#48 - Optimizing Public Goods Allocation: A Critical Analysis

A Theoretical Proof of Quadratic Funding and Practical Limitations in Decentralized Funding Mechanisms

Stanford Blockchain Review

Volume 5, Article No. 8

📚Author: Brian Grenadier — Stanford University

🌟Technical Prerequisite: Advanced

Introduction

Achieving the optimal allocation of public goods in a decentralized system is prone to under- investment due to the free-rider problem. Vitalik Buterin, Hitzig, and Weyl provides a generalization of the quadratic voting algorithm to a mechanism for achieving the socially optimal allocation of public goods [2]. The algorithm, known as quadratic funding, involves a sponsor/donor that matches the contributions of a decentralized community of individual donors. Under the quadratic funding mechanism, the total funds allocated to a public good project equals the square of the sum of the square-roots of individual contributions.

In this paper I begin by providing a simple mathematical proof that, under idealized conditions, the quadratic funding mechanism achieves the first-best allocation of public goods. Then I describe four deviations from these idealized conditions that may lead to suboptimal results for the quadratic funding mechanism. These limitations are asymmetric information, collusion, fraud, and underfunding by the donor. Finally, I discuss Gitcoin Grants, a real-world application of the quadratic funding mechanism.

The Quadratic Funding Model

This section will provide a brief summary of the model that underlies the quadratic funding model for the allocation of funds for public goods. I begin with deriving the first-best resource allocation of a central planner, and then demonstrate that the quadratic funding model can implement the central planner’s funding levels across public goods in a decentralized setting. The derivation will be mostly at a heuristic level, and omit some of the finer details such as second-order conditions.

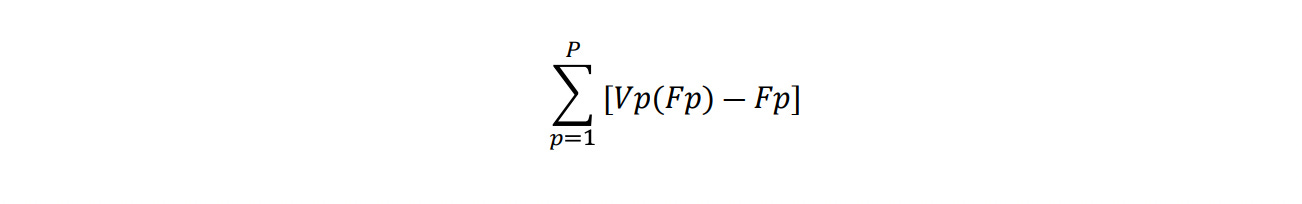

Let there be P public goods, indexed with p = 1, 2, ..., P. The central planner chooses funding levels Fp for each of the public goods. Public good p provides utility value of Vp(Fp). The planner then chooses to maximize:

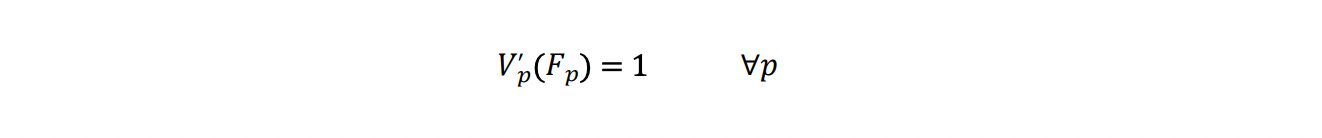

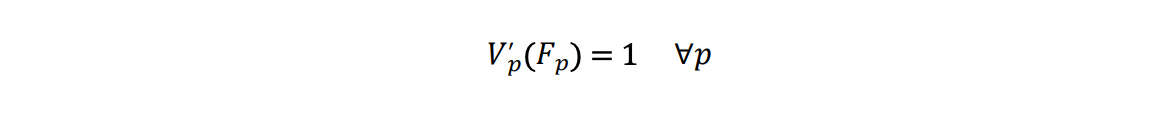

The first-order condition is:

Thus, the planner will choose to fund each of the public goods up to the point at which the marginal benefit of the last dollar of funding equals its marginal cost.

Now, consider the funding of public goods under a decentralized system with quadratic funding. Let there be N individuals, indexed with i = 1, 2, ..., N. Each individual i has preferences for public good p denoted by

Each individual i contributes to public good p an amount

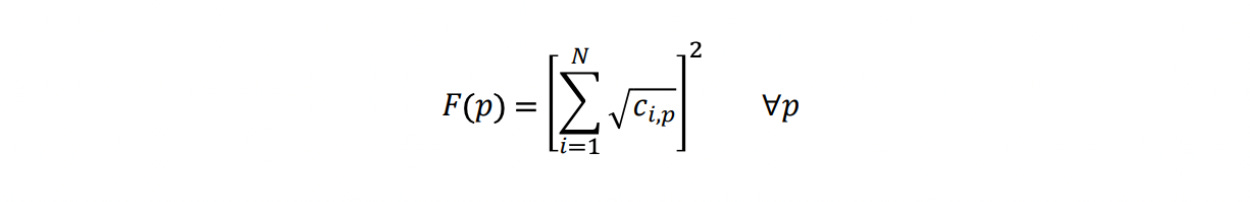

However, the actual funding of public good p will be determined by the quadratic funding rule:

Note that we assume that the difference (deficit) between the total amount of funds spent and the total amount of funds contributed by the agents is made up for by some benefactor/donor. This entity serves to fund the deficit of

Each agent i will choose

so as to maximize:

The first-order condition is:

or,

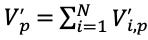

Summing across i, and noting that

and thus

so,

Thus, the Quadratic Funding mechanism will lead to the identical funding levels of the P public goods as the central planner.

Issues with Quadratic Funding

Asymmetric Information

One important assumption underlying the ability of quadratic voting to achieve the optimal aggregate allocation is that voters are certain about the underlying quality of the projects on which they vote. That is, while voters are allowed to have different preferences, they all agree on the quality of the projects. However, in reality, voters will hold asymmetric information about the quality of the projects. For example, suppose a particular public good is a sponsored coding contest for an algorithm for the allocation of kidney donations. Voters are likely to differ on their assessment of how likely the coding contest will result in a functional algorithm, and if so, how much better it will be over the status quo. In such settings, we seek both allocative and informational efficiencies.

Benhaim, Falk, and Tsoukalas analyze quadratic funding under asymmetric information [3]. They begin with the previously demonstrated result that under full information, quadratic voting achieves allocative efficiency. However, this is not generally true under quality uncertainty. Here is the basic intuition. Under quality certainty, the weighting scheme under quadratic voting, where the cost of acquiring voting power is convex, permits voters’ preferences to aggregate with just the right amount of voting power to achieve first-best. However, under uncertainty, we are looking at more than just aggregating preferences. In particular, we wish to aggregate asymmetric information so that the “wisdom of the crowd” can best be heard. That is not true under quadratic voting, where voters are seen to have a diminished incentive to have their beliefs aggregated.

BFT finds that under asymmetric information, quadratic voting can actually underperform traditional linear voting. This is due to the fact that quadratic voting’s cost convexity can disincentivize voters from casting enough votes to reflect their beliefs. However, as the number of voters increases towards infinity, both quadratic voting and linear voting lead to efficient aggregation of voter information. This suggests that under conditions in which information asymmetry is greatest, designers of the voting system should focus on increasing user participation. For example, they could provide explicit rewards for voter participation.

Collusion

Collusion refers to agreements between contributors so as to benefit themselves at the expense of other token holders. Such agreements can be either tacit or explicit, with tacit agreements obviously being difficult to detect. In essence, coordination between large voting blocs can enable the siphoning off of public benefits to the colluding agents. BHW admits that collusion is a central vulnerability of quadratic funding.

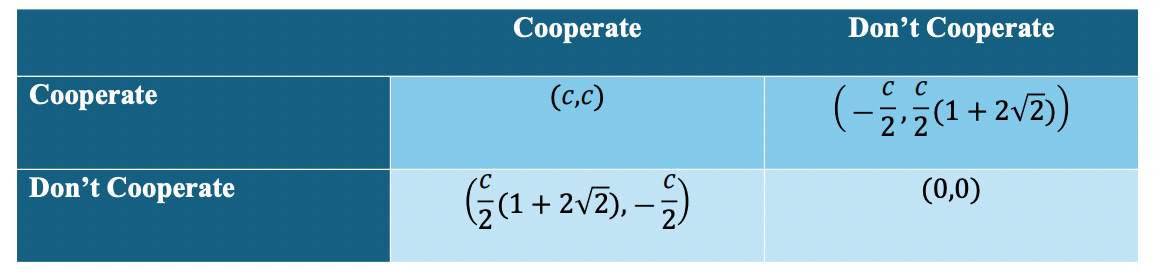

Let me give a simple game-theoretic example of collusion, drawn from Pasquini. Consider a one-shot game between two contributors, voting on two projects, each with a material interest in the funding of one of the two projects. Contributors 1 and 2 each have c funds to invest. The total amount of funds raised by project 1 goes to contributor 1, and the total amount of funds raised by project 2 goes to contributor 2.

Each contributor can either cooperate or not cooperate. Cooperation means that the contributor gives c/2 to each project. Not cooperating means giving c to their own project, and nothing to the other.

Consider the 4 possible payoffs:

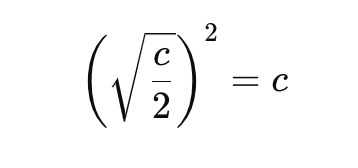

A. If both cooperate, then each project’s funding under the quadratic rule equals If both cooperate, then each project’s funding under the quadratic rule equals

On net after paying c, each receive 2c-c=c.

B. If one cooperates and the other does not, then the one that cooperates has their project funding equal to

with a net payoff of

The one that does not cooperate has project funding of

with a net payoff of

C. If neither of them cooperates, then each project’s funding equals

with a net payoff of c-c=0.

Writing out this game’s payoff matrix:

It is easy to see that the only (pure) Nash Equilibrium is for neither to cooperate, leading to an equilibrium payoff of zero to each voter. This is just a case of Prisoner’s Dilemma, in which both would be better cooperating and earning c, but cooperating is dominated by not cooperating. The intuition from this game is why BHW state that “unilateral incentives run quite strongly against certain forms of collusion.”

However, if this mechanism becomes part of an infinitely repeated game, then we know that (under certain parameter restrictions on discounting) that the cooperative outcome can be sustained under the standard “tit-for-tat” equilibrium. Such strategies would take the form of cooperating with the threat that any deviation would be met by thereafter not cooperating. This result could be a major problem for applications that permit the threat of non-cooperating to permit a cooperative dynamic equilibrium. Notice that Gitcoin Grants has been repeated many times.

Fraud

BHW also lists fraud as a central vulnerability of quadratic funding. In fact, when comparing fraud to collusion, they call fraud the “simpler and more devastating of the issues.” Because of the convexity of the quadratic function, there is a built-in incentive to misrepresent oneself fraudulently as many individuals. This is sometimes termed a “Sybil attack.”

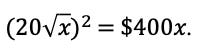

BHW offers this simple example. Consider a single voter contemplating offering to contribute $20x to a project (in which they have a personal stake). If she is able to misrepresent herself as 20 voters contributing $x apiece, she will pay $20x but her cause (which goes to her) receives

That is, her individual contribution grows 20-fold. If this kind of fraud is permitted, then we have a clear arbitrage which will entirely upset the honesty of the voting system.

BHW suggests that the only meaningful system of preventing such fraud is an effective system of identity verification, which may not be trivial in a DAO setting which is often designed to preserve anonymity. In addition, there needs to be actual auditing of voting results with sufficient penalties against fraud to deter the urge to exploit.

Underfunding

Under the quadratic funding mechanism, the role of the sponsor/donor is critical. Recall that the mechanism selects the amount of funding for public goods projects through applying the quadratic rule to individual contributions and using the sponsor funds to reach the resulting implied levels. In reality, the pool of funds provided by the donor is likely to be less than what is needed to reach socially optimal allocations. This is the problem analyzed in Pasquini.

The problem of limited donor funds was addressed by BHW. To address this limitation, they discuss a mechanism called “capital constrained quadratic funding” which essentially makes the public good as large as matching funds allow, and still proportional to the rules of quadratic funding. In fact, this is the implementation used in Gitcoin Grants.

Pasquini shows that capital constrained quadratic funding fails to achieve optimality. That is, even given the constraint, the quadratic funding rule fails to allocate funds in a socially optimal fashion. It is shown that results from the fact that in the constrained equilibrium, individual contributions are lower as they are not fully compensated for the social benefits they generate through their contributions. That is, the constraint impacts the incentives of the individual voter and causes a deviation from the necessary first-order optimality conditions.

Gitcoin Grants

Perhaps the most famous example of a real-world application of the quadratic funding mechanism is Gitcoin Grants. Gitcoin Grants is a method of funding open-source software projects as well as other public goods on the Ethereum blockchain ecosystem. Open-source software is an excellent example of a public good. It is non-rivalrous in that the benefits of the software do not decline due to others’ consumption. It is non-excludable as open-source software is freely available to the public, regardless of whether they contribute or not.

According to Yash Agarwal, Gitcoin has facilitated more than $72.8 million in funding for open-source software [5]. In addition, Agarwal provides a simple example of how Gitcoin utilizes the quadratic funding algorithm, which in practice is actually a variant of the capital constrained quadratic funding mechanism proposed in BHW.

Gitcoin Grants explicitly uses the quadratic funding algorithm. Pasquini illustrates the Gitcoin process employed during the 7th and 8th Gitcoin Grants rounds that took place in 2020. During the days of a round, contributors could find the participating projects described on a webpage, choose which projects in which to invest, and commit a cryptocurrency transfer. The webpage is updated to report the total amount received thus far, as well as the expected amount to be received after matching funds (under quadratic funding) are added. For example, in Round 8 there were 444 projects and 4,953 contributors. Individual contributions per project averaged about 30 DAI.

The Gitcoin Grants public webpage for its financing platform is instructive. Gitcoin Grants has collected 4.6 million unique donations with 5,242 projects having raised funds [6]. That being said, the level of current activity on the site seems underwhelming. For example, many of the projects (even with less than a week remaining in their round) have raised less than $100. In addition, the amount of funds available in the matching pool is also often small, with many less than $1,000.

Thus, while Gitcoin Grants may currently be a relatively minor player in public goods financing, it truly is a living and breathing example of quadratic funding. In a sense, it is a remarkable accomplishment that a funding algorithm moved from an academic working paper to real world application in a matter of just a few years. This serves as a testament to the flexibility of the DAO model to provide a testing ground and an openness for novel platforms for governance.

About The Author

Brian Grenadier is a J.D Candidate at the Stanford Law School. He holds a bachelors degree in History from Stanford University and a strong background in mathematics and data analysis. This piece was written as his final paper for CS 352B: Blockchain Governance.

References

[1] https://www.gemini.com/cryptopedia/gtc-crypto-gitcoin-bounties-web3-gtc-token

[2] https://arxiv.org/abs/1809.06421

[3] https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4416748