Maria received her A.B. in Government from Harvard and M.Eng. in Computer Science from Cornell. Maria is interested in talking to women, minority, and immigrant founders. She encourages them to reach out to her via Twitter @MariaShen.

[1] https://www.developerreport.com/developer-report

[2] https://www.c-span.org/video/?c5118238/user-clip-mcmorris-rodgers-electric-capital

[3] https://www.theblock.co/post/290429/bip-420-op-cat-covenants-bitcoin

[4] https://hackmd.io/@uTlMZA23Qz-cK8e7PqQt0A/rkOAbFIhn

[8] https://www.tylerxhobbs.com/words/fidenza