#36 - To Jupiter and Beyond

Exploring Solana’s DeFi Hub and its Future

Stanford Blockchain Review

Volume 4, Article No. 6

📚Author: Kole Lee – Stanford Blockchain Club

🌟Technical Prerequisite: Low/Moderate

Introduction

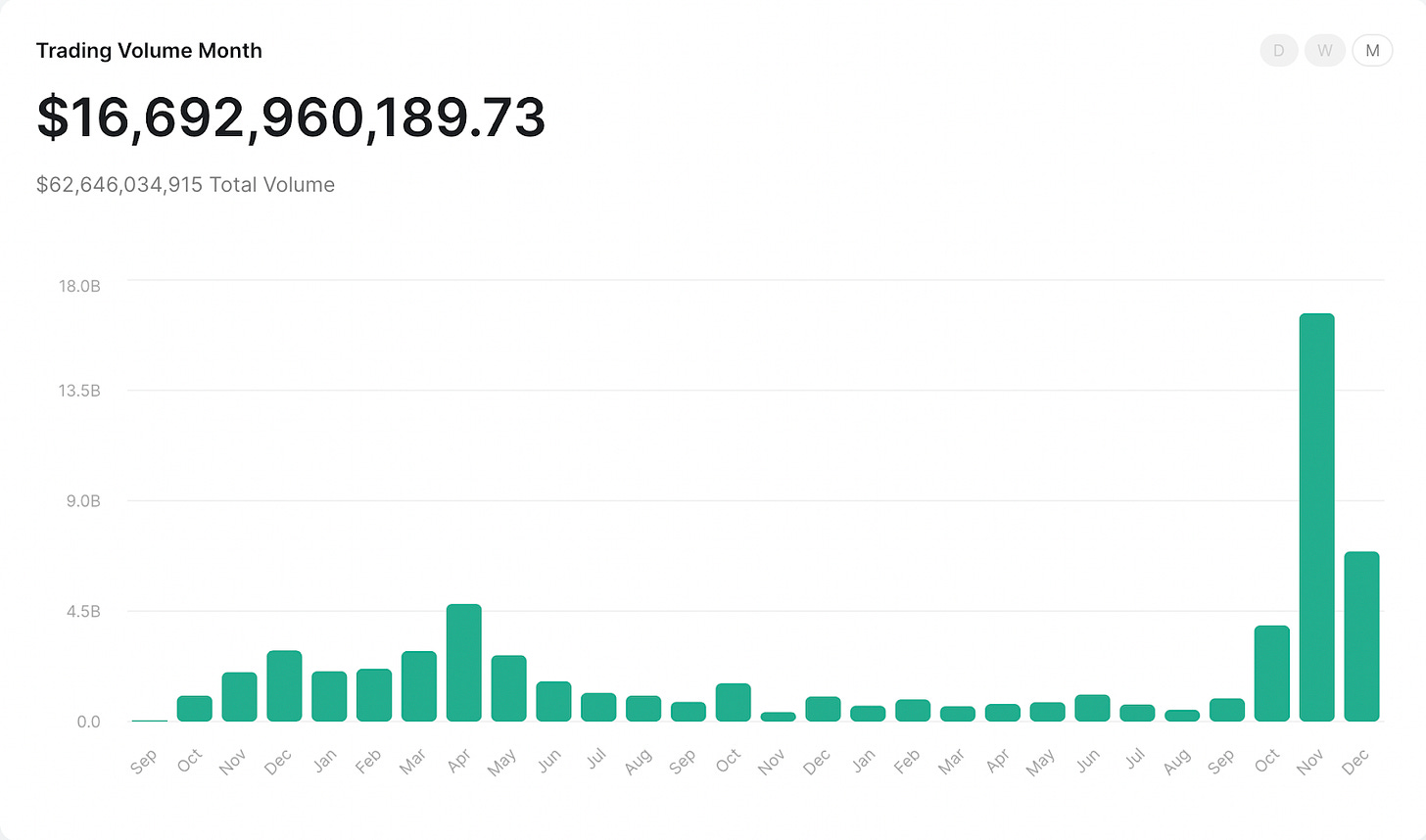

As Solana’s premier swap aggregator, Jupiter provides users with the best price by routing swaps across multiple Decentralized Exchanges (DEXes). In addition to its swap feature, Jupiter offers Limit Orders and Dollar Cost Averaging (DCA). Jupiter has facilitated over $60 billion in Volume since its inception in late 2021. Alongside the growth of Solana over the year, Jupiter’s monthly routed volume has increased 2300% since the beginning of 2023 [1].

In this article, we will explore how Jupiter builds features to leverage Solana’s unique strengths, assess Jupiter’s impact on the overall Solana ecosystem, and evaluate the project’s future visions and directions.

The Go-To Platform For Swaps on Solana

Ethereum and Solana present contrasting landscapes in terms of volume and usage. On Ethereum, aggregators like 1inch, 0x, CoW, and Paraswap manage a fraction of the total DEX volume, routing about 20-25% collectively. The majority of users prefer to use DEX Uniswap for their transactions [2].

In contrast, Jupiter dominates Solana’s DEX landscape by routing more than 80% of the total volume, a stark difference from Ethereum's scenario. Despite Raydium and Orca being the top two DEXes on Solana in terms of volume, the bulk of users opt for Jupiter for their swapping needs. This unique position of Jupiter on Solana illustrates its significant impact and user preference in the Solana ecosystem [3].

Jupiter’s Features: Leveraging Solana’s Strengths

Part of Jupiter’s dominance as the go-to platform for swaps in the Solana ecosystem can be attributed to leveraging Solana’s capabilities and features. Solana’s characteristics, such as low gas fees and multistate accounts, enable Jupiter to have better pricing and user experience as an aggregator.

Low Gas Fees Enable Better Pricing and New Features

Fees on Ethereum typically cost $5-15 for swaps [4]. This directly affects how much better price aggregators on Ethereum vs. a single dex. For your average user on Ethereum, a swap on 1inch may be minimally cheaper than swapping on Uniswap due to gas fees.

Dex aggregators operate by allocating portions of transactions across multiple liquidity sources, each which offer different exchange rates. To swap WETH for DAI, a service like 1inch might get a better deal than a direct full swap by breaking up some of the WETH and trading it to USDT on one exchange, then it will convert the USDT to USDC on DoDo. Finally it will convert it to DAI on Uniswap V3, all because it finds that the USDC-DAI liquidity pair is better. This is shown in the image below:

However, the more routes and contract interactions a path takes, the more gas is required. Thus, while the best price without gas might have been a complex split across 6 or 7 paths, such a route would be realistically too expensive with gas. Aggregators operating on Ethereum put a lot of focus instead on gas optimization for better pricing.

Jupiter takes advantage of Solana’s sub-cent gas fees with its Metis algorithm, which can generate the best possible paths regardless of complexity or length [5]. By utilizing the Bellman-Ford algorithm to iteratively build a route that can split and merge at any stage, Jupiter quotes prices that are 5.2% better than its older v2 algorithm [6].

Throughput Enables Better Limit Order Execution

Solana’s high throughput and fast transaction speed can be particularly beneficial for executing limit orders. In fast-moving markets, where oracle prices can vary rapidly, execution is critical. Quick execution is important for needs such as catching wicks, a common phenomenon where a sell order causes a very brief 20% or higher drawdown in price.

Solana enables Jupiter to have limit orders that have fast execution. Whereas slower transaction speeds and congestion may mean that an order may fail on other chains, Solana’s speed enhances the ability to execute these trades effectively.

Token Ledger for Increased Swap Success Rates

A common issue with DEX aggregators is that direct swaps can fail [7]. These platforms use simulations to figure out the best trading paths, however estimated results from simulations can differ from what actually happens at the time you trade. During periods of high volatility, swaps can often fail due to high slippage.

Instead of approximating the amount, Jupiter’s Token Ledger takes advantage of Solana’s multistate program capabilities to calculate all actual amounts transacted. It then combines all instructions into one transaction, which is executed atomically, increasing swap success rate [8].

Impact on Solana’s Ecosystem

Integrations

Swap Interface For Applications

Data Aggregation platforms like Birdeye and Hellomoon use Jupiter Swaps to generate revenue by adding Jupiter Terminal to their UI and adding a platform fee [9].

With the advent of games on Solana, Jupiter has also made it easy for Game Developers to integrate swaps into their games. They partnered with MagicBlock, the team behind Solana’s Unity SDK, so Solana games like Star Atlas, DeFiLand, and GenoPets can use Jupiter for marketplace purchases, asset-swaps, and gamified trading experiences.

Margin Products

Jupiter integrates with platforms like Solend, Solana’s premier lend and borrowing platform, and Drift Protocol, one of Solana’s top perpetual exchanges, for better margin trading experience.

Before Jupiter, users would use Solend manually to do margin trading swaps, borrowing, swapping on another platform, and depositing collateral back into Solend [10]. By integrating flash loans with Jupiter swaps, Sollend users can do margin trading swaps all in one transaction. Drift additionally combines flash loans and Jupiter’s deep liquidity so users can trade with up to 5x leverage at the best prices.

Payments

Jupiter built out ExactOut API, which allows exact payments with any token. It allows users to specify a precise amount of output tokens that a user requires, and the input token amount is calculated accordingly. Payment Platforms like Helio and Sphere leverage Jupiter so platforms can take payments with any SPL token [8].

Enabling DEX Competition

By creating a hub where most of Solana’s users use Jupiter on the frontend or backend as their swap platform, Jupiter does not just find the lowest prices. It encourages even lower prices by enabling competition. While Uniswap volume continues to dominate the majority of volume on the Ethereum ecosystem, on Solana there seems to be more and more fragmentation of volume occurring:

This could be because Jupiter makes it easier for new DEXes to spring up. On chains without high usage of aggregators, a new protocol might need to rely more on liquidity mining strategies and marketing to gain initial users and volume. Now, as long as the DEX has a strategy to have competitive prices, integrating with Jupiter ensures that the DEX will gain sizable volume. Incumbents cannot just rest on their laurels-they know that since most users use Jupiter, they will lose market share as Jupiter will route to the dex with the best price.

Phoenix is a fully-on-chain limit order book that receives significant volume from Jupiter. GooseFX, which created Single Sided Liquidity pools, so depositors can earn fees by providing a single asset, receives most of its swap volume from Jupiter. Lifinity, a capital-efficient proactive market maker that receives more than 10% of Solana’s Dex Volume, captures almost all of its volume through Jupiter on Solana [3][11].

By creating more DEX competition, Jupiter not only creates better prices for the ecosystem, but strengthens its position as the leading location to trade on Solana. Increasing the diversity of DEX systems means more liquidity fragmentation, increasing the need for Jupiter’s aggregation for the best prices and selection.

Jupiter’s Future

The Jupiter team’s vision for the future centers around what they call “growing the pie”: the idea that driving the growth and prosperity of the Solana ecosystem will result in Jupiter’s future success. This ultimately means making efforts and building out products that drive users to Solana.

JUP Airdrop and Speculation

The most recent and direct effort to drive users is the upcoming JUP airdrop. At the end of January, Jupiter plans to airdrop its first round of JUP, its governance token. Jupiter will airdrop 1 billion tokens, or 10% of the supply, to previous Jupiter users based on factors like their past usage and trading volume [12]. Jupiter plans on having 3 more airdrops for users of the platform.

Aevo.xyz, which is running a liquid pre-launch tokens market for JUP, currently prices the governance token to be worth several billion dollars in fully diluted value [13]. If JUP launches at where futures markets expect, billions of dollars in incentives could drive an influx of users to use Jupiter, potentially driving much more volume and liquidity to Solana. Solana DEX Volumes flipping Ethereum could become a more common occurrence [14].

However, the long-term impact of this strategy on platform growth and token value remains yet to be seen. Airdrop farmers may boost stats, but retention from a great user experience and a great surrounding ecosystem is necessary for long-term growth. Furthermore, selling pressure from future airdrops due to mercenary farmers could reduce JUP’s valuation. Lastly, JUP appears to be purely governance for now-there will be no fee sharing for at least 2 years, and while Limit Orders and Dollar-Cost-Averaging (DCA) features make revenue with its 0.1% fees, Jupiter makes no revenue off of swaps [15].

Products

Jupiter is working on various products to drive users to Solana. Jupiter Start is in the works, an attempt to grow the pie by creating a better launchpad for upcoming projects on Solana. Their Pre-Listing process streamlines the introduction of a new token onto Jupiter and other integrated platforms. By going through the pre-listing process via community attestation and specifying the exact time liquidity is added, projects can enhance liquidity and availability of their token.

The team is also building out xSOL, similar to Maker’s stablecoin backed by ETH-a leveraged stablecoin based on LSTs that will offer 7-20% yield annually. Finally, there is Jupiter Perpetuals, a LP perpetual exchange which offers 100x leverage on Solana [8].

Vision

Meow, co-founder of Jupiter, sees a world where Jupiter replaces traditional centralized exchanges (CEX) [16]. Achieving this vision requires overcoming several hurdles. While Jupiter’s spot token selection is increasing, selection is currently specific to Solana SPL tokens, and liquidity needs to deepen significantly to rival pricing of exchanges like Binance. Finally, the on-chain user experience still faces challenges, hindered by issues with wallet onboarding, contract security risk, and miner extractable value (MEV). Furthermore, it is necessary to address Solana-centric issues such as its inflationary tokenomics, which subsidize the blockchain’s low fees, and potential downtime from bots [17][18].

There are emerging responses in the ecosystem. Clients like Jito, which democratizes MEV, mitigating bot impact, and Firedancer, which aims to vastly increase transaction capacity, represent efforts to address these issues [19][20]. If these hurdles are overcome and Jupiter achieves its vision to replace the CEX, millions of users would be brought on-chain, accelerating the broader adoption of decentralized applications.

About the Author

Kole Lee is an undergrad studying Computer Science at Stanford University. He is the Co-Chief Editor of the Stanford Blockchain Review. Previously, he worked at blockchain analytics company Nansen and did software engineering at NFT startup Tonic.

References

[1] https://station.jup.ag/stats

[2] https://dune.com/hagaetc/dex-metrics

[3] https://dune.com/ilemi/jupiter-aggregator-solana

[4] https://etherscan.io/gastracker

[5] https://solanacompass.com/statistics/fees

[6] https://station.jup.ag/blog/jup-v3-metis-routing-algo#metis

[7] [https://blog.1inch.io/staying-safe-from-slippage/

[8] https://station.jup.ag/blog/jup-planetary-dev-update

[9] https://station.jup.ag/docs/jupiter-terminal/jupiter-terminal

[10] https://twitter.com/solendprotocol/status/1687154843679662080

[11] https://lifinity.io/

[12] https://station.jup.ag/blog/grow-the-pie-1

[13] https://app.aevo.xyz/perpetual/jup

[14] https://app.artemis.xyz/chains

[15] https://twitter.com/weremeow/status/1736889629209710787/photo/1

[16] Jupiter: The Aggregator Fueling Solana’s GDP | Meow

[17] https://solanacompass.com/tokenomics

[18]https://cointelegraph.com/news/solana-outage-triggers-ballistic-reaction-from-the-crypto-community