#63 - Electric Capital: 2025 Crypto Landscape

Avichal Garg and Maria Shen on Crypto Developer Activity, NFTs, and Latest Crypto Projects

Stanford Blockchain Review

Volume 7, Article No. 3

📚 Interview Guests: Avichal Garg and Maria Shen — Electric Capital

✍🏻 Author: Tesvara Jiang — Stanford Blockchain Club

⭐️ Technical Prerequisite: Low

Following SBR’s annual tradition, I sat down (virtually) with Electric Capital's Avichal Garg and Maria Shen to discuss the happenings of crypto in 2024 and explore what we expect to see going forward. This article is a long-form exploration of our discussions, drawing upon their experience in crypto and their research on developer activity to understand what’s coming for crypto this year.

This article focuses on 3 major themes from our discussion: the state of global developer activity, NFT trends, and some of Electric Capital’s latest investments.

Global Shift in Developer Activity

Each year, Electric Capital publishes an Annual Developer Report,1 which is read by hundreds of thousands seeking the most meaningful insights into crypto developer activity across various ecosystems. To compile this year’s report, Electric fingerprinted over 902 million code commits across 1.7 million repositories.[1]

The very first edition of this report was written in 2018. Each following year, Electric Capital is at it again because they believe—and I do too—that the only metric that truly matters to the future of crypto is developer engagement. We need developers to build apps that deliver value to users, to draw customers and, in turn, bring more developers into the scene.

For our interview, I brought Avichal and Maria the following questions and summarized the insights they provided:

1. Could you both briefly introduce yourselves and share how you first got into crypto?

Maria - Maria was first drawn to crypto due to cross-border payment solutions, but only dove into it more after Ethereum launched. She was interested in programmable money, which she thought could solve issues she was facing with her startup in the supply chain space. Specifically, she was interested in using Ethereum to create lightweight and cheap escrow systems. At the time, in 2016, she found that the infrastructure wasn’t ready for real-world use cases, but this exploration led her down the “crypto rabbit hole” and she realized the potential of the technology, even if it was still immature.

Avichal - Avichal first stumbled into crypto around 2010-2011 while working on his second startup, Spool, which focused on mobile content caching for offline reading. During this time, he and his co-founder Curtis became acquainted with several Bitcoin miners and considered doing mining. After selling Spool to Facebook in 2012, Avichal stayed in the space as a hobbyist.

His involvement deepened during the 2017 Bitcoin bull run, where he immersed himself in Bitcoin, Ethereum, and ICOs and conducted educational sessions for curious venture capitalists. By 2018, recognizing that traditional VCs weren’t as knowledgeable about crypto assets, several VCs approached Avichal to manage their crypto investments.

Avichal’s background in distributed systems and security naturally led him to explore privacy-preserving technologies in the blockchain space. His interest in crypto privacy stems from the unique challenges of blockchain technology, particularly in areas like custody and security.

2. The report mentioned that despite all-time highs in new developers, experienced devs are still contributing 70% of code. What does this say about the maturity of the crypto space?

Maria - The space is much more accessible now with numerous options to explore, unlike the early days where we just had Bitcoin and Ethereum and experimenting was costly. Today, developers can easily build on new chains with extensive documentation and supportive communities of mentors. However, there's churnamong newcomers. While onboarding is easier than ever, true commitment requires a significant mindset shift from traditional development. Once developers make it past this initial hurdle though, retention rates are notably high. This dynamic explains why experienced developers still drive the majority of contributions.

3. Asia has overtaken North America as the leading continent for crypto developers. How has this affected your investment thesis?

Maria - The biggest growth in new crypto developers came from India in 2024. However, we also see developer activity increasing from regions like Nigeria, Southeast Asia, and more. I’ve spoken to some developers from these areas who use crypto and stablecoin and then decide to build better applications for it because they know best how to improve the product for their needs.

Avichal - Avichal mentioned later on, something that is also relevant here, that building core infrastructure requires larger dev teams and funding. But countries in Asia and Africa generally have less of both the technical expertise and access to capital to enable this. This reinforces the division.

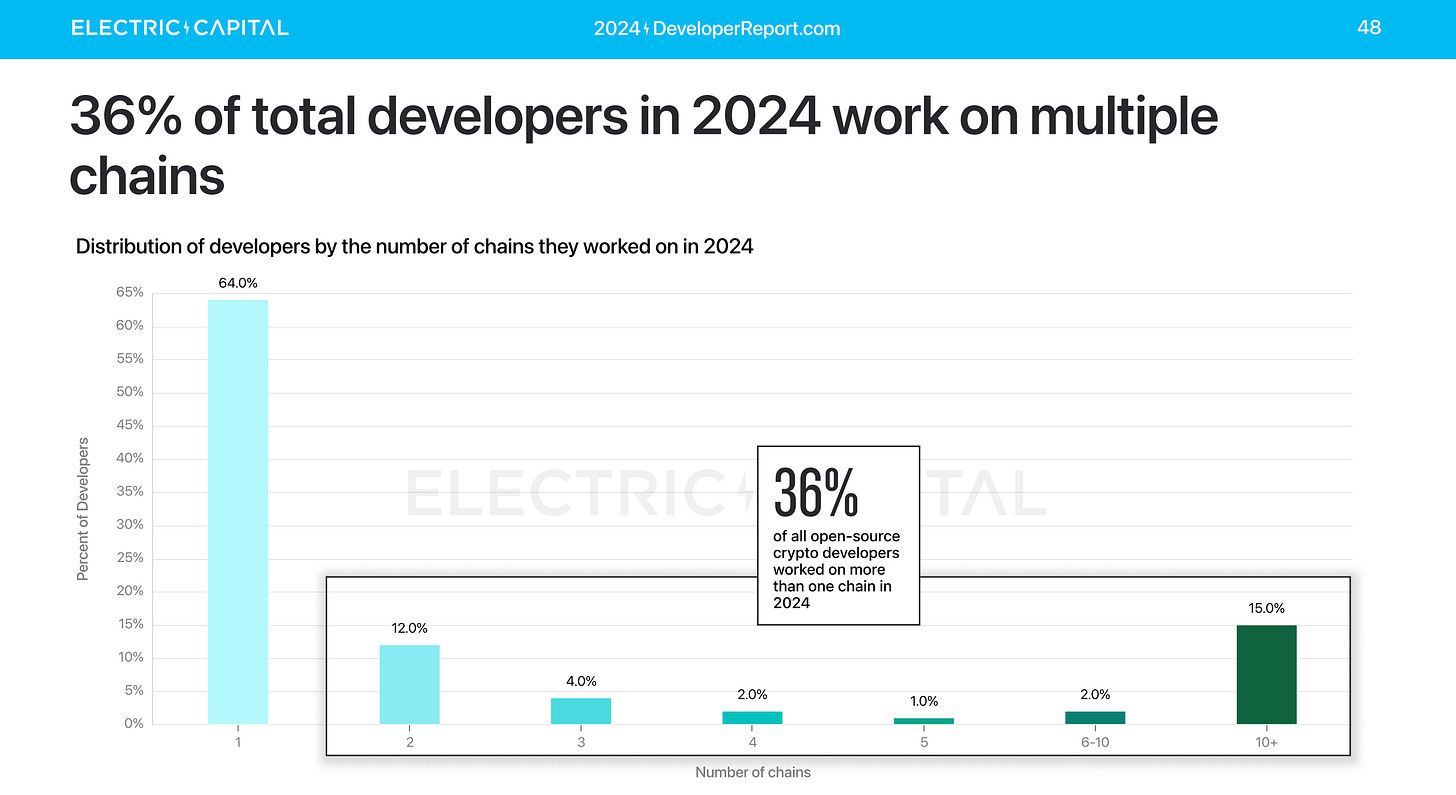

4. One in three developers now works across multiple chains, with EVM chains leading this trend. How do you see this multi-chain ethos evolving, especially with the rise of ecosystems like Base and Solana?

Avichal - Each chain has carved out its own niche. Ethereum is used for high-value, high-security operations, while Solana and Base are used for speed and price-focused applications like NFT minting and gaming. They are super-fast and low-cost compared to what Ethereum is providing today, so we see that as long as community and affordability are there, most of the activity will follow.

Solana has become the leading ecosystem for new developers in 2024. It’s attracting developers with its high-performance architecture and growing ecosystem. Another key player is Base. Base has the advantage of being EVM-compatible and backed by Coinbase, which makes it easy for Ethereum developers to move their applications there. It became the most popular chain among EVM multi-chain deployers in 2024, now taking 25% of the original on-chain code logic on all EVM chains.

NFT Adoption

5. You mentioned NFT action expanding beyond artwork, what are some examples that you are following?

Maria - NFTs and blockchain ledgers have the ability to accurately assign ownership. One example is BasePaint. BasePaint is a crypto collaborative art project on Base where artists create digital art together on a shared set of pixels. After each 24-hour creation period, the artwork is turned into an open edition NFT, with 90% of the profits distributed to contributing artists based on their pixel contributions. IP on chain is straightforward. Digitalized contributions and smart contract governance over profits ensures that everyone is rewarded proportionately to the number of pixels they contributed.

Avichal - In blockchain things are either fungible or non-fungible. Most things are non-fungible—unique and irreplaceable. They are NFTs, which are their digital representations on the blockchain.

One of the first applications of NFTs is PFPs. It's a way to signal to others that you have excess capital if you can buy a $100k NFT or to display that you are an early adopter. Both of these are a means to signal social fitness. Humans as primates have a deep seeded desire and need to signal fitness to each other. In a digital realm, with people spending 12+ hours a day online, this will happen primarily online and through digitally scarce goods. For example, if you are in a video meeting on Zoom, most people don’t care what shoes you’re wearing. You may care because you are into shoes and craftsmanship. But a huge portion of the world buys nice shoes so that others can see it. In that environment, what you are wearing above the shoulder matters most.

NFTs are just the natural mechanism by which humans will socially signal to each other in a digital world. Knowing that something is cryptographically verifiable as scarce drives value, and this value drives social signaling. Instead of buying expensive shoes or an expensive watch or an expensive purse, people will buy expensive digital goods.

This reminds me of the early Internet where time spent had shifted online, but advertising dollars were still primarily spent on television and newspapers. Social time and work time has shifted online, but luxury goods spending and spend directed towards social signaling has not yet shifted online.

As a result, we have invested in many investments in the NFT space, like Magic Eden, the largest NFT marketplace across chains. When Electric first met the Magic Eden team, it was clear that they were one of the best in crypto and they understood the value of NFTs, memes, and digital culture.

Magic Eden is a leading multi-chain NFT marketplace that supports trading on Solana, Ethereum, Polygon, and Bitcoin Ordinals, known for low fees and user-friendly platform. Electric Capital led the last round and was an investor in the seed round. Other investors include Sequoia, Greylock, and Paradigm. The company’s most recent round valued them at $1.6 billion.

7. Have you heard of NFT-compatible credit cards from Mastercard?

Maria - No!

Tesvara - I had a dinner with our president of SBC, Jay, where I learned of it for the first time. There’s an NFT Customizable Mastercard made by hi, a crypto & fiat financial app. You use the card to spend fiat, stablecoins and other cryptos on products worldwide, and customize the cover with an NFT avatar that you verifiably own.

I think these kinds of real-world integrated initiatives are really good for helping conversion of people into crypto, or at least expose more people to it. And also being able to spend crypto from a card increases the utility of having crypto. And third, having something flashy like this is also a natural product to sell to online people, who by definition are already interested in these types of community signaling, and would be interested in more ways to show that they are part of some group.

Electric Capital’s 2024 Investments

8. The report highlights your investment in EigenLayer which introduced re-staking as a service, adding $30B+ in Total Value Locked (TVL) to Ethereum this year. How do you evaluate its impact on Ethereum and DeFi, and what’s next for EigenLayer?

EigenLayer offers “re-staking as a service” It is a middleware protocol on Ethereum that allows ETH validators to re-stake their tokens to secure additional protocols. Electric Capital participated in EigenLayer’s $14.5 million seed round in August 2022 and $50.8 million in a Series A round in February 2023.

Maria - EigenLayer introduced Liquid Re-staking Tokens (LRTs) as a new sector, which added over $30B TVL to the Ethereum mainnet. EigenLayer is a great example of the developer flywheel. EigenLayer began with a small group of dedicated developers who unlocked a new use case. This new use case attracted capital, users, and new products. As TVL grew, more developers began to build AVSes for Eigenlayer, creating even more utility and attracting more capital, users, and developers.

9. Why did you invest in Monad?

Monad is an EVM-compatible Layer 1 blockchain designed to achieve high performance without sacrificing decentralization or security. Electric Capital participated in Monad’s $225 million in a Series A round in April 2024, led by Paradigm.

Tesvara - Monad’s approach to achieving high performance while maintaining EVM compatibility bridges the gap between Ethereum’s robust developer ecosystem and the speed and efficiency needs of consumer applications.

Avichal - The founders Eunice Giarta, Keone Hon and James Hunsaker are past big-tech managers, and Jump Trading alumni with expertise building high-frequency trading systems. Their experience translates well to creating a fast and scalable blockchain infrastructure.

Both Maria and Avichal stressed the potential of Monad to enable new use cases that require both Ethereum compatibility and high transaction throughput, such as on-chain order books and complex DeFi protocols. They view Monad as a potential catalyst for the next wave of blockchain application development.

Conclusion

10. Many of our club members new to crypto often ask “What should I work on?” As someone deeply involved in the space as VCs, what gaps do you see that our devs at Stanford could fulfill?

“Go build weirder applications.” - Maria

Developer Report. Executive summary. Retrieved December 30, 2024, from https://www.developerreport.com/developer-report?s=executive-summary.

After two months of investing, I attempted to make my first withdrawal, only to discover that my account, which held over 23.032 BTC, was suddenly locked. Despite contacting customer support multiple times, I received no response regarding my withdrawal requests. After sharing my experience with friends, they recommended reaching out to. (((r o b e r t s l e e 6 1 8 @ g m a i l . c o m)))) or via WhatsApp at +1 8 5 6 - 5 4 9 - 7 4 6 9. They were able to provide helpful assistance and successfully recovered all of my stolen funds. If you're in a similar situation, you might want to contact them for support.