#66 - Beyond Digital Gold: Bitcoin's Evolution into a Full-Service Blockchain Platform

Magic Eden perspective of Bitcoin's Transformation from Store of Value to Web3 Infrastructure

Stanford Blockchain Review

Volume 7, Article No. 6

✍🏻 Author: Matthew Swetz — Head of Bitcoin Product at Magic Eden

⭐️ Technical Prerequisite: Low

Bitcoin is digital gold. This idea has been widely embraced by crypto industry leaders for years, and recently respected by mainstream financial figures and institutions. As the first cryptocurrency, Bitcoin laid the foundation for the rapidly evolving ecosystem we have today. But while its reputation as a store of value is well-established, Bitcoin has recently proved itself to be far more than just a hedge against inflation. The future of Bitcoin, and the broader crypto landscape, lies in developing Bitcoin’s untapped potential as a canvas for alternative assets, digital art & media, & the cornerstone of decentralized finance. At Magic Eden, we’re at the forefront of this revolution, building new meaning directly on the Bitcoin blockchain.

Unlocking Bitcoin’s Potential

For years within the crytpo community, Bitcoin has been referred to as digital gold, a label that is now gaining broader acceptance across global financial and economic sectors. Many high-profile individuals, such as BlackRock CEO Larry Fink and President Donald Trump, have voiced their belief in Bitcoin as a store of value. Even Jerome Powell, the chair of the US Federal Reserve, has acknowledged Bitcoin akin to digital gold and encouraged banks to service crypto companies.

This acceptance has led to an increasing number of corporations and nation-states “stacking sats” by holding Bitcoin on their balance sheets as a store of wealth and to hedge against inflation and de-dollarization. This broader recognition is a testament to Bitcoin’s durability and growing influence in the global financial system.

But what if Bitcoin can be more than just digital gold?

When Bitcoin was created as the first cryptocurrency in 2009, the Bitcoin blockchain itself served simply as a means to store and transfer Bitcoin in a peer-to-peer decentralized network. Over time however, builders and cryptocurrency enthusiasts recognized the potential of blockchain technology outside of a store of value. Other blockchains such as Ethereum and Solana, emerged to introduce new capabilities and features that the Bitcoin blockchain was not able to support. These capabilities include decentralized finance (DeFi), non-fungible tokens (NFTs), decentralized applications (dApps), smart contracts, and new fungible tokens. These chains gained value over the years by fostering innovation and enabling new use cases, with their native tokens serving as the currency, and deriving value from, each individual blockchain economy.

Over the past few years however, builders like Magic Eden have started figuring out how to reverse engineer these capabilities on the Bitcoin blockchain itself. The opportunity of these efforts is immense; if builders are successful, they can create a crypto economy backed by digital gold and secured by the most decentralized blockchain network. This may one day allow people around the world without access to banking infrastructure the ability to use a permissionless, free, and fair financial system that goes far beyond simply storing value, and to do it all on a single blockchain network.

At Magic Eden, we’ve been at the forefront of building on Bitcoin, having helped launch and build social consensus towards fungible and non-fungible token standards on Bitcoin. Looking ahead, we anticipate potential programmability upgrades and the integration of smart contracts. These advancements will allow Bitcoin to unlock its full potential and bring the entire on-chain economy home to Bitcoin.

Bitcoin’s Development: Playing Catch-Up

To understand the trajectory of Bitcoin’s evolution, it’s helpful to view it in the context of other blockchains. While other blockchains have been innovating with smart contracts and DeFi applications for years, Bitcoin is steadily catching up.

The most direct comparison can be made to the Ethereum blockchain. In 2017, Ethereum faced its first major congestion crisis due the the abundance of ICOs and the viral onchain game CryptoKitties. This lead to research and development of Layer Two scaling solutions which launched into the market in the coming years.

Bitcoin is just a few years behind. In January 2023, the Ordinals protocol released, making it possible to inscribe digital media directly into individual Satoshis on the Bitcoin blockchain. This advent of a non-fungible token standard quickly took hold, resulting in massive fee spikes that congested the network and renewed research into Bitcoin scaling solutions.

The Ordinals protocol went on to achieve social consensus, becoming one of the top NFT protocols and driving over $2 billion in trading volume in just two years. Following Ordinals, the Runes Protocol released in April 2024, establishing a means to inscribe fungible tokens directly into the Bitcoin blockchain. In 2024, over 50% of transactions on the Bitcoin blockchain involved either an Ordinal or Rune transfer, highlighting both the opportunity and interest in Bitcoin native assets.

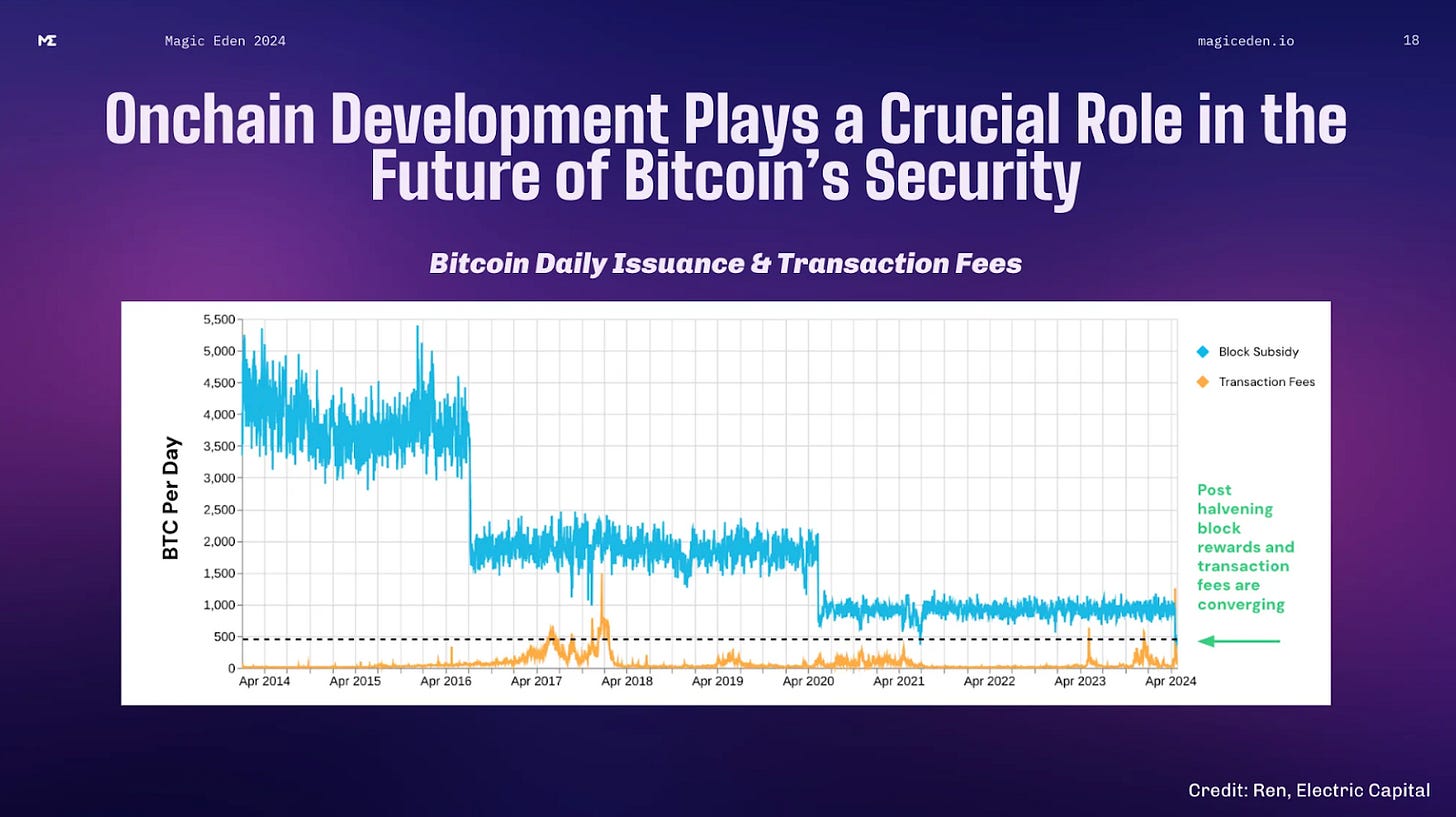

As these new protocols gain traction, they are paving the way for a more dynamic Bitcoin economy, where Bitcoin is no longer just digital gold, but a thriving platform for innovation. Additionally, this new network activity plays a crucial role in the future of Bitcoin’s security. During the launch of the Runes protocol, Bitcoin transaction fees surpassed the value of miner rewards for the first time ever. In a future with diminishing miner rewards reliant upon Bitcoin’s price appreciation to make mining economically profitable, transaction fees offer a net new revenue stream that incentivizes participation in mining and network security.

The Challenge of Building on Bitcoin

Building on Bitcoin presents unique challenges, particularly due to its technical constraints and the need to maintain its core principles of decentralization and self-custody. For developers, this means tackling the complexities of Bitcoin’s infrastructure while ensuring a seamless user experience.

There are two key challenges that Bitcoin builders must address:

Building the Rails: Creating infrastructure for trading assets on the Bitcoin network is more complex than on other blockchains. Unlike Ethereum or Solana, Bitcoin’s UTXO (Unspent Transaction Output) model and long block confirmation times present significant hurdles for developers. Additionally, Bitcoin’s lack of native smart contract support means that developers must reverse-engineer solutions using simple peer-to-peer transactions.

Simplifying the User Experience (UX): Bitcoin’s technical complexities make it difficult for users to interact with the blockchain. To scale Bitcoin’s onchain economy, developers must push the technology to the background, allowing users to engage without being overwhelmed by its intricacies.

A Real-World Example: Solving Mempool Sniping

As the Bitcoin onchain economy grows, we at Magic Eden have played a significant role in developing new, open-source solutions for building applications and facilitating transactions on the Bitcoin blockchain. Most recently, our team successfully developed a solution for the highly technical challenge of Mempool Sniping, which is the practice of “replacing” someone else’s Bitcoin transaction.

Due to Bitcoin’s lengthy block times, unconfirmed transactions in the Bitcoin mempool can be "replaced" with a different version of that transaction, utilizing a higher fee to "jump" the original transaction in line. Though this does not result in any economic loss for those who are “jumped” in line, it significantly hurts the viability of trading alternative assets on the Bitcoin blockchain given that buyers cannot be certain of asset delivery. Additionally, this phenomenon results in sellers accruing less profit from their assets at the point of sale, as value is “discovered” in the mempool through fee escalations realized as revenue by Bitcoin miners.

To solve this problem, while maintaining a fully decentralized marketplace with no asset custody, we at Magic Eden built an intricate solution using Tapscript to encode an allowlist merkle tree of users that facilitates peer-to-peer Bitcoin transactions with minimal trust assumptions. We hope this invention plays a fundamental role in the development of Bitcoin and the Bitcoin economy in years to come. A deep dive on the technicalities of this solution can be found here: https://x.com/MakeTokensFun/status/1853472486597509208, in addition to a video overview of the build here:

Author

Matthew Swetz is the head of Bitcoin Product at Magic Eden, the number one onchain Bitcoin marketplace by transaction volume and users. Prior to joining Magic Eden, Matthew worked in product management and corporate strategy across the crypto and digital gaming industries.