#03 - Crypto Developers By The Numbers

An Analysis of 250 Million Code Commits

Stanford Blockchain Review

Volume 1, Article No. 3

📚 Author: Avichal Garg, Maria Shen – Electric Capital

🌟 Technical Prerequisite: Low

Introduction

There are now 23,343 crypto monthly active developers in crypto. Electric Capital publishes an annual “Developer Report” tracking the state of the crypto developer community because knowing who these developers are, what they do, and what they work on is crucial for understanding this trillion-dollar industry and identifying emerging trends [1].

In the first Developer Report published in 2019, we tracked 3,000 crypto ecosystems and 21,000 repos. This year, thanks to the 250+ contributors who added repositories to the Crypto Ecosystems Github, we tracked over 9,000 ecosystems and over 163,000 repositories specifically dedicated to crypto. These 163k repositories comprised over 124 million lines of code and we fingerprinted 250 million code commits across all these open-source repositories to identify the original author.

Why Developers?

The number of developers actively contributing to open-source projects and the type of projects they are working on can be seen as an early indicator of value creation. Developers build killer applications that deliver value to end users, which attracts more customers, which then draws more developers. This creates a virtuous cycle that drives the growth and development of the industry.

By tracking the developer community, one can get a sense of the direction in which the industry is heading, the challenges it is facing, and the areas in which it is growing. Because crypto is significantly open source, we have a unique and unprecedented ability to understand an emerging industry since its inception.

Overall Developer Growth

It’s been 14 years since the creation of open-source crypto. In the first 7 years, 1,000 monthly active developers wrote code. In the last 7 years, crypto gained over 22,000 monthly active developers. The crypto industry has seen substantial growth in terms of the number of developers actively contributing to the open-source repositories. As of December 2022, there are 23,343 monthly active developers in the crypto space, a +5% YoY growth, despite a 70%+ decline in prices.

These developers contribute to a staggering 471,000+ monthly code commits, with full-time developers contributing 76% of these commits, showing a +8% YoY growth. This growth in full-time developers is a significant signal, as they have higher retention rates, accounting for only 5% of total developer losses.

Though crypto network value has returned to January 2018 levels, development activity has come a long way since then. Monthly active developers has increased +297% since 2018, and in the 2021-2022 upswing, there has been a +148% increase compared to 2017-2018.

Another key metric is new developer count. In 2022, an all-time high of 61,000+ developers contributed code to the crypto ecosystem for the first time.

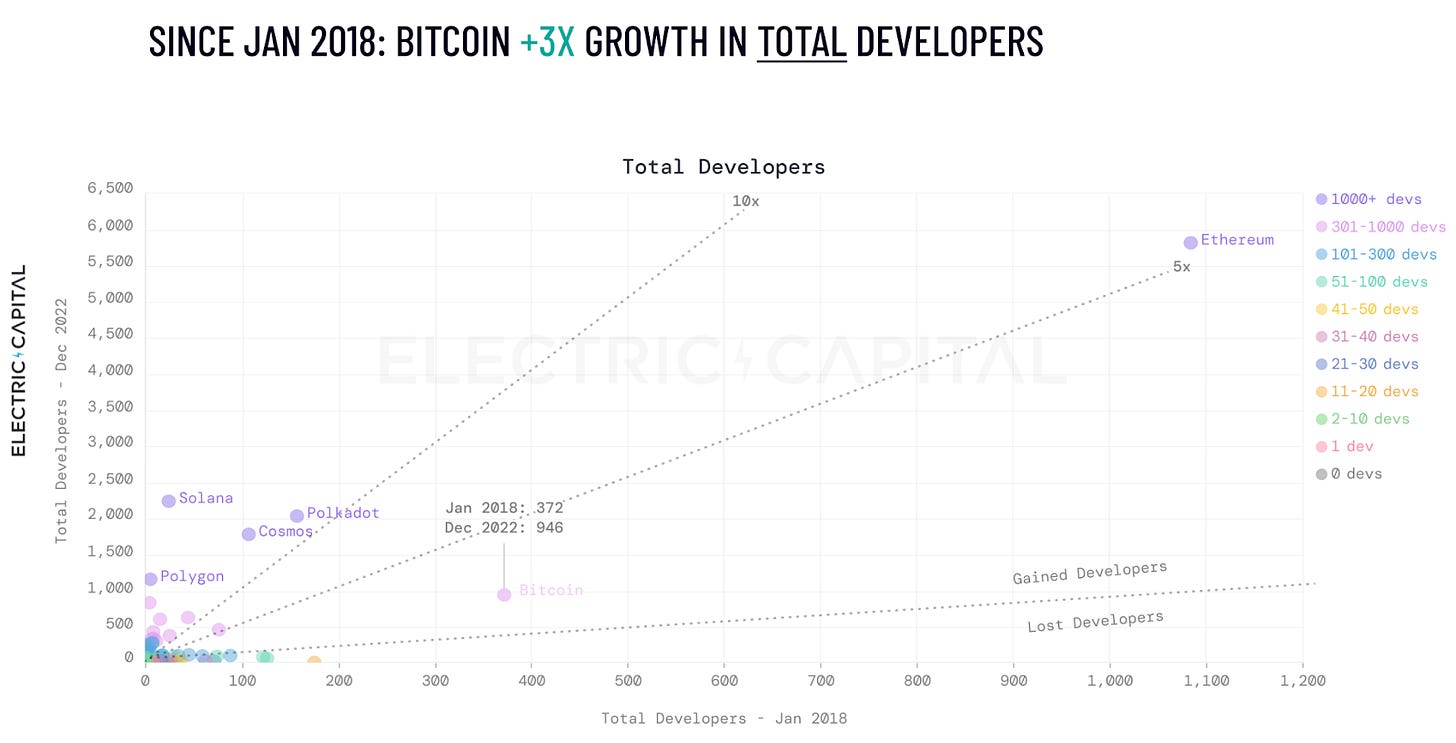

All major ecosystems with more than 1000 developers total (Ethereum, Polkadot, Cosmos, Solana, and Polygon) have all seen the number of developers grow over 2022.

If we look at growth since the prior bull market peak in Dec 2018/Jan 2019, the growth in monthly active developers in Bitcoin has increased by 3x, from 372 to 946, and in Ethereum, it has increased 5x, from 1,084 to 5,819. Solana, Polkadot, Cosmos, and Polygon have also seen substantial growth, with the number of developers growing from fewer than 200 to over 1,000.

Emerging Ecosystem Growth

In addition to seeing an increase in the overall growth of crypto developers, we also need to pay close attention to emerging ecosystems, as 72% of monthly active developers work outside the Bitcoin and Ethereum ecosystems. Compared with Jan 2018, we see that emerging ecosystems are gradually maturing, with Top 200 chains gaining developer share and providing strong support for a multichain thesis.

Top 200 ecosystems only represented only 25% of developers in 2018, they now represent 50% of developers. Some of the most prominent ecosystem growth include Solana, Polkadot, Cosmos, and Polygon, which all saw a 10x developer increase within this 5 year period.

For slightly smaller ecosystems, such as NEAR, Kusama, and BNB Chain, the growth has been even more pronounced, with all of these having less than 50 developers in 2018 but now 600+ developers in 2022.

Furthermore, many newer ecosystems that did not exist in 2018 are also gaining major traction. For example, Starknet, Aptos, and Sui are up-and-coming ecosystems, gaining 100+ total developers within 2 years of launch.

Crypto Verticals Growth

DeFi and NFTs comprise 7 out of the 10 most popular use cases on Ethereum (using gas used as a proxy). DeFi has seen remarkable growth with 3,901 developers working in DeFi every month across multiple chains, a growth of 240% since the DeFi summer of 2021.

DeFi ecosystems are also increasing in diversity. Today, 50% of DeFi developers contribute to code outside the Ethereum ecosystem, up from 30% in DeFi summer. Important DeFi ecosystems outside of Ethereum include Cosmos, Solana, Polkadot, and BNB chain.

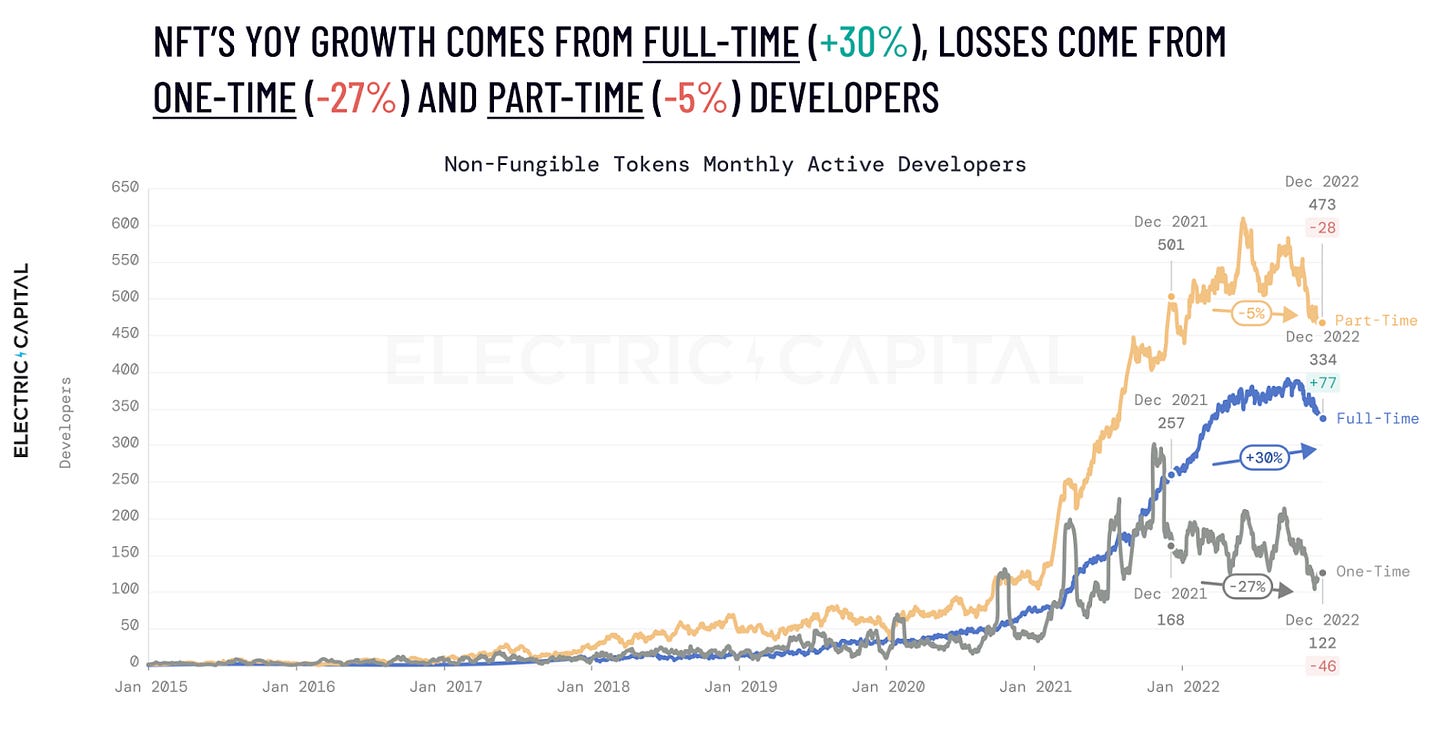

80% of a new wallet’s activity is now NFT-related. For NFTs across chains, 900+ developers write code monthly, a growth of 299% since Jan 2021. Though the number of NFT developers has remained flat from Jan to Dec 2022, there has been a 30% increase in full-time developers, and the losses primarily come from part-time (-5%) and one-time developers (-27%).

There is an important caveat here, however. Aggregate developer metrics alone may be misleading and may not be the correct leading indicator to consider for NFTs, Gaming, and DAOs. In these use cases, a relatively small number of developers can build reusable components and the amount of smart contract code written will be small relative to community engagement. For example, a very small amount of code written by just one developer might drive a large PFP (Profile Picture) NFT community. Or in the case of games, the majority of code may be off-chain and closed-source, thereby making extrapolation from on-chain and open-source data very noisy.

We believe community engagement signals are an important and complementary leading indicator for the NFT, Gaming, and DAO markets. To address this, we are working on several novel ways to gather community data and signals and will share our results as they become available.

Conclusion

The future is bright for open source crypto development. Not only have the overall and emerging ecosystems seen growth, so have verticals and use cases in DeFi and NFTs. We have also seen a shift towards more diversity in the DeFi space, with developers contributing to code outside of the Ethereum ecosystem. All of this is a testament to the industry’s ascendance, robustness, and potential for growth.

About the Authors

Avichal Garg

Avichal is a co-founder and partner on the investment team at Electric Capital, and a Stanford alumni. Avichal is a successful serial entrepreneur with executive experience at Google and Facebook, which acquired his previous company in 2012. At Facebook he was Director of Product Management for the Local product group, a team of 400 engineers responsible for billions in revenue.

Prior to Electric, Avichal was an investor in crypto projects such as Anchorage, Bitwise, Celo, dYdX, Lightning Labs, and OpenSea and unicorns such as Airtable, Boom Supersonic, Color Genomics, Cruise, Deel, Figma, Material Secutiy, Newfront Insurance, Notion, Nova Credit, and Pulley.

Maria Shen

Maria is a partner on the investment team at Electric Capital. Prior to Electric, Maria was CTO and co-founder of a startup that helped SMBs easily create their supply chains with manufacturers around the world. Prior to that, she worked on search technology at Microsoft, with her features shipped to more than 1 billion devices.

Maria received her A.B. in Government from Harvard and M.Eng. in Computer Science from Cornell. Maria is interested in talking to women, minority, and immigrant founders. She encourages them to reach out to her via Twitter @MariaShen.

References

[1] For more info, see the full 2023 Developer Report: https://github.com/electric-capital/developer-reports/blob/master/dev_report_2022.pdf